- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Need help with filing taxes earned in a work release center in Florida.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with filing taxes earned in a work release center in Florida.

I was in prison in 2023 and got sent to a work release center, got a job and paid federal taxes in the amount of 453 dollars( I was only there a month). So when I got out I filed my taxes and have been waiting on my return for 2 months, got a letter from IRS and it says the money I made doesn't qualify for earned income credit. Did I click something wrong, I don't understand how I paid federal taxes and are they not going to recognize any income while locked up or just earned income credit. Any help or information is beneficial to me as I'm not hip with taxes, I pay TurboTax and always get my return till this year. Thank you in advance

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with filing taxes earned in a work release center in Florida.

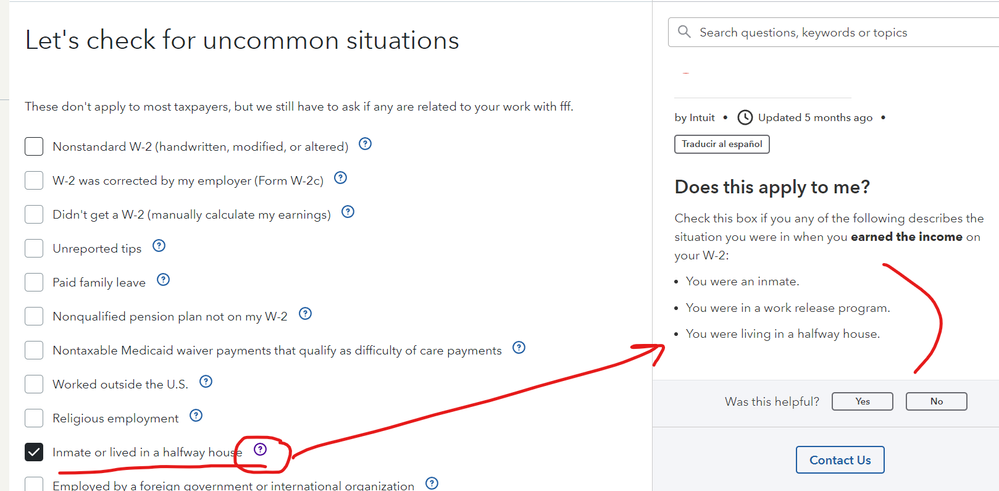

Yes you made an error ... after you entered the W-2 you did not click the box for ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with filing taxes earned in a work release center in Florida.

I believe that you were told that by mistake. Money made while incarcerated does not count as earned income, but money earned in a work release program does. Call the IRS and get it straightened out. TurboTax cannot do that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help with filing taxes earned in a work release center in Florida.

Work release and half way houses are considered still being in prison for the EIC.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

bigjames1982

New Member

bigjames1982

New Member

S-brady

New Member

Jon Seagull

Level 2

DanFEU

New Member