- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Issue with tax refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

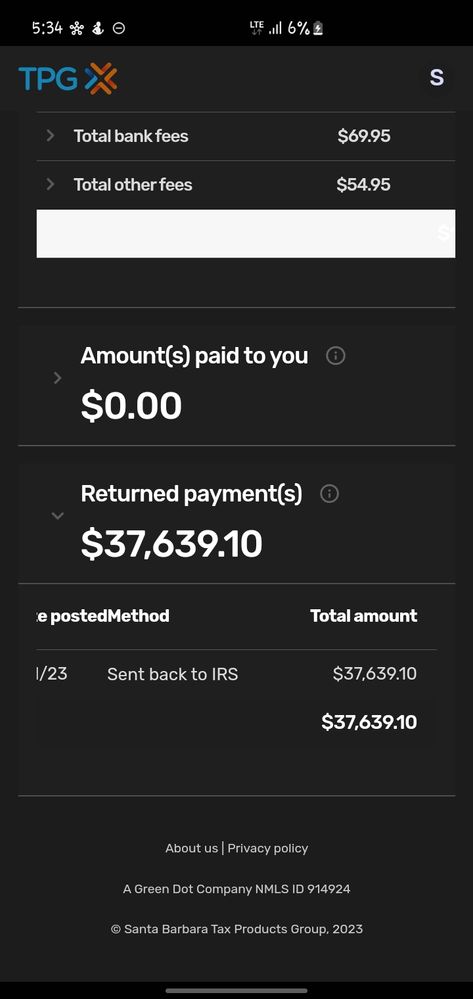

Good day everyone. My name's Sherri. I have an issue regarding my recent tax refund payment. On June 24th, 2023, my tax refund payment of $37,794.00 was approved. However, the direct deposit attempted on June 28th, 2023 was returned to TPG, according to my bank, Chime.

I was informed that a paper check would be mailed to me after the deposit was returned, but I haven't received it yet. I received a communication from TPG regarding this matter saying :

"Hello Sherri,

Due to security reasons TPG is unable to share specific details. Our system has recognized your refund as part of a group that will be returned back to the IRS. We apologize for any inconvenience this may cause.

Our systems perform a variety of checks to ensure the integrity and security of all transactions, While I cannot provide specific details, Please rest assured that this means is intended to protect your interests. The IRS will review your refund and proceed accordingly.

Please I'm confused, did anyone else recieve this message as well ? What happens after the review and for how long do I have to wait for ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

@Sherriann124 - I may be incorrect, but I think I have seen other posts over time that very large tax refund deposits are denied by Chime. Thus SPTG would have little recourse but to return the money to the IRS which would issue a paper check .

suggest contacting the IRS to understand when they will issue the check,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

Without knowing more, I can reassure you that, once your refund is returned to the IRS, the IRS will automatically mail a paper check to the address you used on your tax return, this usually takes 3-4 weeks.

I can't tell you why Chime would refuse a large refund. You may want to discuss it with them, or choose another bank.

TPB had the option of contacting you and mailing a paper check to you, instead of returning the funds to the IRS. Based on their e-mail, it sounds like they consider your refund to be so large that it is a risk for fraud, and they don't want to be responsible, so they are returning the funds to the IRS and letting the IRS handle it. I can tell you that in past years, TPG allowed themselves to be tricked into sending legitimate refunds to the wrong people, and I expect they don't want to be in that position again.

Lastly, I would suggest that it is a sign of poor financial planning to be expecting so large a refund. Under the best of circumstances, you gave the IRS an interest-free loan for a year that could have paid you $1000-$5000 or more depending on how you invested it. If you want to discuss your tax situation in more detail, we may be able to offer some suggestions on how to pay less to the IRS up front, so you keep more of your money in hand and get a smaller refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

OK. Although it's still showing "under review - amount pending return to IRS" on tpg website

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

@Sherriann124 wrote:

OK. Although it's still showing "under review - amount pending return to IRS" on tpg website

I suppose that means that TPG has not actually sent the money back yet? You could call them. It seems like it should not take more than 1 or 2 business days for them to make a decision. Unfortunately, the people in the forum are volunteers and have no direct connection with either Turbotax or TPG.

There is also the possibility of filing a complaint with your state banking regulator. However, it does seem that the process is meant to protect taxpayers from fraud, even though it is inconvenient.

I would also recommend in the future, not using TPG at all. If you are expecting a 5-figure refund, there is no reason to want to have turbotax deduct your fee from your refund (for an extra service charge, of course). Just pay up front with a credit or debit card. You can even buy a prepaid debit card from a drug store and load it with enough cash to cover the fee, if you don't want to use your personal card. If you pay the fee up front and don't use "refund transfer", your refund is between the IRS and your own bank and there is no middleman to interfere or delay things.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

Alright, thanks for the explanation. Really appreciate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

OK guys, update. So I tracked my refund using TPG website and it happens my tax return has been returned back to IRS. Please will IRS mail a paper check ? And if so, how long will it take ? Anyone experienced this before ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

The IRS guidance is that they will mail a paper check in 3-4 weeks. You may be able to use the IRS “where’s my refund?” Site, but it may take several days to update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Issue with tax refund

I hope so because I called and they said it's still being handled by the taxpayer advocate service. I just want to know if there's anyone who's ever been in this kinda situation before ? And is there any possibly that I'll still recieve the refund ? Because I'm tired of waiting already. TPG was supposed to send a check after direct deposit to my bank failed, but I never got a word from them only to check thier website and see that the money has been returned back to IRS. Please is there any possibly I'll still get my refund soon ?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

kingstino312

New Member

antlekellie80

New Member

Ashley3191989

New Member

Mampogoane Natasha Mphahlele

New Member

hterrence1

New Member