- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Intangible Drilling Costs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

I am an investor in an oil & gas partnership. I do not materially participate. Is there any limitation on how much of the intangible drilling costs I can deduct in year 1? I am under the impression that I have the choice of deducting 100% of the IDC's in year one or amortizing it over five years. However, does one need to materially participate in the venture in order to take a 100% deduction in year one?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

material participation is not required. this is the reason some taxpayers may elect to amortize

Intangible drilling cost (IDC) is either capitalized and amortized or written off as an expense in the current year. If written off, there is a possibility that a portion of the entire excess IDC amount is included as a tax preference item subject to the alternative minimum tax. If capitalized and amortized, there is no tax preference on IDC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

material participation is not required. this is the reason some taxpayers may elect to amortize

Intangible drilling cost (IDC) is either capitalized and amortized or written off as an expense in the current year. If written off, there is a possibility that a portion of the entire excess IDC amount is included as a tax preference item subject to the alternative minimum tax. If capitalized and amortized, there is no tax preference on IDC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

How do you make the election expense Intangible Drilling Cost or Amortize in Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

I don't think you make an actual election. Rather, you simply entire the entire amount of the intangible drilling costs reported to you or you enter 1/0th that amount if you decide to amortize over 10 years. If you deduct 100% in year 1, it is treated as a preference item so you want to make sure that does not cause you an AMT issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

Sorry, I didn't understand how you enter this information into Turbo Tax. Were exactly would you do this, in the program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

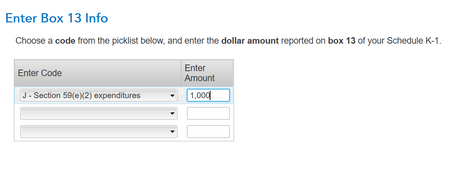

For me, I received a k-1 showing intangible drilling costs. The IDC expense was in box 13J of the k-1 and I entered the number in TurboTax when I was entering all my k-1 info for this particular partnership.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

![]()

See here, this is how it would be entered.

Following this, you'll see this screen

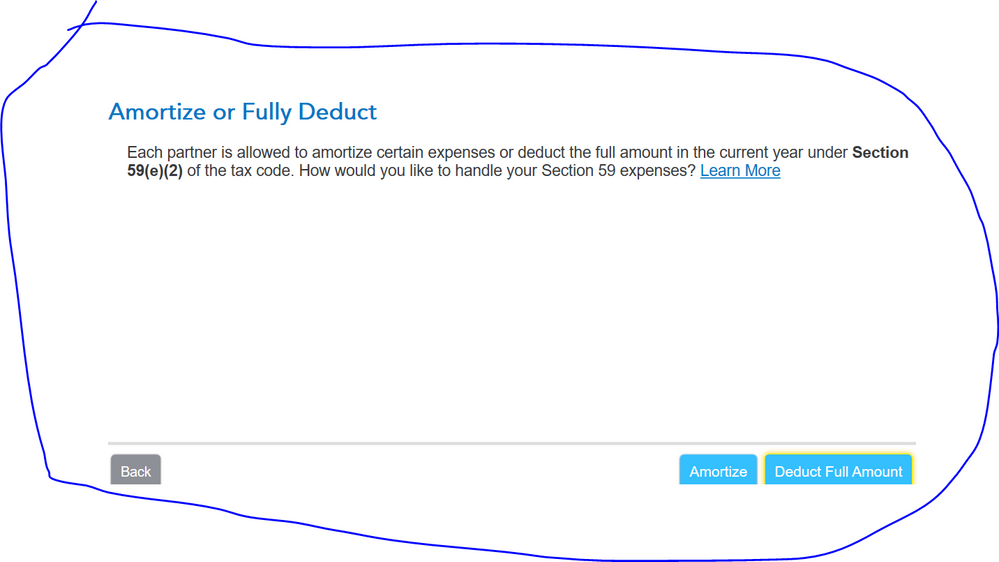

Hit edit, then you get to this screen

Hit edit, then you get to this screen

And then finally to this screen which will give you the option to amortize of fully deduct.

And then finally to this screen which will give you the option to amortize of fully deduct.

Section 59(e)(2) expenditures can be taken in full in the current year for regular tax purposes. However, they have to be amortized over a certain amount of time for AMT. If no type code is selected, the default is mining costs. For AMT purposes, mining costs are required to be amortized over 10 years. @atrabul

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

Thanks alot... all these types of investments, the investors should receive a schedule K I assume?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

Yes, you are correct. An investment in a partnership means that your share of income, intangible drilling costs and other expenses or credits will be reported to you on your own 1065-K1.

Due Date:

Generally, a domestic partnership must file Form 1065 by the 15th day of the 3rd month following the date its tax year ended as shown at the top of Form 1065. For calendar year partnerships, the due date is March 15. Check with your partnership to see when you could expect your K1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

I believe that IDC can be amortized over 60 month period. The election is made on form 4562. The problem with deducting the entire amount is that they are a tax preference item subject to the Alt Min Tax. Does Turbotax suggests the best decision or do you have to run it both ways?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

It depends on your personal tax return situation to see which method would be most beneficial to you. You would need to run both scenarios to decide which is best. An AMT adjustment is required if costs are not amortized over 60 months.

As mentioned, Intangible Drilling Costs may be fully deducted as a business expense by electing to do so, or capitalized and recovered through depreciation or depletion. These costs are defined as costs related to drilling and necessary for the preparation of wells for production, but that have no salvageable value. These include costs for wages, fuel, supplies, repairs, survey work, and ground clearing. They compose roughly 60 to 80 percent of total drilling costs. Intangible drilling costs are 100% tax-deductible in the year incurred. It doesn't matter if the well produces or strikes oil; as long as it is operating by March 31 of the following year. the intangible costs are 100% deductible.

See additional information that might be helpful to you in the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

I see that the 59(e)(2) worksheet is calculating Excess intangible drilling costs on line 11. This doesn't match what was reported on the K1 Box 17 code F. Form 1065 is erroring out because the calculated number auto populates but doesn't match the K1 number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

Please clarify what version of TurboTax you are using and where you are entering IDC.

It would also help to know the amounts from K-1 - Box 13 code J and Box 17 code F - and from the 59(e)(2) worksheet Line 11. Did you elect to expense the IDC?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Intangible Drilling Costs

Version: Premier

Where: K1 entry form - Box 13

13 - J: 3,540

17 - F: 3,530

worksheet line 11: 3,186

yes, expense.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lad20

Level 2

kashyapvijay

Level 3

kashyapvijay

Level 3

turner121

Level 2

Nhanda

Level 3