- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, your dependent's income is added to yours when determining household income for the Premium Tax Credit. TurboTax will add their entire income for the year if they are claimed as your dependent. If your child moved out and is no longer your dependent, you may allocate the health plan between both of your tax returns and you would no longer claim their income to determine your Premium Tax Credit.

Your dependent's MAGI that you are reporting for the Premium Tax Credit does not impact any other area of your return or your MAGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, you can split the information on the 1095-A. You would use the information on the 1095-A that reflects the entire tax year for yourself, and the dependent would use the information from the 1095-A on his tax return that shows the first five months of the year for his share of the Premium Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

@PattiF Thanks. I just manually calculated half for the first 6 months on my 1095-A and entered those figures and then the next question in TurboTax is was what percentage do I want to allocate to this other person and I put 50% and gave his SS # and the dates. Should I have left the figures as they appear on the 1095-A for those first 6 months and then this next question on the 50% will do it for me? Or am I correct in manually halving and then answering 50%? And then entering this manual calculation on my son's Tax return too?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

No, you do not have to manually calculate it. TurboTax will automatically divide up the numbers using your percentage if you follow these steps:

- In Federal > Deductions & Credits scroll down to Medical and click Start/Revisit next to Affordable Care Act (Form 1095-A)

- Enter the information as it appears on Form 1095-A

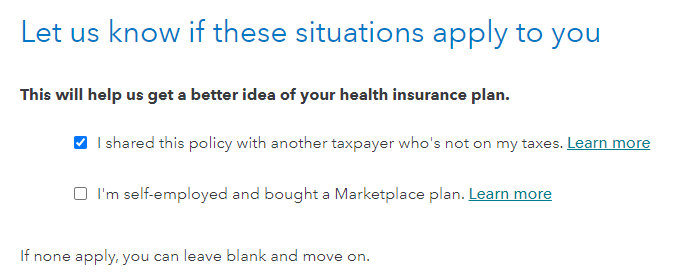

- Let us know if these situations apply to you click I shared the policy with another taxpayer who's not on my taxes.

- Enter the allocation information that you have determined, including the start and end months that you shared this policy with your child. Please note, the three percentages must be equal, if you are sharing 50% of the premium percentage, you must also share 50% of the SLCSP percentage and the advanced payment of PTC percentage.

On your son's return, if he was only covered by your policy from January through June, you would only enter the 1095-A information for those months. You would use the numbers as they are reported on the 1095-A, and allocate 50% of it to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, search for ACA and use the Jump to ACA link to go back to the ACA entry. Answer the Unemployment question and then click EDIT next to your 1095-A that is linked. Scroll to the bottom and click Continue. On the next screen, uncheck the box that say ''I'm self-employed and purchased a Marketplace plan'' box. This will unlink the policy from your business return. You can leave the first option checked and continue through to allocate the policy as your choose. Remember, you can allocate it however you want as long as the totals are 100%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, your dependent's income is added to yours when determining household income for the Premium Tax Credit. TurboTax will add their entire income for the year if they are claimed as your dependent. If your child moved out and is no longer your dependent, you may allocate the health plan between both of your tax returns and you would no longer claim their income to determine your Premium Tax Credit.

Your dependent's MAGI that you are reporting for the Premium Tax Credit does not impact any other area of your return or your MAGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Great info and thanks @RaifH - this helps a lot.

So if I only received the one 1095-A for me and it shows both me for the whole year and my son for 5 months and I am not claiming him as a dependent, do I just manually split the first 5 months of the year? And add his split to his tax return and remove his split from my tax return for those first 5 months?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, you can split the information on the 1095-A. You would use the information on the 1095-A that reflects the entire tax year for yourself, and the dependent would use the information from the 1095-A on his tax return that shows the first five months of the year for his share of the Premium Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

@PattiF Thanks. I just manually calculated half for the first 6 months on my 1095-A and entered those figures and then the next question in TurboTax is was what percentage do I want to allocate to this other person and I put 50% and gave his SS # and the dates. Should I have left the figures as they appear on the 1095-A for those first 6 months and then this next question on the 50% will do it for me? Or am I correct in manually halving and then answering 50%? And then entering this manual calculation on my son's Tax return too?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

No, you do not have to manually calculate it. TurboTax will automatically divide up the numbers using your percentage if you follow these steps:

- In Federal > Deductions & Credits scroll down to Medical and click Start/Revisit next to Affordable Care Act (Form 1095-A)

- Enter the information as it appears on Form 1095-A

- Let us know if these situations apply to you click I shared the policy with another taxpayer who's not on my taxes.

