- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- k1 line 20 ah statement

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

k1 line 20 ah statement

Have a k1 for an oil partnership. Line 20 "AH" "STMT". The attached statement includes items for production and depletion. Do I need to enter this in, and, if so, how/where? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

k1 line 20 ah statement

The IRS Instructions for Form 1065 Schedule K-1 box 20 code AH can be viewed at this link. That list of items doesn't appear to relate specifically to production and depletion for oil production. Instead, the IRS instructions for reporting the partner's share of production and depletion for oil and gas activ... specify that information be reported in box 20 with a code T.

If you decide that your box 20 code AH Statement is reporting information that should have been reported as box 20 code T, you can enter it with code T instead of code AH to get the "screens" you need to report your depletion.

Once you enter your code T and amount on the "box 20" screen, you'll make the choice between cost and percentage depletion on a subsequent screen in the TurboTax K-1 entry questions.

Here are the instructions given in TurboTax for box 20, code T:

"Using the information supplied with the K-1, enter the cost depletion amount, if provided, on the K-1 Additional Information worksheet Box 20, Other Information section for Code T, line 1. On lines 2a and 2b of that worksheet, enter the gross income from oil and gas and calculate and enter the percentage depletion amount based on the information supplied. The program will deduct the greater of the cost or percentage depletion amounts."

Note that the working interest depletion gets entered when you enter your box 20 code T information. Any royalty interest depletion is entered on a Schedule E that gets created when you enter the K-1 with royalty income. You'll need to find that Schedule E in the Rental Properties and Royalties section, and edit it to answer that the royalty is an oil and gas royalty. At that point, TurboTax will automatically enter 15% depletion for the royalty income, but you change the amount in that "box". Click the "Learn more" link on that page where depletion is entered if you want more information.

Lastly, note that if your K-1 is reporting information on several different properties, and you want to use cost depletion for some properties and percentage depletion for others, you'll need to enter a separate K-1 in TurboTax to do that. One K-1 will report the cost depletion properties and the other will report the percentage depletion properties.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

k1 line 20 ah statement

I have the above but it is for a real estate LLC - what exactly is Turbotax / IRS wanting me to enter here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

k1 line 20 ah statement

Box 20 of the K-1 for Partnerships/LLCs can be used for many situations. Consult the instructions that were included with your Schedule K-1. These should tell you the form and line where the amount should be entered.

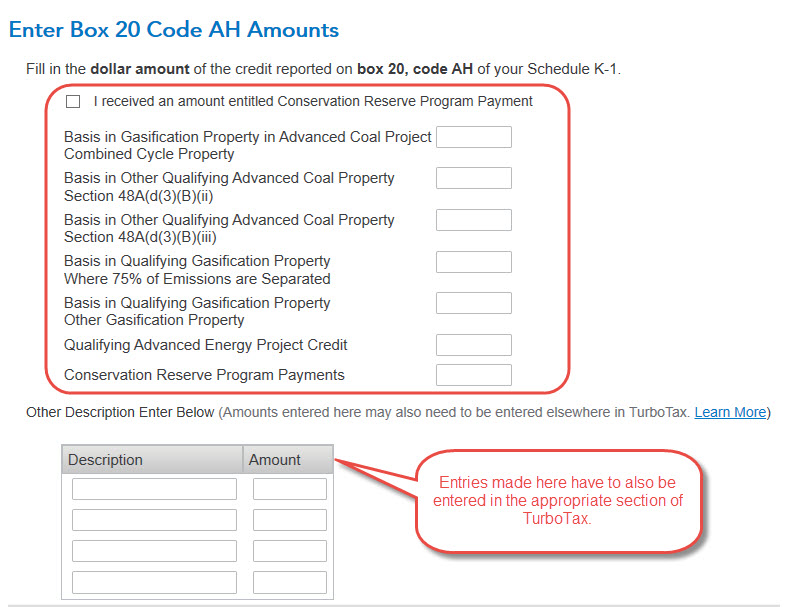

Unless the entry falls in one of the categories listed on the Box 20 Code AH screen [See Screenshot below], you will have to manually enter the number in the appropriate section of your return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

orrinbare

New Member

datarmd

Level 1

ZPPM

Level 2

cmsmith714

New Member

ncghost1

Level 1