- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Material / Supplies / labor expense VS COGS when entering expense payments in quickbooks for import to Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material / Supplies / labor expense VS COGS when entering expense payments in quickbooks for import to Turbotax

Our first year with Quickbooks and Turbotax, so clarification needed for how to best enter expenses. We have many labor and supplies/material expenses for our small business. No actual inventory kept. Example: Manual labor and concrete/gravel supplies to complete installation of a concrete driveway for client. Only current materials needed for a job purchased and labor paid to complete the driveway, and then on to the next job. What is the best way to code/categorize the expenses in quickbooks to that Turbotax imports and reads it accurately to deduct all of the expenses? Should all of these items that are direct expenses for an installation job just all be categorized as Cost of Goods Sold? Or should the labor, material/supplies be separated into individual categories? This is our first year using the two programs, and want to be sure the way we enter into Quickbooks imports correctly and in the best manner to obtain full deduction of the expenses when completing taxes in Turbotax. Thanks for any assistance/clarification you can offer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Material / Supplies / labor expense VS COGS when entering expense payments in quickbooks for import to Turbotax

You did not state what type of entity your business is, such as Proprietorship, Partnership, or S Corporation first off. However, most treatment in your situation is the same but the programs utilized may differ. For instance, if you are a Proprietorship, the information will flow to TurboTax Home and Business. If you are a Partnership, LLC, or Subchapter S Corporation, your information will flow to TurboTax Business, and then to TurboTax Premier at a minimum.

Normally, the Cost of Goods sold section is utilized if you maintain inventory similar to a retail store. You stated above you have a substantial amount of materials and supplies and labor costs. When accessing the business income and expenses section, you will be asked if you have inventory to report first. If you say no, and generally materials and supplies are not categorized as inventory, you will revert back to the Business Income and Expenses area.

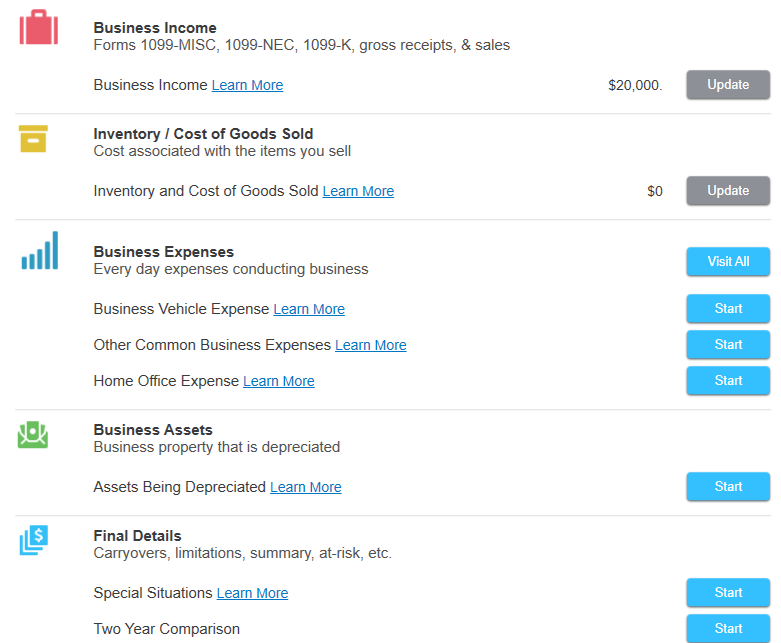

Quickbooks will give you many options and sub-options to choose from when entering expense titles. For migration to TurboTax, I first recommend you look at the TurboTax Version you are going to utilize to see what areas are available to you to have your data migrate to. The screenshot below is typical of what you will see in the TurboTax program.

Ironically, in your case, my belief is a goodly portion of your expenses should flow to "Other Common Business Expenses" under the main Business Expenses category. Most of the other areas are pretty self-explanatory, such as vehicle expenses, and Business Assets for depreciation purposes.

The above is not all encompassing when it will come to transferring the data from Quickbooks to TurboTax and I strongly suggest you make a trial run before finalizing anything. By that I mean do your categorization in Quickbooks, and once you are satisfied that the data in Quickbooks is complete and accurate, transfer the data into TurboTax and compare the amounts. In addition to a trial balance, you should also print out a Balance Sheet and Profit and Loss statement for comparative purposes. If there are discrepancies, try to identify which items are different and why, and clear and start over in TurboTax. This will not affect any data in Quickbooks.

After identifying the discrepancies, if any, make whatever changes in categories you feel you need to, transfer the data again and compare. It should now give you the same numbers in both packages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ash49

Level 2

JRB0

New Member

knamulanda

New Member

Rrapp

New Member

tsukada2006

Level 1