- Enter the allocation information that you have determined, including the start and end months that you shared this policy with your child. Please note, the three percentages must be equal, if you are sharing 50% of the premium percentage, you must also share 50% of the SLCSP percentage and the advanced payment of PTC percentage.

On your son's return, if he was only covered by your policy from January through June, you would only enter the 1095-A information for those months. You would use the numbers as they are reported on the 1095-A, and allocate 50% of it to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

@RaifH @PattiF Your answers have helped me complete my return! But then I get to final review and I get:

Review says "Shared Policy allocations for a form 1095A linked to a business... are not supported.

I am self employed and I have a shared Obamacare policy in which I am the main policy holder and my adult son who is not on my tax and I are the members.

The Review feature of TT Online show these complaints:

- Form 1095-A - Insurance Exchange (xxx) Social Security Number policy allocations for a form 1095A linked to a business, Business Related Premiums Smart Worksheet below, are not supported.

- Form 1095-A - Insurance Exchange (xxx) Shared Policy SLCSP Pct policy allocations for a form 1095A linked to a business, Business Related Premiums Smart Worksheet below, are not supported.

- and similar for other two numbers.

How do I work around this to get past this and my return passes the review? This has been very hard and time consuming in TT this year with the 1095-A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

The calculation is not supported by the software for allocating a marketplace plan that is also used for the self-employed health insurance deduction. In this situation, the IRS does not prescribe that the allocation has to be 50/50 if you received advanced premium tax credit. You and your son can allocate the policy using whatever percentages you choose as long as they add up to 100, so you can allocate it to whichever one of you would derive the greatest tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

@RaifH This seems like a huge failing ad I have paid extra for self employed! Now can't proceed?

What does your answer mean? Do I allocate me 51% and my son 49% on his separate return? Will that work and let me proceed in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

You would either have to take 100% of the Marketplace allocation or 0% of it to work around the limitation that the allocation does not work with the self-employed health insurance deduction. If you take 0%, then your son would have to claim the entire 100% of premiums and advance premium tax credit on his tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

@RaifH This is not a good solution. What happens if a unallocate the premiums from my business? Can I then do 50/50 %?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, if you unlink the 1095-A policy from your business, you can divide (share) the policy 50/50 and you will be able to e-file. The limitation applies to Marketplace policies with Advance Premium Tax Credits taking the self-employed health insurance (SEHI) deduction. If you unlink the policy, it will be Schedule A personal deduction and the SEHI deduction would not apply. See #6-8 under Health, 2021 for more details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

@DawnC Thank you for that information, is there a particular area I go to to unlink the 1095-A? What would I type in search bar?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Yes, search for ACA and use the Jump to ACA link to go back to the ACA entry. Answer the Unemployment question and then click EDIT next to your 1095-A that is linked. Scroll to the bottom and click Continue. On the next screen, uncheck the box that say ''I'm self-employed and purchased a Marketplace plan'' box. This will unlink the policy from your business return. You can leave the first option checked and continue through to allocate the policy as your choose. Remember, you can allocate it however you want as long as the totals are 100%.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If my dependent's MAGI is only for 4 months that he lived with me and I am entering in the Health Insurance 1095-A Plan info, will Turbo Tax account for this in MAGI?

Thank you for the consideration explained details and picture. This is very helpful. Wish I had known all of these answers in the beginning in TT.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lrwilcox

New Member

Oscaroporto74

New Member

shikhiss13

Level 1

lenahanpatrick

New Member

cmatchett18

New Member