- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Need Clarification on HSA Distribution After Overcontribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

In year 2022, my spouse and I both contributed to our HSA account but we overcontributed around 400$ than family limit. So, we withdraw that excess money from my spouse HSA account before April 15, 2023 to avoid penalty and it was added as other income in tax return of 2022.

After that, in year 2023, my spouse didn’t contributed to her HSA account and I only did to mine up till family limit.

Coming forward to year 2023 tax return: My spouse received 1099 SA from her HSA account and that 400$ is showed up as “Gross Distribution”. When filling the turbotax HSA section, a question is asked as follows for my spouse HSA account:

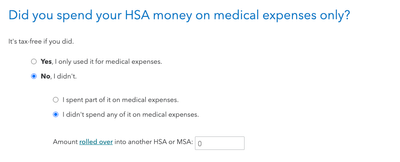

“Did you spend your HSA money on medical expenses only?”

I think answer should be “NO”, given we simply withdraw that and kept it in our bank account. Does that seem right? If yes, does that, I will taxed again on this distribution. Given I was already taxed in 2022 tax return, why would I taxed again in year 2023?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

1. Did you tell the HSA custodian back in early 2023 that this ($400) was a withdrawal excess contributions?

2. What was the distribution code in box 2 of the 1099-SA? Was it "1"?

As for why you should be taxed again, let me explain.

In 2022, you withheld through payroll deduction your HSA contributions. This is the code W amount in box 12 of your W-2. This code W amount is removed from Wages in boxes 1, 3, and 5 before your W-2 is even printed.

When part of this amount was declared to be in excess, TurboTax add the amount back to your Income (since it was removed from Wages in the first place). So you were taxed on this amount in 2022 because you didn't play by the rules.

In 2023, when you got this 1099-SA, it should have had a code 2 as the distribution code. If so, the amount in box 1 is ignored (i.e., you are not paying tax on it again), and only the earnings in box 2 are taxed. Got that? You are not paying tax on that box 1 amount again.

And if indeed you did not get a 1099-SA with a code of 2 in box 3, come back and tell me and I describe how to fix it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

Thanks for your reply and explanation. Appreciate it.

1. Did you tell the HSA custodian back in early 2023 that this ($400) was a withdrawal excess contributions?

>> By custodian, do you mean the brokerage account that has the HSA account. That was Fidelity. Do we need to tell them? We never told them. How can we do that? When I withdrawn, maybe there was an option to tell that. I don't remember right now.

2. What was the distribution code in box 2 of the 1099-SA? Was it "1"?

>> It is 1 for 1099-SA of 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

There are rules for putting money into and talking money out of an HSA. I encourage you to read IRS Pub 969 to familiarize with the HSA rule, at least (there are other financial accounts in there, so don't get them confused). This is not written with the user in mind, so I encourage you to nose around the Internet looking for user-friendly descriptions if how to use an HSA.

The HSA custodian is a specialized unit of a company like Fidelity, that abides by the IRS rules in handling the HSA dollars. It is different from a brokerage account.

Yes, you should have contact Fidelity and asked for the "withdrawal of excess contributions". In fact, Fidelity likely has a form on their website so you can do this "self-service". This would get your money back, but the HSA custodian would have their paperwork done correctly.

OK, we have a few days to fix this. First, you need to contact Fidelity and tell them that the withdrawal for this $400 was a "Mistaken Distribution". Fidelity will want you to complete a form (also maybe online) and have you send the $400 back. Be nice when you ask, because they don't have to do this.

Then tell them that you want to request the "withdrawal of excess contributions". You MUST do this before April 15th, so get started on it now. Fidelity will ask you to complete different paperwork and will send you the $400 plus any earnings that the $400 earned while it was in the HSA.

Then you will receive a 1099-SA with the distribution code of 2 in box 3. Box 1 will probably have the $400 in it, but as I explained above, this is ignored by TurboTax. The amount in box 2 - the earnings - will be added to your income - in 2024.

Yes, this 1099-SA is for you 2024 return, i.e., next year.

Happy studying...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

Thanks. Looks like I missed doing that while withdrawing and did a regular withdrawal. And thank you for the detailed solution, although it looks pretty complicated to me.

By the way, if I just report in turbotax for year 2023 with code 1 only (which is what I got in 1099 SA), does that mean, I have to pay tax + penalty when I mark it as "it was not for medical expenses.". This essentially means, I paid taxes twice + penalty, right?

I just feel given the amount is small, it is okay to just do this and get done with that. I guess then going forward, I don't need to worry about it. Is that right? And from IRS point of view, I think they should be fine, given I am paying taxes again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

"This essentially means, I paid taxes twice + penalty, right?" - Yes.

I have been mulling over if you are right that "I just feel given the amount is small, it is okay to just do this and get done with that." The problem as I see it is that if an auditor looks at your paperwork and the paperwork of the HSA custodian show that there was an excess in HSA contributions, and that they were not withdrawn before due date of the return (because you did not use the correct paperwork). This may look like the excess should be carried over to the next year, and you dinged 6%.

However, one way to terminate the carryover is to take a distribution and say that it was not for medical expenses (so gets added to Other Income and you get dinged 20%). What I haven't figured out yet is the timing - will this work even before the excess gets carried over?

Plus the auditor will be confused by what you are doing. If you do what I said, it will be obvious to the auditor that you are fixing the problem.

P.S., IRS auditors don't look to see if things even out at the end. In almost 20% of audits, the taxpayer gets a refund, because the auditors are precision-oriented.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

shubham-123

Level 2

Ames_01

Level 2

Cat_Sushi

Level 2

rglickman1

New Member

andyb_

Returning Member