- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- nc state taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

nc state taxes

Since I don't pay nc state taxes on nc teacher retirement pension, how is that entered on state tax forms

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

nc state taxes

When you are working on your North Carolina return be sure to answer Yes to the question: Did you receive any Bailey Settlement Retirement on a W-2? and follow the prompts in this section of the program.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

nc state taxes

@MacWood You really didn't specify how your NC retirement $$ were being reported to you at year's end . Were they on a W-2? or on a 1099-R form?

We need to be a bit more clear here on some subtle differences to the answer @SusanY1 provided. Those directions are only used if your Bailey retirement income was issued on an actual W-2 form, which apparently isn't all that common, but does occur.

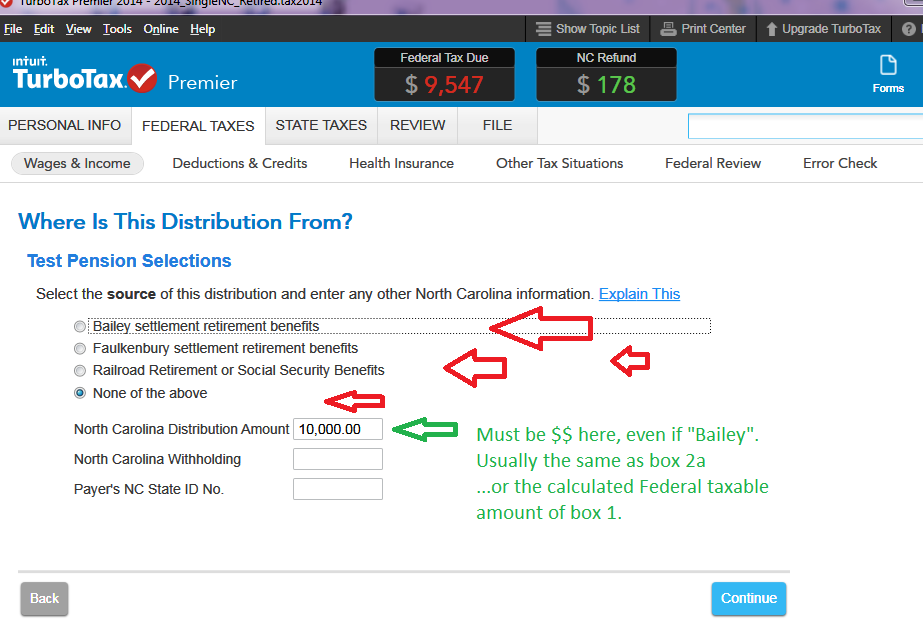

IF your NC Teacher's retirement income tax form is shown on a 1099-R form, then the Bailey selection is dealt with in the Federal taxes area of your software interview, when you enter that 1099-R form....on a followup page after your main 1099-R entries, you will make the Bailey selection (picture below)

1) For the NC Distribution Amount, you would enter the value of box 2a of that particular 1099-R form.

2) IF box 2a is empty or 'unknown", then it would be the Federally-taxable portion of box 1, once that value has been calculated.

NC starts with the Federal AGI as the starting point for it's tax returns.....that Federal AGI includes the box 2a value (or the federally taxable amount of box 1 in that starting AGI ). Once you click on the "Bailey Settlement" button on the followup page (after you enter the main 1099-R form in the Federal section of the software)...once you click on that Bailey Settlement button, the "North Carolina Distribution Amount" entered becomes the $$ value it will deduct from the Federal AGI to create a new NC-AGI....so that value is critical to be entered.

________________________________________

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

48908d580c30

New Member

chadshe05

New Member

223ad398e851

New Member

Corinejk

New Member

michaeldailey-ho

New Member