- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My children are Canadian citizen on visa in USA. According to IRS they qualify for Other Dependant Tax Credit. Line 19 on my 1040. How can I get Turbotax to add them?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My children are Canadian citizen on visa in USA. According to IRS they qualify for Other Dependant Tax Credit. Line 19 on my 1040. How can I get Turbotax to add them?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My children are Canadian citizen on visa in USA. According to IRS they qualify for Other Dependant Tax Credit. Line 19 on my 1040. How can I get Turbotax to add them?

Please be aware that they need to be an U.S. resident alien to qualify for the Other Dependent Tax Credit. Please review the all requirements here: What is the $500 Credit for Other Dependents (“Family Tax Credit”)?

Please follow the steps to add your children into TurboTax to see if you might qualify for the Credit:

- Login to your TurboTax Account

- Click "My Info" from the left side of your screen

- Scroll down to "+Add a dependent"

To review the Credit:

- Click on the Search box on the top and type “Credit for Other Dependents”

- Click on “Jump to”

[Edited 2/3/2021 | 10:38am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My children are Canadian citizen on visa in USA. According to IRS they qualify for Other Dependant Tax Credit. Line 19 on my 1040. How can I get Turbotax to add them?

Dana,

Thank you for your response.

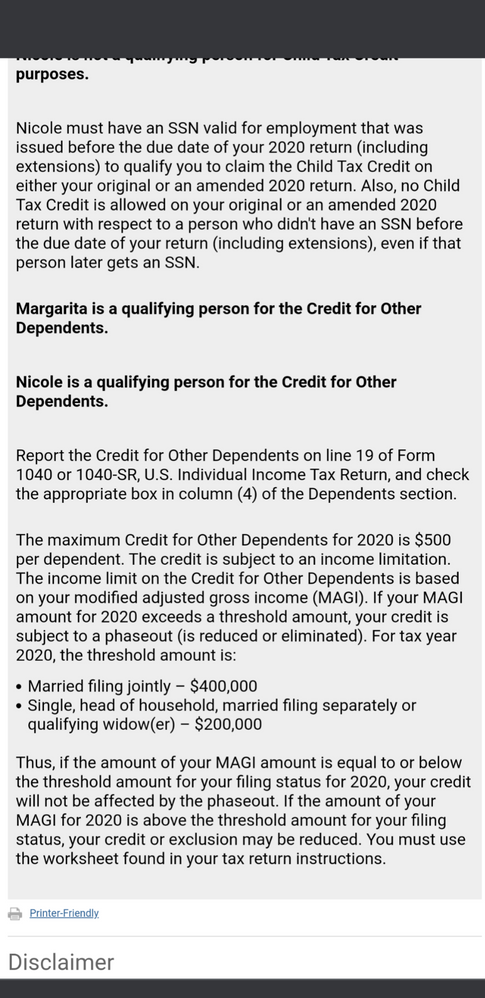

They have ITIN numbers and they do not qualify for Child Tax Credit, but they qualify as Other Dependant according to IRS web site check and it should be added to line 19 on 1040 form. Below is some screenshots from the IRS website

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My children are Canadian citizen on visa in USA. According to IRS they qualify for Other Dependant Tax Credit. Line 19 on my 1040. How can I get Turbotax to add them?

According to IRS Pub. 972 - Child Tax Credit and Credit for Other Dependents

A person qualifies you for the ODC [Other Dependent Credit] if the person meets all of the following conditions:

1. The person is claimed as a dependent on your return. See Pub. 501 for more information about claiming someone as a dependent.

2. The person cannot be used by you to claim the CTC or ACTC. [Child Tax Credit or Additional Child Tax Credit]

3. The person was a U.S. citizen, U.S. national, or U.S. resident alien.

A resident alien for tax purposes is a person who is a U.S. citizen or a foreign national who meets either the “green card” or “substantial presence” test as described in IRS Publication 519 - U.S. Tax Guide for Aliens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My children are Canadian citizen on visa in USA. According to IRS they qualify for Other Dependant Tax Credit. Line 19 on my 1040. How can I get Turbotax to add them?

Irene,

Thank you. I think I have answered wrong one of the questions on the IRS website.

Appreciate all the help!

Thank you!

Rumen

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

christianalb07

New Member

WendyF

New Member

fj7

Returning Member

crookedoak

New Member

hopiegirl

New Member