- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I keep getting "Review your 1099-DIV info" The problem seems to be related to Section 199A Dividends. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting "Review your 1099-DIV info" The problem seems to be related to Section 199A Dividends. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting "Review your 1099-DIV info" The problem seems to be related to Section 199A Dividends. What should I do?

Review your entry carefully and follow the prompts after the post.

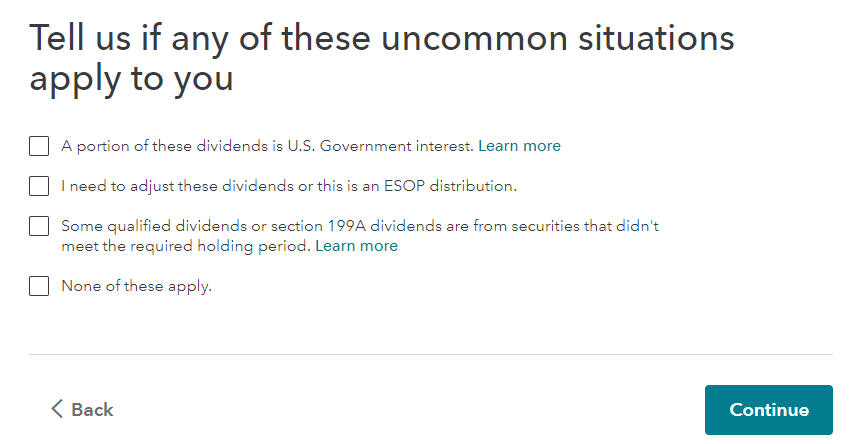

Click here to read about when you would need to click the box about the uncommon situation involving the holding period.

In TurboTax Online, the explanation:

Certain dividends receive preferable tax treatment if specific criteria are met.

Most criteria are determined by the institution that reports the dividends. However, you may need to reduce this amount if the security that generated these dividends was not held for the required holding period.

The holding period varies depending on the type of security. Only dividends attributable to securities for which you met the holding period are eligible for the preferred tax treatment.

For Section 199A dividends (also known as REIT dividends), the required holding period is more than 45 days during the period beginning 45 days before the ex-dividend date and ending 45 days after the ex-dividend date.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

claire-hamilton-aufhammer

New Member

blankfam

Level 2

dlz887

Returning Member

sierrahiker

Level 2

abcxyz13

New Member