- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Ira Conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ira Conversion

In 2020, I converted my IRA to a ROTH IRA. I only have 1 IRA. TurboTax said none of the proceeds, not just the 10% penalty, were taxable. The IRA was not inherited and no form 8606 was generated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ira Conversion

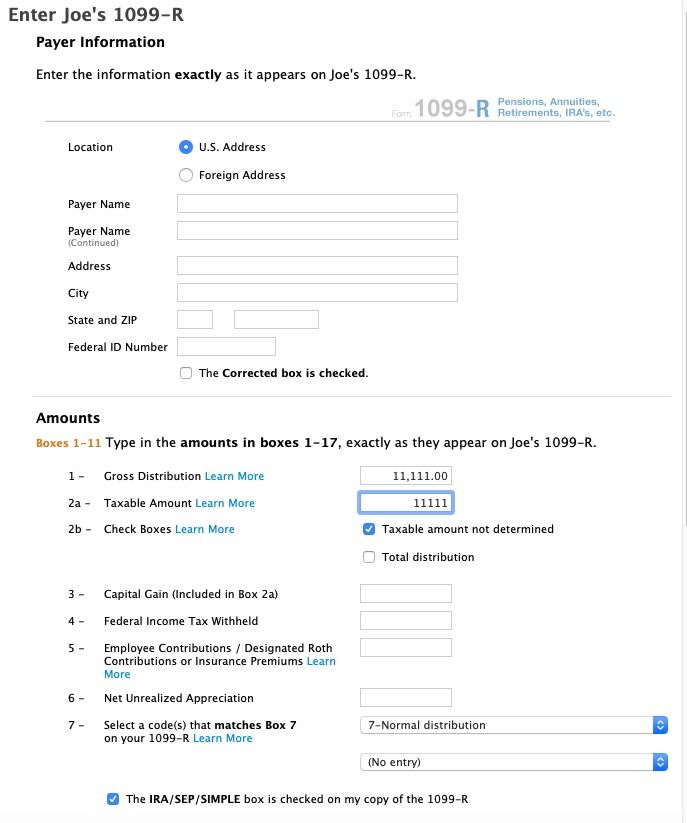

What code is in box 7.

What is in box 2a?

Is the IRA/SEP/SIMPLE box checked?

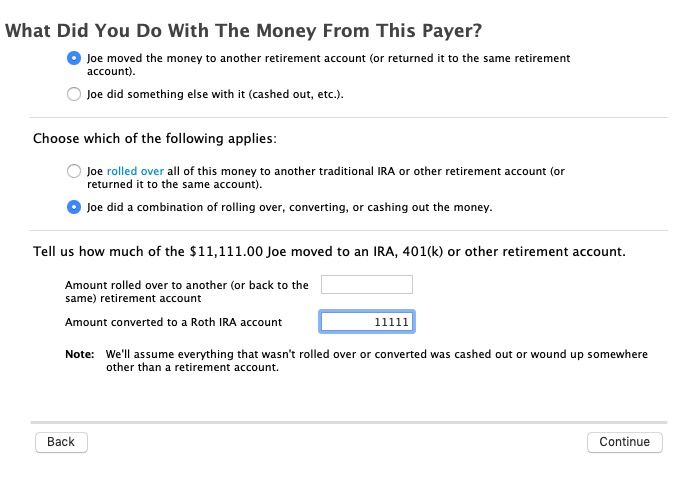

Did you it in the 1099-R section and say you "moved: the money, then did a combination if things and entered the amount converted into the lower box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ira Conversion

Thanks Champ for the follow-up. Here is the info:

Box 7 = 2

Box 2a = equal to box 1 (don't want to give an exact amount as that should not matter)

Ira/Sep/Simple = checked

I don't follow your question regarding "moved:". I use the desktop version of TurboTax and am not sure what you are referring to. I answered the question that I moved it to another retirement account and move all the money. Once I entered the 1099-R, turbotax said I would not be taxed on it. When I answered the questions that I oved the entire amount TT again said I owed no taxes on it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ira Conversion

@Confusedreturn wrote:

Thanks Champ for the follow-up. Here is the info:

Box 7 = 2

Box 2a = equal to box 1 (don't want to give an exact amount as that should not matter)

Ira/Sep/Simple = checked

I don't follow your question regarding "moved:". I use the desktop version of TurboTax and am not sure what you are referring to. I answered the question that I moved it to another retirement account and move all the money. Once I entered the 1099-R, turbotax said I would not be taxed on it. When I answered the questions that I oved the entire amount TT again said I owed no taxes on it.

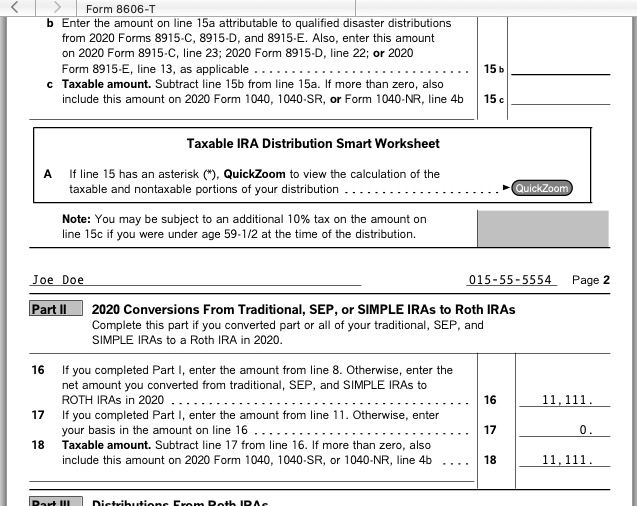

Did you enter it this way?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ira Conversion

The short answer is no, I did not do it that way. I have a value of 2 for Box 7 and never got the screens you listed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ira Conversion

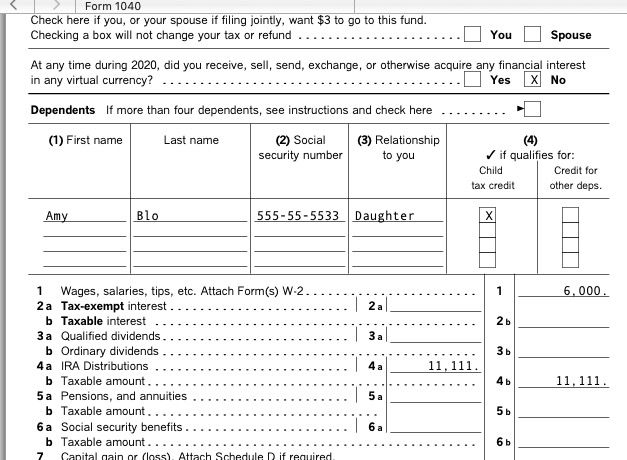

Form 1040 line 4a is fine but line 4b says rollover.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Terryjohnson2454

New Member

haunbarrett

New Member

TDills

New Member

mg36799

New Member

spowers11

New Member