- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

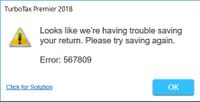

I know I have a lot of 1099 transactions and it was really dumb of me to import them all without saving so after all the work I was unable to save the file. I bit the bullet and closed without saving. I then started over, downloading the accounts one at a time, saving the file in between each download. Time consuming, yes, but it worked until I got the second message accompanied by a refusal of the program to download any more.

There are nowhere near 3000 transactions. More like 1100 and no different than any other year. It seems like there is a counter somewhere that gives the "more than 1000" warning twice then issues the "...you have more than 3000" failure on the third connection. It doesn't seem to care that I only downloaded one account (a couple hundred) transactions each time.

This seems to be one of your programmers "improvements" this year as I have never encountered this issue previously. I need another work around or I am out of business as far as turbotax is concerned. I need a way to override this idiotic, condescending (and factually very incorrect) "We notice you have more than 3000 transactions to import..." error message. It issues that message before I even tell it which accounts I want to download.

Someone screwed the pooch big-time on this one.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

I got it done, but just barely. For the benefit of any other poor bast_rd suffering with this, my advice is:

1. Organize your institutions and start with the ones that have the most 1099Bs and would be most difficult to enter by hand.

2. After importing from each institution, save the file. If you are lucky enough to successfully save the file, exit the program and copy the file to another location and rename it so you know what 1099s it has successfully imported. I found it helpful to keep a spreadsheet listing all accounts on the side and color the lines in after a successful import.

3. Repeat step two for each institution until you start to get crashes and failures. At this point, hopefully you will only have ones left that are relatively easy to enter manually.

I got Fidelity and Schwab in this way, leaving me with only TD Ameritrade and Vanguard to enter manually. The crashes began on the TD Ameritrade imports so I went back to the file that had only the Fidelity and Schwab 1099s successfully imported and manually entered the TDA 1099-Divs and the Vanguard 1099-R.

I now have a file that has everything and that seems reasonably stable, that is, I can open, save and close it without apparent issues. I will still save, exit and backup whenever I do anything significant to the file and hopefully I will get to a completed return at some point.

Good luck

ps. I also encountered some hopefully benign ridiculousness entering 1099-Rs. even though I said "no" to all the qualified disaster questions it still wanted to know how much of my distributions were a result of natural disasters, etc, so that part of the program seems somewhat fubar also.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

try the 'remove imported data' option under 'file' - and then reimport.

how are you sure there are 1100 records. Maybe the financial company is sending more than you expect (and that may be their error???)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

The frustrating thing is this is simply lazy sloppy code work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

I got it done, but just barely. For the benefit of any other poor bast_rd suffering with this, my advice is:

1. Organize your institutions and start with the ones that have the most 1099Bs and would be most difficult to enter by hand.

2. After importing from each institution, save the file. If you are lucky enough to successfully save the file, exit the program and copy the file to another location and rename it so you know what 1099s it has successfully imported. I found it helpful to keep a spreadsheet listing all accounts on the side and color the lines in after a successful import.

3. Repeat step two for each institution until you start to get crashes and failures. At this point, hopefully you will only have ones left that are relatively easy to enter manually.

I got Fidelity and Schwab in this way, leaving me with only TD Ameritrade and Vanguard to enter manually. The crashes began on the TD Ameritrade imports so I went back to the file that had only the Fidelity and Schwab 1099s successfully imported and manually entered the TDA 1099-Divs and the Vanguard 1099-R.

I now have a file that has everything and that seems reasonably stable, that is, I can open, save and close it without apparent issues. I will still save, exit and backup whenever I do anything significant to the file and hopefully I will get to a completed return at some point.

Good luck

ps. I also encountered some hopefully benign ridiculousness entering 1099-Rs. even though I said "no" to all the qualified disaster questions it still wanted to know how much of my distributions were a result of natural disasters, etc, so that part of the program seems somewhat fubar also.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

importing 1099s is a real problem this year.... Never had this problem in the 15+ years I have been using TT

I am having problem with importing 1099 from Schwab this year also.

More info and workaround in the blog below:

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jcsmile312

New Member

Kristina260

New Member

NYC89

New Member

stan_walker

New Member

nomad

Level 1