- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

![]()

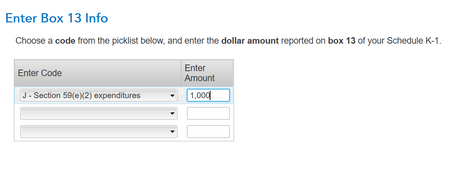

See here, this is how it would be entered.

Following this, you'll see this screen

Hit edit, then you get to this screen

Hit edit, then you get to this screen

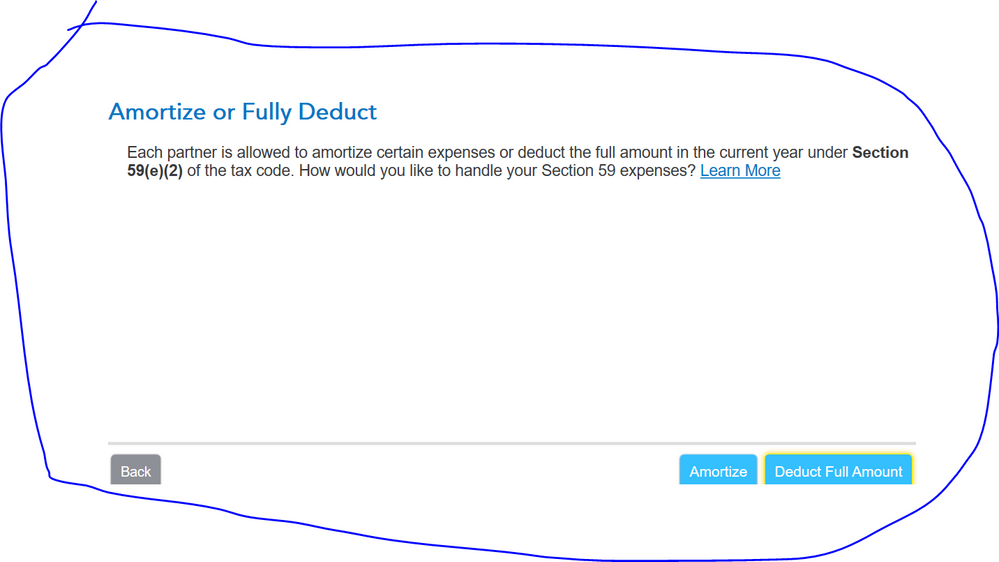

And then finally to this screen which will give you the option to amortize of fully deduct.

And then finally to this screen which will give you the option to amortize of fully deduct.

Section 59(e)(2) expenditures can be taken in full in the current year for regular tax purposes. However, they have to be amortized over a certain amount of time for AMT. If no type code is selected, the default is mining costs. For AMT purposes, mining costs are required to be amortized over 10 years. @atrabul

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 7, 2023

11:04 AM