- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to enter asset for first time turbotax user for business? The business is already 6 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Which version of TurboTax are you using (you need to be using Home & Business or Self-Employed).

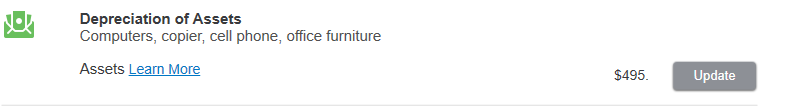

Do you see anything similar to the screenshot depicted below?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

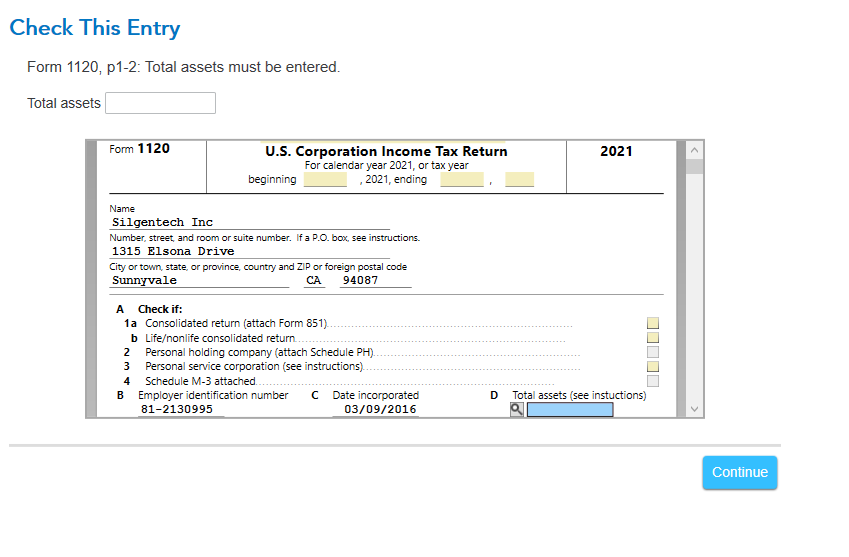

You enter the corporation's total assets as of the end of the tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Which version of TurboTax are you using (you need to be using Home & Business or Self-Employed).

Do you see anything similar to the screenshot depicted below?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

I'm using Turbotax business 2021. I got following similar screen

After finish income and deductions, it comes to review and it asks info displayed in following screen.

I don't know how to enter the total assets.

Thank you very much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Hello Champ,

My second screenshot contains some info, it better not be here. I can't delete it. If you're from intuit, could you help to delete it.

thank you very much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

You enter the corporation's total assets as of the end of the tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Also, no one (here or at Intuit) can delete anything for you on that return.

You are using TurboTax Business so you are the only person who can alter the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Where can I got the those info? I have total assets data for 2020. How can I calculate assets for 2021? I feel turbotax should be able to calculate for me since I entered the property info and all info already. thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

If you have your 2020 return, you should have the total asset figure at the end of the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Yes. I do have the total assets for end of 2020. But I don't know how to calculate that for end of 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter asset for first time turbotax user for business? The business is already 6 years.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vgutierrez65

New Member

vgutierrez65

New Member

vgutierrez65

New Member

CCCD

New Member

pdunamis

New Member