- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I entered farm rental expense. The farm summary page is $0 and form 4835 is blank. The edit button for the only farm on the summary page shows the values entered. Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered farm rental expense. The farm summary page is $0 and form 4835 is blank. The edit button for the only farm on the summary page shows the values entered. Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered farm rental expense. The farm summary page is $0 and form 4835 is blank. The edit button for the only farm on the summary page shows the values entered. Why?

There is a farm summary and a farm-rental summary. Are you sure you have entered the expenses/income in the correct sections of TurboTax? If you are still experiencing an issue, please let us know what version you are using.

Farmers can forgo making estimated tax payments from their income as long as they file and pay their taxes by March 1st. In order to qualify for the March 1st deadline, two-thirds of your income must come from farming or fishing. For further information, please refer to the IRS website for the most current information for those impacted by natural disasters.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered farm rental expense. The farm summary page is $0 and form 4835 is blank. The edit button for the only farm on the summary page shows the values entered. Why?

Yes, I see that and understand the difference. The phrase 'operate a farm' is confusing. It means actually DO the farming and throws you into the wrong (for me) territory. I deleted both forms and started over. That may be why it sometimes shows nothing in my 2022 column. The farm name may not be exactly the same as before.

I am using TT H&B on a Lenovo notebook computer and there are no pending program updates as of 1/17/24. Is that what you mean by version?

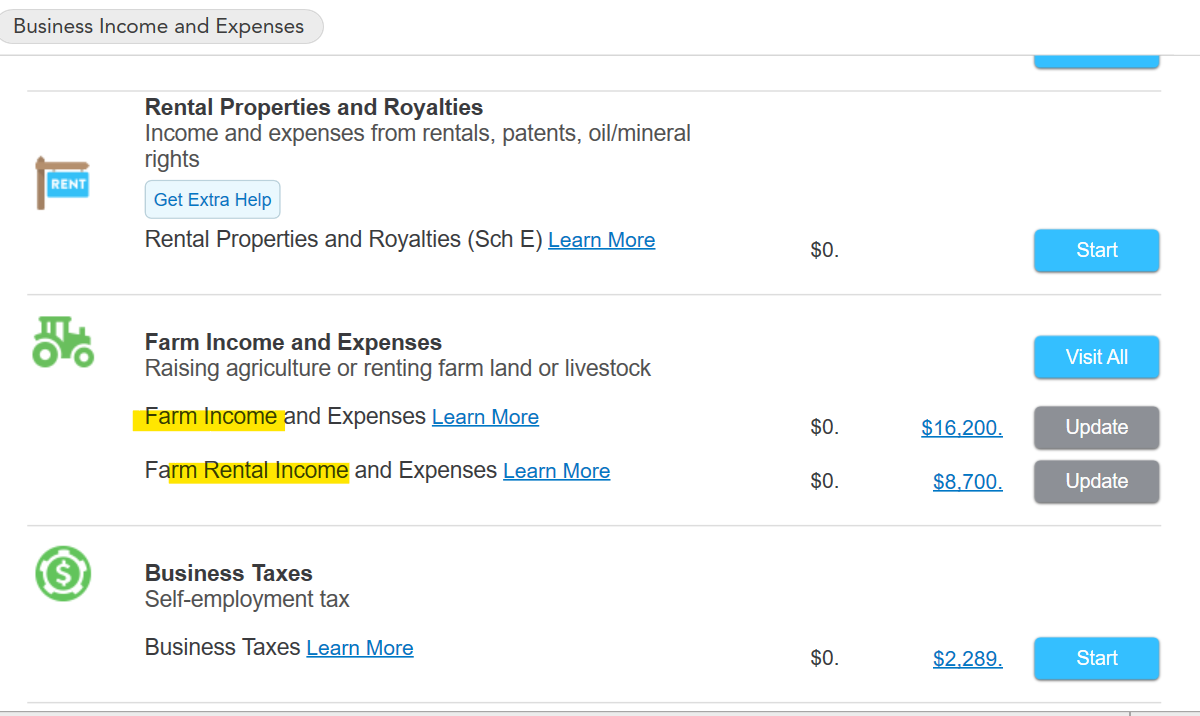

When I go into Business Income and Expenses TT shows 2022 numbers for Farm Rental Income and Expenses and zeros in the 2023 column. I click Update and select ‘share of production’ and ‘did NOT materially participate’. I click Edit on the farm name and enter the income and expenses. When I Continue I see the values I entered for Crop income and the expenses. After that page the Farm Rentals Summary page shows zeros for 2023 and the same number for 2022 (I haven't checked that previous return to assure that it’s the correct number). I switch to Forms view and the 4835 has the numbers I entered. Please explain how to fix this in the Step by Step interface.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered farm rental expense. The farm summary page is $0 and form 4835 is blank. The edit button for the only farm on the summary page shows the values entered. Why?

There is no need to fix this in step by step just as long as the 4835 has all the correct information. If it is on the form, then the correct information will be sent to the IRS regardless on whether or not it appears in a summary page in step by step.

Version refers to the Turbo Tax product you are using and you stated that you are using TT Home and Business version of the software.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered farm rental expense. The farm summary page is $0 and form 4835 is blank. The edit button for the only farm on the summary page shows the values entered. Why?

As a former software developer, it's difficult for me to believe that no one at Intuit cares that the step-by-step user interface has a bug — incorrectly showing current status of totals the user just entered. I hope I provided enough information to either reproduce the problem or let me know what I doing wrong (since it worked correctly for me last year). I do appreciate that the data is getting through the step-by-step interface to the Form 4835.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

cirithungol

Returning Member

jamesmac007

Level 3

jamesmac007

Level 3

TaxpayerNoDoubt

Level 1