- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I assume that you refer to estimated taxes you have paid...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

I assume that you refer to estimated taxes you have paid quarterly.

You can enter the estimated taxes you paid by following these steps:

- In TurboTax, open your tax return and click in Personal, then Deductions & Credits

- On the next page, click on I'll choose what I work on

- Locate the section named Estimates and Other Taxes Paid

- Click on Start next to Estimates (see attached screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

The description of where to go is wrong, this doesn't get me to the location where pre-paid taxes can be entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Estimated taxes are pre-payments of your tax due. Follow these steps to enter these payments:

- From the Federal menu, click on Deductions & Credits

- Expand the menu for Estimates and Other Taxes Paid

- Click Start/Revisit next to Estimated Tax Payments

- Click Start/Revisit next to Federal estimated taxes for 2019 (Form 1040ES)

- Answer YES to Did you pay federal estimated taxes for 2019?

- Enter the payment information on the screen that follows

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Your explanation is clear enough, but I don't think we are using the same software.

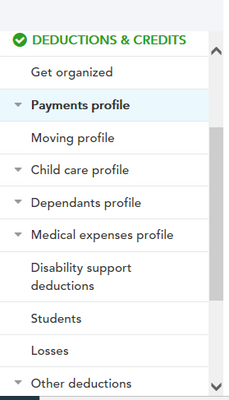

I click on the Deductions and Credits list, and "Estimates and Other Taxes" paid is not present. Below is a screen shot of what I see.

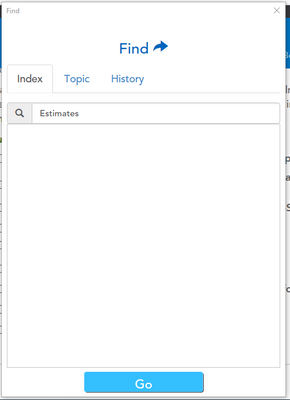

If "Estimates" was a portion of a title of an easy step page it should be accessible through the search function. Below is a screenshot of the lack of results found when I searched that word:

Or similar in the help section where that word "estimates" doesn't seem to be searchable in the help index either.

I sure hope that this is a simple error in my software or perhaps there may be something wrong with the several responses that seem to be directly written to instruct me to fine menus that don't seem to exist.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Those screens are not from Turbo Tax. You must be using something else. Are you maybe doing a Canada return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

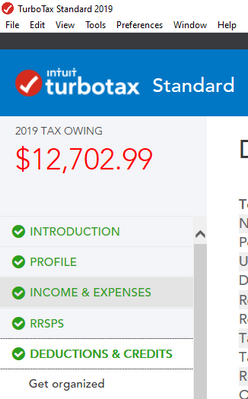

They are from Turbo Tax:

This is a Canadian Return, I searched TurboTax Canada Prepaid Tax and a response similar to yours is what TurboTax presented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

This is the USA forum.

Here is the Canada forum

https://turbotax.community.intuit.ca/tax-help

Or Contact TurboTax Canada Support

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Thanks for your help. I don't understand why TurboTax doesn't explicitly show how to do this.

Andy Evans

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Thanks for this helpful information.

It's a pity that my TurboTax account doesn't automatically show record of my payment and direct me to this page or offer a link.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

Mostly correct assumption. I had $75000 moved from a normal IRA to a ROTH in May of 2021 and electronically transfered $18000 from another non IRA account to the the IRS (May 16) to PRE PAY the tax. BUT, TURBOTAX reduced, by it’s calc, in the form of an $11 penalty, my refund.

If the IRS does not catch this, you owe me $11.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

@UncleJim2u You entered the $18,000 estimated payment? You might have been able to eliminate it or at least reduce it. You can go to Federal Taxes tab or Personal tab, under Other Tax Situations and select Start by the Underpayment Penalties. You will answer a series of questions that may reduce or eliminate the penalty. Or you can elect to have the IRS figure the penalty for you. It's form 2210.

How to add form 2210 for Underpayment Penalty

https://ttlc.intuit.com/community/tax-payments/help/how-do-i-add-form-2210/00/25703

It's under

Federal or Personal (for Home & Business Desktop)

Other Tax Situations

Additional Tax Payments

Underpayment Penalties - Click the Start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do i enter prepaid federal taxes

See my previous reply. And, add this to your answered direction: That is what I did.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

d-nicewander

New Member

neldred

New Member

werman01

New Member

armando50

Returning Member

rwedell

New Member