- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

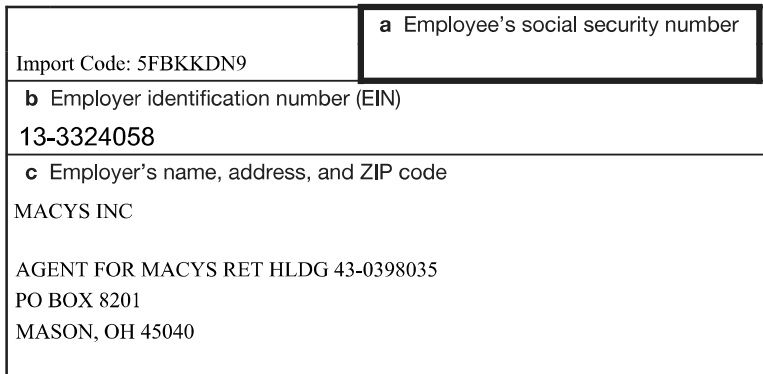

- I e-filed my state and federal returns and they were rejected because of the employer ID number I went back and checked other forms and compare them with the W-2s and the numbers were right but on the

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed my state and federal returns and they were rejected because of the employer ID number I went back and checked other forms and compare them with the W-2s and the numbers were right but on the

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed my state and federal returns and they were rejected because of the employer ID number I went back and checked other forms and compare them with the W-2s and the numbers were right but on the

If your return is rejected because your employer ID number is not correct, and you verified that the employer ID number agrees to what is shown on your W-2, please try the following:

- Verify that you entered your employer's name exactly as it is shown on your W-2

- Delete your entry for the Employer Identification Number (EIN) and re-enter it again. (You may have an extra space or some other issue that is causing the rejection.)

If everything agrees to your W-2, you will need to contact your employer to get the correct ID number. Please click here for instructions on how to correct your W-2 in TurboTax.

Unfortunately, the IRS will not allow you to e-file a return if the Employer Identification Number (EIN) and the employer name do not agree to what is in their database.

If you are unable to get the correct information from your employer, you will need to mail your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed my state and federal returns and they were rejected because of the employer ID number I went back and checked other forms and compare them with the W-2s and the numbers were right but on the

Second year in a row I wasn't able to E-Files my daughter's taxes. Same error each year - EIN invalid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed my state and federal returns and they were rejected because of the employer ID number I went back and checked other forms and compare them with the W-2s and the numbers were right but on the

Plus it went ahead and charged me for NOT filing the state return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I e-filed my state and federal returns and they were rejected because of the employer ID number I went back and checked other forms and compare them with the W-2s and the numbers were right but on the

Please see the following instructions posted by @BarbaraW22 above.

If your return is rejected because your employer ID number is not correct, and you verified that the employer ID number agrees to what is shown on your W-2, please try the following:

- Verify that you entered your employer's name exactly as it is shown on your W-2

- Delete your entry for the Employer Identification Number (EIN) and re-enter it again. (You may have an extra space or some other issue that is causing the rejection.)

If everything agrees to your W-2, you will need to contact your employer to get the correct ID number. Please click here for instructions on how to correct your W-2 in TurboTax.

Unfortunately, the IRS will not allow you to e-file a return if the Employer Identification Number (EIN) and the employer name do not agree to what is in their database.

If you are unable to get the correct information from your employer, you will need to mail your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JoO5

Level 1

michelleneal1977

New Member

rjford-author

New Member

RMH122600

Level 1

ricardo-lugo7

New Member