- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Need exact procedure for handling interest reported to the deceased AFTER death, but paid to a beneficiary

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need exact procedure for handling interest reported to the deceased AFTER death, but paid to a beneficiary

According to the IRS Publication 559, interest accrued to the deceased's account needs to be reported by the beneficiary. But the bank issued the 1099-INT in the name/SSN of the deceased.

How to enter this properly in TurboTax for the deceased?

Note: Since the account had a beneficiary (and it was not the executor) and thus not subject to probate, but the executor has to handle the last tax return for the deceased, does the executor have to send a 1099-MISC to the beneficiary (on behalf of the deceased) ?

Note2: Yes, there will be a separate "estate income tax return / 1041" for other income received that has not been distributed. But the key question here is how is the interest reported to the deceased properly handled in the various tax forms (ie: for the deceased and for the beneficiary). Decased's tax return will be filed via TurboTax by the executor; interest claimed by the beneficiary will be via a separate CPA/Tax Preparer. I'm the executor.

Thanks for any help! (ie: an exact procedure is needed).

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need exact procedure for handling interest reported to the deceased AFTER death, but paid to a beneficiary

You can correct this situation with what is called "Nominee interest".

Allocating the interest is relatively easy and I will give you the steps below to show you how.

You can split the income that was reported on the 1099-INT by taking the portion that applies to the beneficiary and listing the income as "nominee" income assigned to another. These are the steps you should follow for the assignment of the interest income:

- In TurboTax, go to "Wages & Income"

- Scroll to "Investments and Savings"

- Click "Edit/Add." for the particular interest to which this applies. If not initially entered then enter the information as shown on Form 1099-INT.

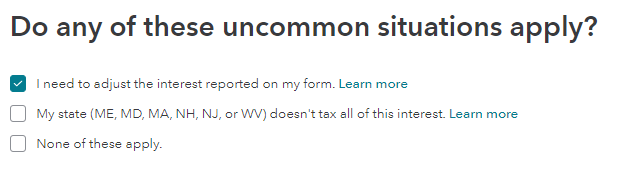

- The next screen will ask if any uncommon situations apply, checkmark "I need to adjust" and click "I need to adjust the interest reported on my form".

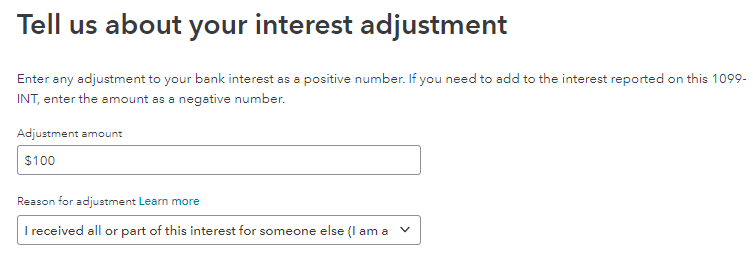

- Place the amount of the interest that applies to the others in the adjustment amount line and click "you received all or part for someone else".

- Click continue and the portion of the interest that applies to the others should be deducted from the decedent's income

The $100 is just an example. After you enter the amount that does not apply to the return you are preparing, click continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

el501

Level 1

muzicengineer

Level 1

NN68

Returning Member

hrmfph

New Member

Sactax74

Level 2