- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- No EIN number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No EIN number

I do delivery driving on the side, but when filing my taxes for this it keeps asking for my EIN number and I do not have one. I am at the last step and I keep getting trapped in this loop of "fix federal return" and I have tried putting my SSN in the EIN blank and it still will not allow me to continue. There is a blank for SSN instead, but it is grayed out.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No EIN number

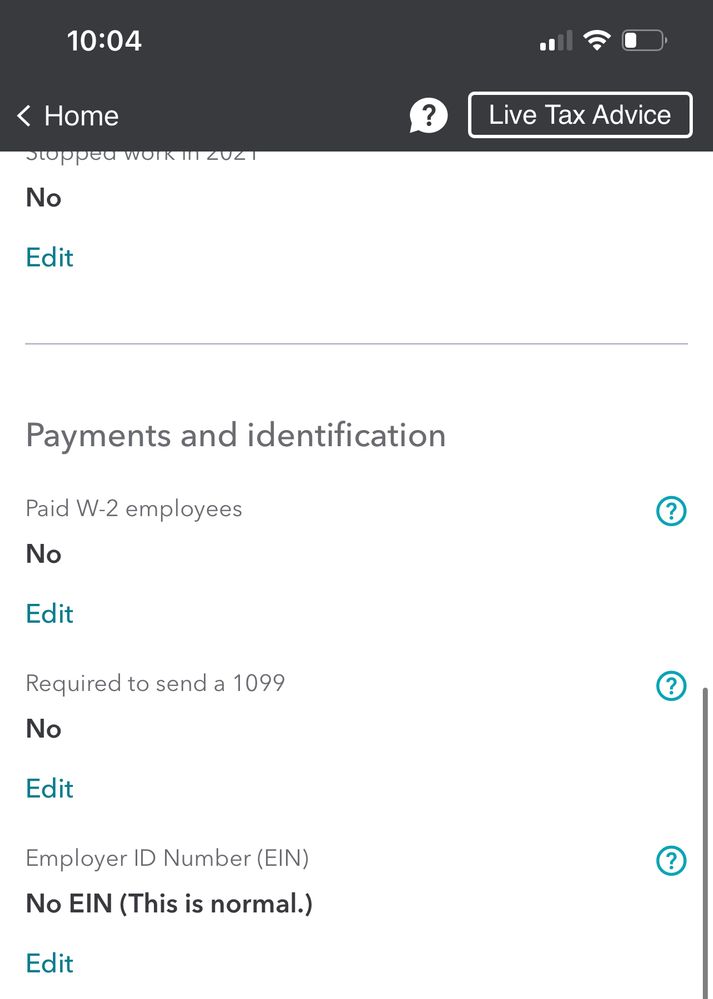

If you are getting an error of no EIN number for your Schedule C, please review the general information inputted for your business. I have attached a picture of what your page should look like under Payments and identification.

To access these fields in TurboTax, complete the following steps:

- Open your return.

- Search for Schedule C with the magnifying glass tool on the top of the page.

- Select the Jump to Schedule C link in the search results.

- Select Edit next to your line of work.

- Select Edit next to General Information.

- Scroll down and look under Payments and identification. The third column, Employer ID Number, should say No EIN.

- Click edit to make a change.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No EIN number

Hello, I am having this same issue and followed these instructions step by step. When I come to the end it still tells me to check this section. How can I proceed without having an EIN?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

ajm2281

Level 1

Geary-Burns

New Member

mmcdono7612

New Member

mostertpiet8

New Member