- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to file Form 982

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Under these circumstances and in order to file the Form 982, we generally recommend using the CD/Download version of TurboTax Deluxe or a higher edition. I notice that you are currently using our TurboTax online product. If you have not paid anything yet, you can easily cancel and change to the desktop version for your return.

Form 982 (Reduction of Tax Attributes Due to Discharge of Indebtedness) reports the amount of cancelled debt to excluded from taxable income. We'll automatically generate Form 982 if your cancelled debt is due to:

- Cancellation of qualified principal residence indebtedness, aka mortgage debt relief;

- Debt cancelled in a Title 11 bankruptcy;

- Debt cancelled during insolvency (the amount exceeding your assets);

- Cancellation of qualified farm or real property indebtedness.

In addition, you should have a 1099-C to report the amount of cancelled debt.

In order to the switch from online to CD/download. please see the following link: https://ttlc.intuit.com/questions/1901476-how-do-i-switch-from-turbotax-online-to-the-turbotax-softw...

Once you have done the above you can access the forms mode of your desktop program using these steps:

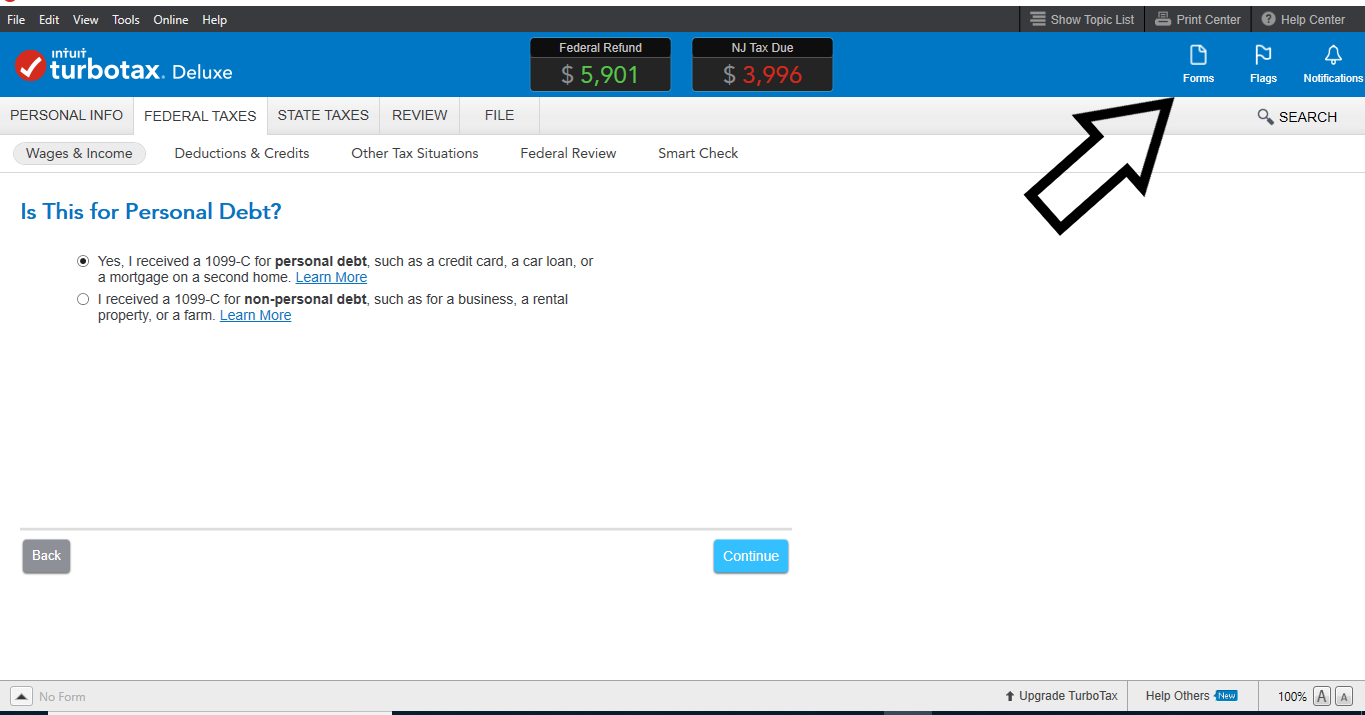

To switch to Forms Mode, open your return, and then click the Forms icon in the upper right corner of your screen (or choose Forms from the View menu at top).

The Federal Information Worksheet will display and all the forms in your return will be listed on the left side. Then click on Open Form and type in the search box : Form 982.

To make sure its excluded within your return, you will need to fill out the following forms:

- Form 1099-C (Cancellation of Debt), fill out accordingly

- Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason)

- Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion)

- Part VIII Exclusion for Insolvency (must fill out the Statement of Insolvency)

- Then check Form 1040, look at Line 21 Other Income, should be 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Under these circumstances and in order to file the Form 982, we generally recommend using the CD/Download version of TurboTax Deluxe or a higher edition. I notice that you are currently using our TurboTax online product. If you have not paid anything yet, you can easily cancel and change to the desktop version for your return.

Form 982 (Reduction of Tax Attributes Due to Discharge of Indebtedness) reports the amount of cancelled debt to excluded from taxable income. We'll automatically generate Form 982 if your cancelled debt is due to:

- Cancellation of qualified principal residence indebtedness, aka mortgage debt relief;

- Debt cancelled in a Title 11 bankruptcy;

- Debt cancelled during insolvency (the amount exceeding your assets);

- Cancellation of qualified farm or real property indebtedness.

