- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Injured spouse and stimulus payment

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

@mtmberry03 All we can do now is wait for the IRS to open back up. and I agree on filing another form to be safe. But, I hope this teaches them a lesson.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I printed one out from irs.gov and basically copied the exact one that was submitted through Turbo Tax with my taxes. I then overnighted it to my state tax office in Austin, Texas.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

EXACTLY How in the *&( is it legal to take the money from the person that does not have a debt obligation? MUCH LESS THE CHILDREN THAT ARE INNOCENT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Why is my husband's child support telling me to file another 8379? I've filed one every year for 6 years now, and we live in a non communal state, so all my refund come directly to me. However, I received the same two letters telling me that one in just his name took $1700, and then another one in both our names taking another $1700. My taxes that I file are for my own dependent children, not his. His ex-wife's spouse files on his kids. So, why take all of my money? They don't have a 8379 form for us to file again just for this. His ex is unreasonable and says she is entitled to my money too and will not provide that back to us, and child support is not doing anything either.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

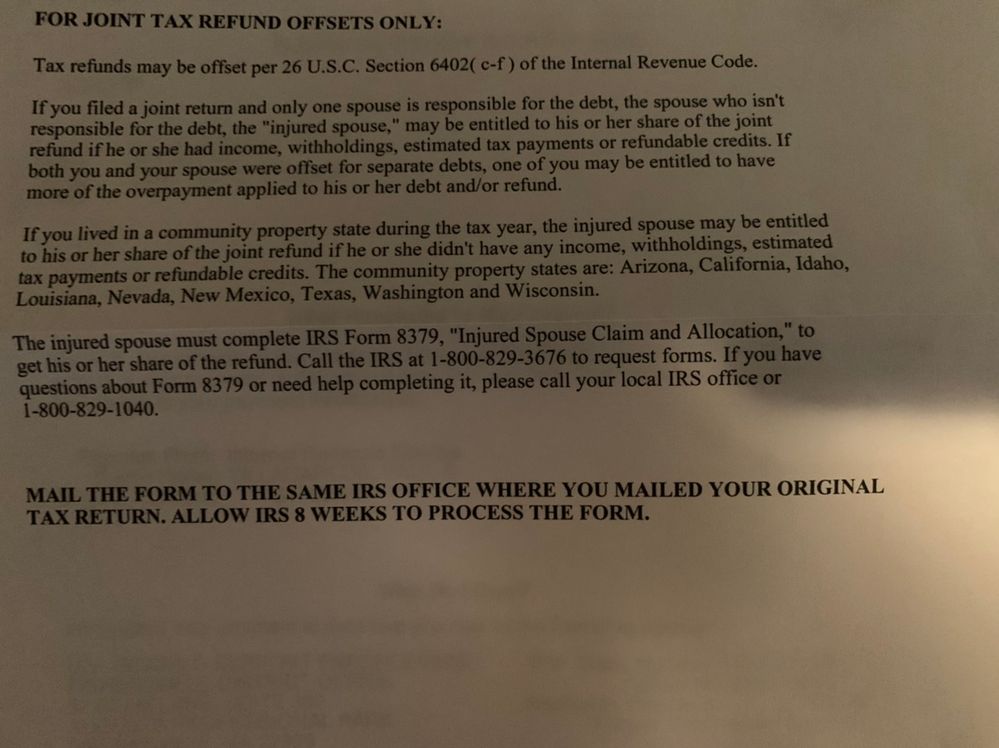

All the offset letters say that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

The letter just gives a number that says they are not taking incoming calls. I spoke to the treasury and they said to talk the child support, child support says to talk to the IRS. They took the entire amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

After waiting 11 weeks for the processing period, when can one expect a refund? Direct deposit or mailed? Thanks! All information is appreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Can I still file 8379 for my 2018 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Yep...We're all pretty much in the same boat....a mad sinking boat....but I digress. Even though we got the offset letters, the money has not been disbursed to any child support account.(I pulled up each CS acct to see payments...) The letter just alerts them to put a holds until injured spouse claims are completed. Regular refunds take 3- 4 months....this probably will too. It sucks!! Something has to change.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I believe the Treasury holds it for 6 months in anticipation of the 8379 being sent in before its released to the custodial parent from what they told us when we called last week.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

yeah, did all the same thing 😒

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

I got the same run around last 3 years. This year I spoke to child support and they told me not to file injured spouse. All it does is put it on the following year that it's still owed for past arrears. Child support says they will try to send my stimulus. They said no one should have been able to touch the stimulus. This was a person who works in pay roll department for child support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

That is ridiculous! She is not entitled to your child's portion. Outrageous! Maybe its time to head back to court and make a modification. We did! At this time my husband owes nothing but they still took. They don't understand why it was even taken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Injured spouse and stimulus payment

Your awesome!! Sounds great!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cher002

New Member

cloudberri000

Returning Member

hwilliams7

Employee Tax Expert

caitlinholden7

New Member

JtnJenna

Level 2