- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have 2 stores on Etsy but neither generated a 1099-K. How do i report my income? Can TurboTax import or sync to my Etsy account to get this information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 2 stores on Etsy but neither generated a 1099-K. How do i report my income? Can TurboTax import or sync to my Etsy account to get this information?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 2 stores on Etsy but neither generated a 1099-K. How do i report my income? Can TurboTax import or sync to my Etsy account to get this information?

No, this is not something that can be imported. You don't need the official form if you have kept track of your income and expenses. . You’ll receive a 1099-K if you accepted credit cards, debit cards or prepaid cards and had over $20,000 in sales and more than 200 individual transactions through a third party processor.

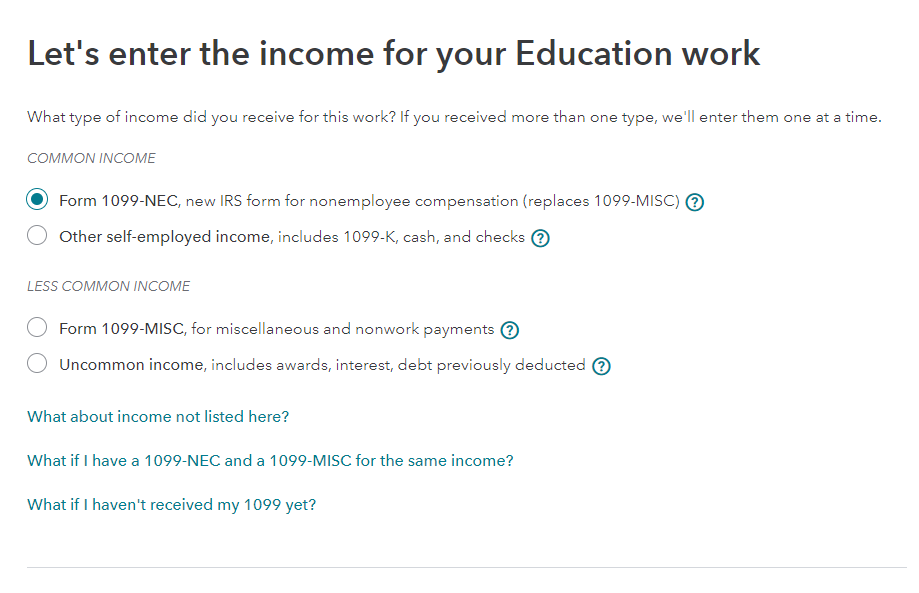

You can enter the income as cash on the same line that asks for 1099-K income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have 2 stores on Etsy but neither generated a 1099-K. How do i report my income? Can TurboTax import or sync to my Etsy account to get this information?

No, this is not something that can be imported. You don't need the official form if you have kept track of your income and expenses. . You’ll receive a 1099-K if you accepted credit cards, debit cards or prepaid cards and had over $20,000 in sales and more than 200 individual transactions through a third party processor.

You can enter the income as cash on the same line that asks for 1099-K income.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dc20222023

Level 3

tianwaifeixian

Level 4

tianwaifeixian

Level 4

dpa500

Level 2

RyanK

Level 2