In addition, you should have a 1099-C to report the amount of cancelled debt.

In order to the switch from online to CD/download. please see the following link: https://ttlc.intuit.com/questions/1901476-how-do-i-switch-from-turbotax-online-to-the-turbotax-softw...

Once you have done the above you can access the forms mode of your desktop program using these steps:

To switch to Forms Mode, open your return, and then click the Forms icon in the upper right corner of your screen (or choose Forms from the View menu at top).

The Federal Information Worksheet will display and all the forms in your return will be listed on the left side. Then click on Open Form and type in the search box : Form 982.

To make sure its excluded within your return, you will need to fill out the following forms:

- Form 1099-C (Cancellation of Debt), fill out accordingly

- Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason)

- Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion)

- Part VIII Exclusion for Insolvency (must fill out the Statement of Insolvency)

- Then check Form 1040, look at Line 21 Other Income, should be 0.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

I HAVE the CD installed software and it still does NOT allow me to search within for this form. 2019

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

In TurboTax desktop, here are the steps:

- Sign back into your account and select Pick up where you left off

- Go to the search bar in the top right corner, type in "982" and Enter

- Select "Jump to 982"

- Follow prompts

- This allows you to enter your Form 1099-C information. In order to manually fill out Form 982, you would have to go to the Forms mode and looks for the form. See the images below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Your response says that line 21 of 1040 should be 0 . Line 21 is about the refund on a 1040. The amount on line 4 should be cleared, but it's not. It still shows the 1099-c amount there. It also shows on schedule 1 on line 9. I don't think adding the 982 form to your return reflects in in the full 1040?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Same question but if this is an amendment so instead of Form 1040 line 21 where should it say 0 on Form 1040X?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Line 21 used to be for 'Other Income'. Now 'Other Income' is Schedule 1 Line 8. That is the line that should be zero.

On an amended return Form 1040X, line 1 is adjusted gross income.

Changes to Schedule 1 line 8 affect adjusted gross income, and would be reflected in changes to 1040X line 1.

Please see below for how to exclude income from cancelled debts due to insolvency.

Exclusion of income from cancelled debts due to insolvency.

Canceled, forgiven, and discharged debt is considered taxable income, unless it qualifies for an exclusion or an exception.

One of those exceptions is insolvency.

The IRS considers you to be insolvent if your debts exceed your assets immediately before the debt was cancelled.

You don't have to include a canceled debt in income to the extent that you were insolvent immediately before the cancellation of the debt.

To determine if you were insolvent immediately before the cancellation of the debt complete the Insolvency Worksheet in Publication 4681.

If you wish to exclude the cancelled debt from income due to insolvency, you can do so using the CD/Download version of TurboTax Deluxe or a higher edition.

If you started your 2019 return in TurboTax Online and want to switch to the TurboTax CD/Download software, here's how. How do I switch from TurboTax Online to the TurboTax software?

- Once you are in the CD/download version you can switch to Forms Mode by selecting the Forms icon in the upper right hand corner of the screen, or selecting Forms from the view menu.

- The Federal Information Worksheet will display and all the forms in your return will be listed on the left side.

- Select Open Form and type into the search Box 1099-C. You will be asked to enter the creditors name, and then a Form 1099-C will display. Enter the information from your 1099-C.

- When you enter the Form 1099-C information a new form will be created just below the 1099-C called Cancelled Debt (Creditors Name). Select that Form.

- Fill out the cancelled debt Form Part VIII Exclusion for Insolvency.

- You must also complete the Statement of Insolvency. You can QuickZoom to that statement from Part VIII.

When you complete the cancelled debt form, Form 982 will also be completed. You do not have to add any information to Form 982.

To verify that your debt has been excluded, look at Schedule 1 line 8, other income. It should not show any income from cancellation of debt.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

I am experiencing the exact same problem. Been on the phone with a TurboTax rep for over an hour and she could not figure out how to include form 982. It does not come up automatically UNLESS we are filling out something incorrectly. Are we supposed to fill out the insolvency worksheet through TurboTax? Where do we actually show that the 1099-c should not be counted as income because of insolvency through form 982. Very frustrating so far. Filed this on my own last year and so much easier!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

I am not using free file. I have a downloaded version via CD

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

@JCB67 You need to use the Forms mode and then the Open Forms option and then type in 982 to bring up the Reduction of Tax Attributes Due to Discharge of Indebtedness form.

Once you have the form 982 open, you can use the QuickZoom to Canceled Debt Worksheet option to find the worksheet where you will apply to have your cancelled debt exempted from tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Can you tell me from the previous replies to this question, is this still the process. This is the only part of my tax return I need to fill out and then print out and sign as I was told I can not efile if form 982 is included on the return. I do not have any assets or own a home and went into a cc debt program and some of the cc debt was forgiven and a smaller amount was to be paid. I filled out Part 1 checked 1b and put in the amount in in number 2.

Part II confuses me

Any help would be appreciated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

Part II may not apply to your debt. Please see the link below for additional information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file Form 982

So, @ThomasM125 and @Cynthiad66, there is no way to file Form 982 from the online version?

My computer doesn't have the latest version of MacOS (and can't update) and the DELUXE version won't run on it.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

connorcnb

New Member

fe23f16100e8

New Member

playbunnymel1

New Member

bran126211

New Member

StuAdler

Level 1