- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need Clarification on HSA Distribution After Overcontribution

In year 2022, my spouse and I both contributed to our HSA account but we overcontributed around 400$ than family limit. So, we withdraw that excess money from my spouse HSA account before April 15, 2023 to avoid penalty and it was added as other income in tax return of 2022.

After that, in year 2023, my spouse didn’t contributed to her HSA account and I only did to mine up till family limit.

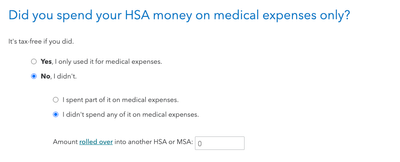

Coming forward to year 2023 tax return: My spouse received 1099 SA from her HSA account and that 400$ is showed up as “Gross Distribution”. When filling the turbotax HSA section, a question is asked as follows for my spouse HSA account:

“Did you spend your HSA money on medical expenses only?”

I think answer should be “NO”, given we simply withdraw that and kept it in our bank account. Does that seem right? If yes, does that, I will taxed again on this distribution. Given I was already taxed in 2022 tax return, why would I taxed again in year 2023?