- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Partial year rental handling in TurboTax

I found the partial year rental house is always confusing in TT...

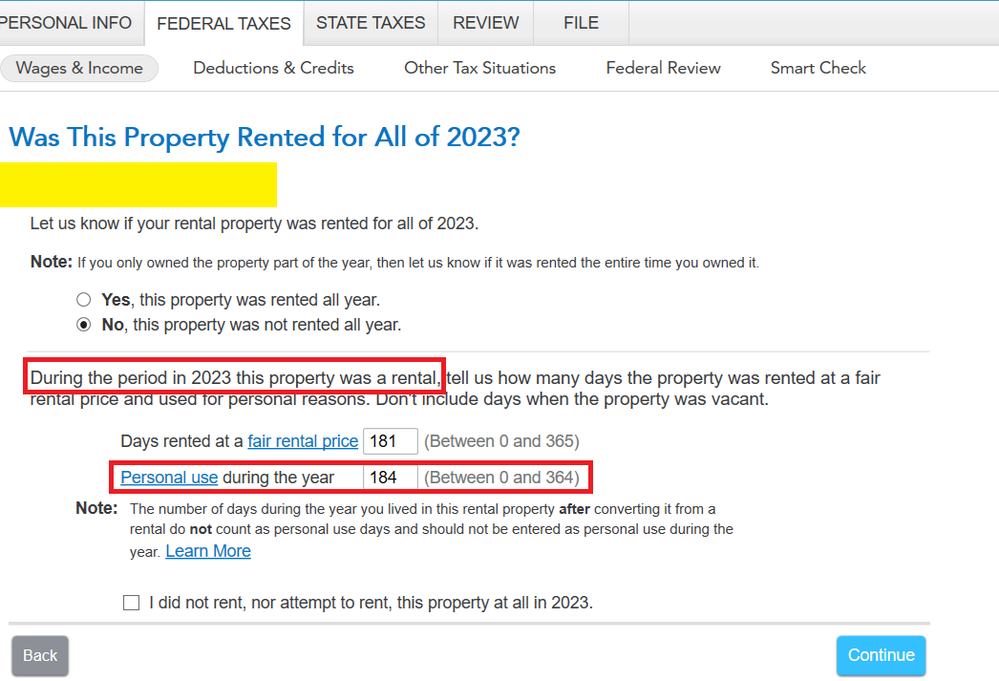

We rented out our home until June 30, 2023 (181 days since Jan 1st) and then converted it back to our primary house. How do I correctly enter it in TT (see the picture)?

Method 1 -- put "184" in the red rectangle.

Or, method 2 -- put "0" in the red rectangle.

I initially used method 1 but then realized if I do that then TT will prorate all the repair cost. E.g. if I tell TT the repair cost is $2,000 then TT will only enter about $1,000 in schedule E. However TT will prorate my property tax correctly for me -- e.g. if the whole-year property tax is $10,000 then TT will enter about $5,000 in schedule E.

After reading the texts more carefully, TT was asking about "during the period... this property was a rental" and this makes me thinking I should put "0" there (method 2). However if I do this then TT will directly enter everything I told it in schedule E and I need to manually prorate everything before entering into TT. E.g. if the whole year property tax is $10,000 then TT will directly enter $10,000 in schedule E. Same for the repair.

I think method 2 is the right way to go but I'd like to confirm it.