- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You can correct this situation with what is called "Nominee interest".

Allocating the interest is relatively easy and I will give you the steps below to show you how.

You can split the income that was reported on the 1099-INT by taking the portion that applies to the beneficiary and listing the income as "nominee" income assigned to another. These are the steps you should follow for the assignment of the interest income:

- In TurboTax, go to "Wages & Income"

- Scroll to "Investments and Savings"

- Click "Edit/Add." for the particular interest to which this applies. If not initially entered then enter the information as shown on Form 1099-INT.

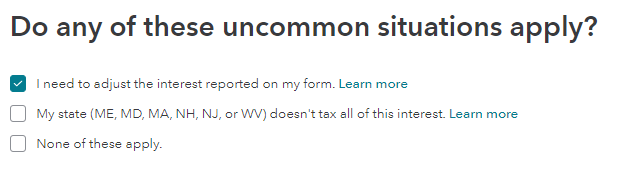

- The next screen will ask if any uncommon situations apply, checkmark "I need to adjust" and click "I need to adjust the interest reported on my form".

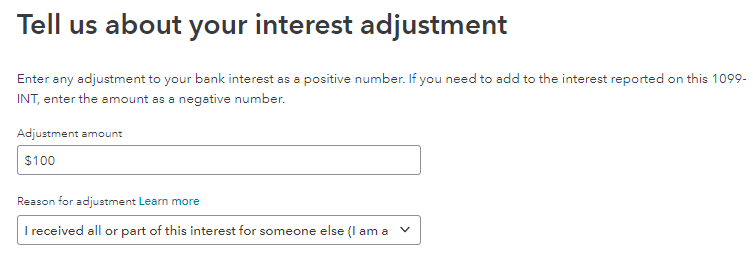

- Place the amount of the interest that applies to the others in the adjustment amount line and click "you received all or part for someone else".

- Click continue and the portion of the interest that applies to the others should be deducted from the decedent's income

The $100 is just an example. After you enter the amount that does not apply to the return you are preparing, click continue.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 16, 2023

12:48 PM