- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- i GOT A RANDOM REFUND FOR (2020)? *Information Provided*

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i GOT A RANDOM REFUND FOR (2020)? *Information Provided*

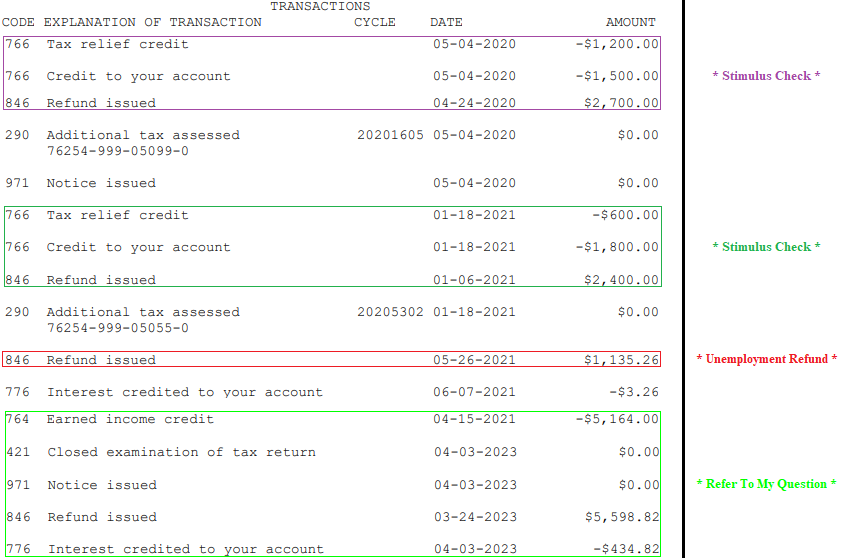

Hey guys, I got a refund check a few days ago which I haven't cashed yet due to me not knowing why I received this refund, I researched this for awhile now, and I found that in 2020 there was a "Lookback Rule" [With this new “lookback” rule, you can choose to use your 2019 earned income information to determine your eligibility for the Earned Income Credit and the Additional Child Tax Credit if your 2020 earned income is lower than your 2019 earned income and doing so results in a larger credit.] and my 2020 earned income was lower then my 2019's because I was on unemployment due to the pandemic, I took a snapshot of my IRS transcript which is provided below. I must add that I did not do nothing to initiate this, I was audited for whatever reason, and after the audit was completed they issued this refund.

So based on the information I made available from all of my resources, I know none of you can tell me %100 that, this is the case, however, by adding all the information available, that would be my ONLY conclusion?

THOUGHTS ?

COMMENTS ?

Thanks a lot!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i GOT A RANDOM REFUND FOR (2020)? *Information Provided*

Yes. The IRS automatically adjusted returns where the look-back period would benefit them and sent the additional refund. You will likely get a 1098-INT from the IRS to report on your 2023 return for interest that was paid on the additional refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i GOT A RANDOM REFUND FOR (2020)? *Information Provided*

Yes. The IRS automatically adjusted returns where the look-back period would benefit them and sent the additional refund. You will likely get a 1098-INT from the IRS to report on your 2023 return for interest that was paid on the additional refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i GOT A RANDOM REFUND FOR (2020)? *Information Provided*

It looks like you were eligible for, but did not claim in our original 2020 return, an "Earned Income Credit" (EIC). All the other refunds in your transcript were for the recent stimulus payments or the non-taxability of unemployment compensation. (That unem comp provision was enacted after most people filed their federal return for that year - thus the federal refund after the filing.) So, check your original 2020 return to see that you did not claim the EIC in the original return. It simply looks like IRS audited your return, found that you were eligible for the EIC, calculated the amount, and sent you a refund. The EIC refund is not taxable in 2023 but any interest income received on the 2023 refund is taxable in 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

i GOT A RANDOM REFUND FOR (2020)? *Information Provided*

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

cooken

New Member

vincepazo

New Member

tishamyers87

New Member

Irasaco

Level 2

NITAMYERS

Returning Member