- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

For my wife's partnership business, she receives a K-1 1065 for income but she also then hired a person to help her specifically and we issued a 1099. She did not have that person get paid through the business as it was more specific to her and a certain project so we paid that person directly. On other Schedule E's there are questions about hiring a person and needing to issue 1099s, but where would we list this as part of the K-1?

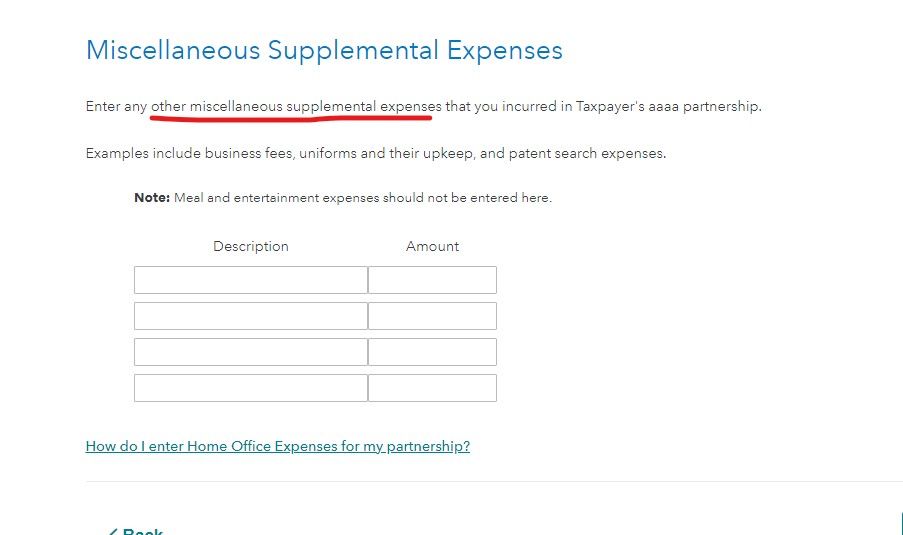

I know there is UPE - unreimbursed partnership expenses to list vehicle expenses, office, telephone, use of the home, etc. Is K-1 1065 - Miscelleneous Supplemental Expenses where to list the person we hired as a 1099?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

If your wife has income and expenses from self-employment she can deduct the cost of paying someone to be her personal assistant. But if all her income is pass-through from a K-1 and not self-employment then she can't deduct the cost of paying for an assistant. Employee business expenses are no longer deductible on a personal tax return.

Your expenses may be deductible on your state tax return if you live in Alabama, Arkansas, California, Hawaii, Minnesota, New York or Pennsylvania.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

Interesting that it seems so similar - on a Sch E self-employment you can deduct for vehicle, office supplies, meals, travel, home office, etc. and on a K-1 there is also UPE - unreimbursed partnership expenses that are very similar like for a vehicle, office supplies, meals, travel, home office, etc. but hiring a 1099 assistant can only be on a Sch E and not when doing a K-1.

I am curious why that might be - do they assume that a 1099 assistant should have been taken out at the LLC business level in their accounting and not by an individual K-1 partner in pass-through? Everything else seems so similar except this.

Thanks so much for your prompt reply!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

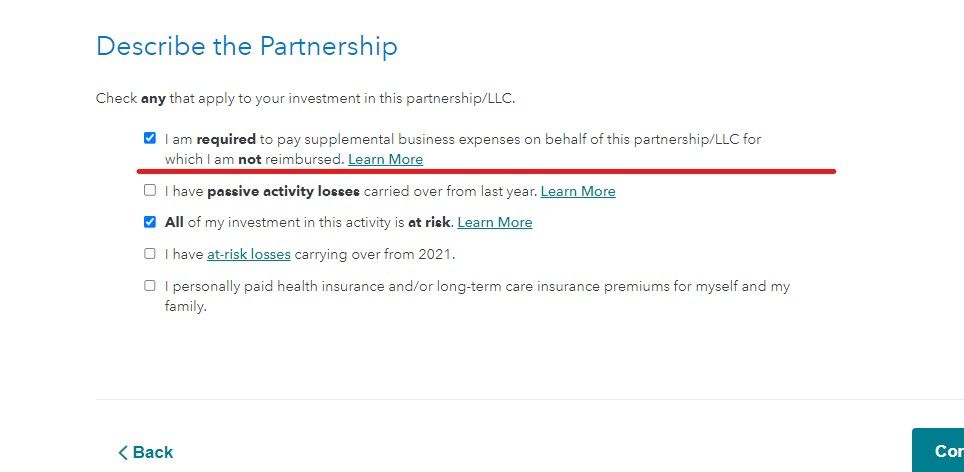

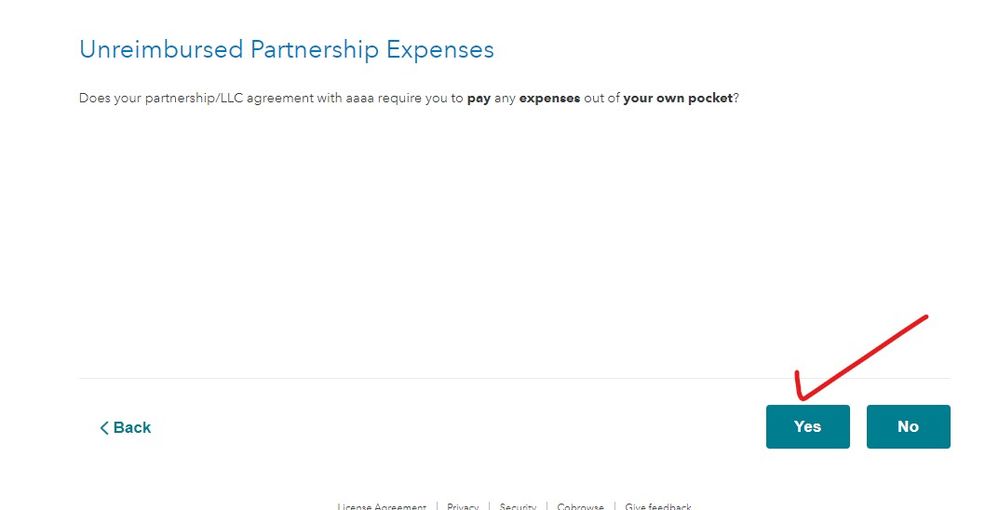

Since a partner gets a K-1 and not a W-2 then all UPE expenses of any kind may be deducted on the Sch E page 2. In the K-1 section follow the interview carefully ... go slow and read everything...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

Critter-3 - thanks for your input and that was exactly where I was thinking of listing the assistant we hired (and gave a 1099 to that person) and which the form does say it is a Sch E of a K-1 1065. I got confused and my question should have been referring to a Sch C (not Sch E) self-employment business where there are questions related to 1099 (I. Did you make any payments in 2022 that required you to file Form(s) 1099? and J, etc.).

RobertB4444's answer does sound like it could NOT go in Miscellaneous Supplemental Expenses area, but only if she had self-employment income with a different Sch C business.

Your answer sounds contrary to this and that it could be in Miscellaneous Supplemental Expenses as UPE.

Sorry if I am putting you both at odds, but that is the exact conundrum I am having.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1 partnership income but we also paid a 1099 contractor - can this be UPE?

This is what you get when you ask a public forum for advice/guidance ... but in the end use your own best judgement and go with the path you can defend in an audit.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

j-zee

New Member

bigmansax

New Member

air1erb

Returning Member

KaitlinSimone93

New Member

KarenL

Employee Tax Expert