- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I sold my boat with broker and was given a 1099misc with the other income box filled out. I lost money on the transaction but it looks like all income. How do I show

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my boat with broker and was given a 1099misc with the other income box filled out. I lost money on the transaction but it looks like all income. How do I show

How do I show that I purchased it for more than I sold it for and it was not income

Topics:

posted

February 17, 2021

5:15 AM

last updated

February 17, 2021

5:15 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold my boat with broker and was given a 1099misc with the other income box filled out. I lost money on the transaction but it looks like all income. How do I show

Report your sale as an investment sale. Be sure to answer all the questions accurately. If the boat was personal use property then the loss will not be allowed, but the income will not be taxed.

- Do NOT enter the Form 1099-MISC, instead this will be your sales price for an investment sale.

- Sign into your TurboTax Account > Federal tab > Wages and Income > Investment Income > Select Stocks, Bonds, Mutual Funds, Other

- The first screen will ask if you sold any investments during the current tax year (This includes any asset held as an investment property or personal use property so answer “yes” to this question)

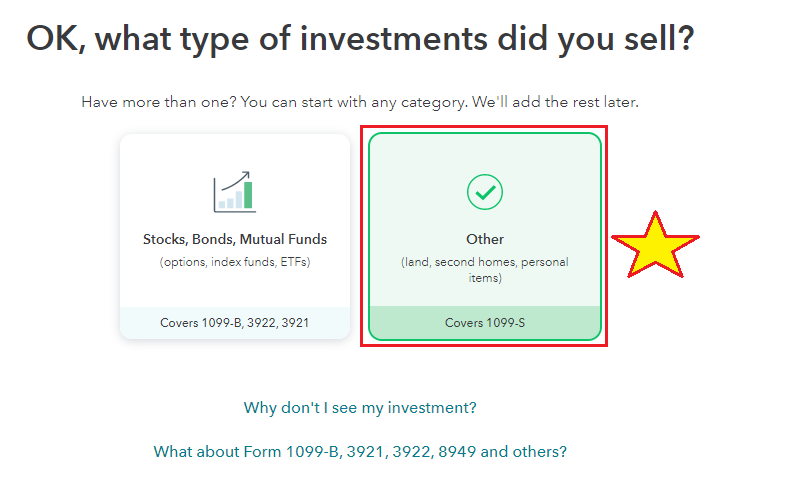

- If you are using the online version - there will be a box to select Other (see image below) Do not select the Stocks, Bonds, Mutual funds box.

- Since you did not receive a 1099-B, answer “no” to the 1099-B question - not in Online version

- Choose type of investment you sold - select 'Other" see image below

- Some basic information:

- Description – Usually the address of the property sold - Timber

- Date of Purchase

- Sales Proceeds – Your net proceeds from the sale

- Date Sold – Date you sold the property

- Cost

- Continue to finish your sale

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 17, 2021

5:36 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

stafford2019

Level 2

scatkins

Level 2

Naren_Realtor

New Member

jmgretired

New Member

asdfasdf4

Returning Member