- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to get "right" withholding - state is good but fed is WAY off

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get "right" withholding - state is good but fed is WAY off

My wife and I file jointly and we both have decent incomes. But we can't seem to get the right W4 withholding. This year our Rhode Island REFUND was $159 but we OWED $3600 to the Feds. It has been like this for the past few years. And there were a few years before that where it was the opposite, we got a modest federal refund but owed a lot to the state.

We were even tagged with a penalty this year for underpayment on our fed taxes.

How do my wife and I calculate and file W4s that get us close(er) for both fed and state?

Note that we still have 3 child dependents

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get "right" withholding - state is good but fed is WAY off

Hi, thepaulsri,

You can fine-tune your withholding and estimated tax payments for 2022 if you unexpected owed money to IRS when you filed your 2021 return.

IRS has a tax withholding estimator to help figure out if you have the right amount of income tax withholding from wages, pensions, IRA distributions etc. The tool asks about various sources of income, provides tips on tax credits and deductions, and estimates how much withholding to request.

Use this tool to:

- Estimate your federal income tax withholding

- See how your refund, take-home pay or tax due are affected by withholding amount

- Choose an estimated withholding amount that works for you

Results are as accurate as the information you enter.

Tax Withholding Estimator

https://www.irs.gov/individuals/tax-withholding-estimator

As you indicated, Federal and State tax results are not always in tandem. Hope the above will improve the Federal outcome for tax year 2022.

One other way is to leave W-4 as is since RI state withholding is good. If tax year 2022 is similar to that of 2021, you can use IRS Direct Pay to pay approx. $3,600 estimated tax payments (1/3 each on 6/15, 9/15, 1/17/2023) so the tax year 2022 filing result has less impact on your cash flow.

Hope the above helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to get "right" withholding - state is good but fed is WAY off

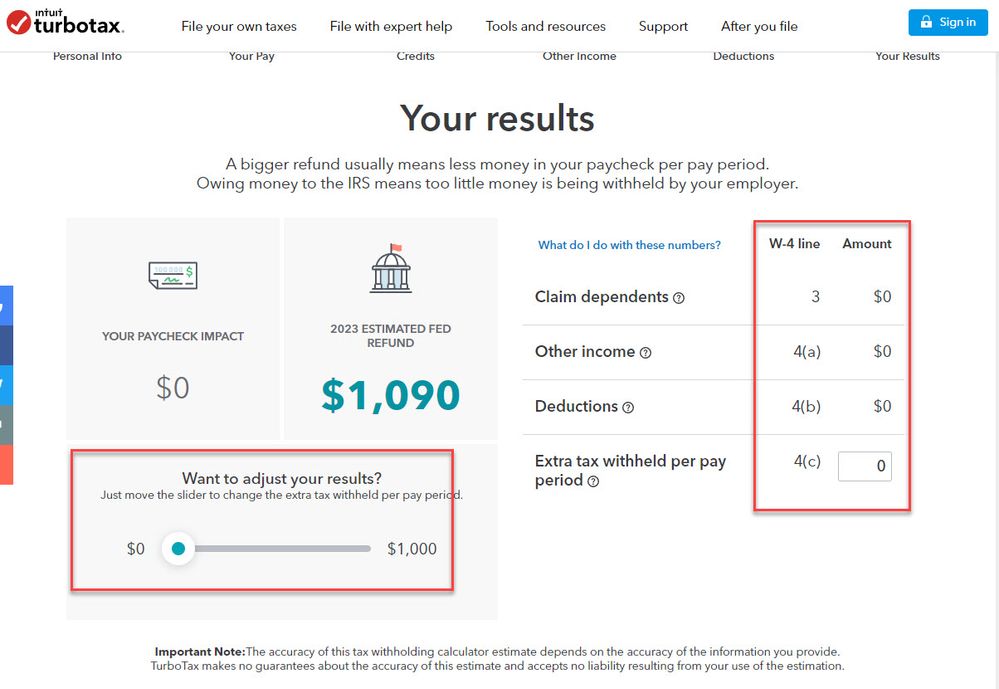

Use the free TurboTax W-4 calculator. It’s better than the IRS app.

At the end it will show you what numbers to fill in on your W-4. There is also a slider bar that shows you how changing your W-4 will affect your refund/balance due.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kvaudo

New Member

DCKristen

New Member

cathrinelivingston

New Member

oregoncac

Level 1

TCT0607

New Member