- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to enter 1099-B Transactions for which Cost Basis /Term is Unknown

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099-B Transactions for which Cost Basis /Term is Unknown

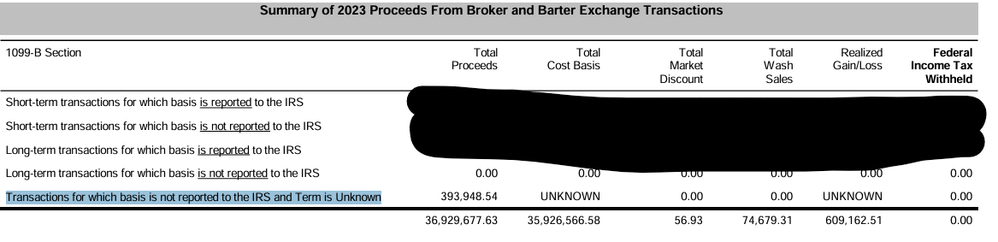

On my 1099-B from my brokerage, I have “Transactions for which basis is not reported to the IRS and Term is Unknown.” For the other sections which have known cost basis/term, I enter sales section totals since the 1099-B is ~1,000 pages long.

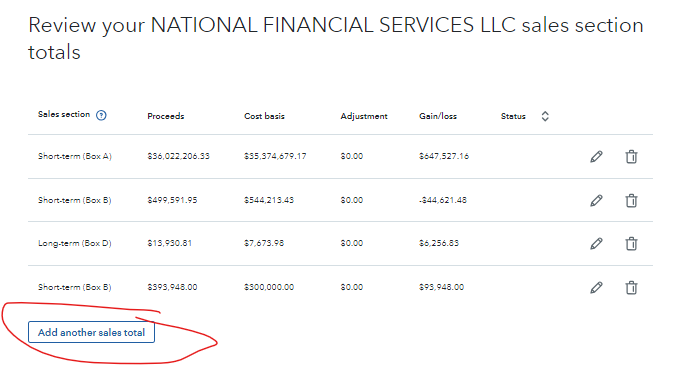

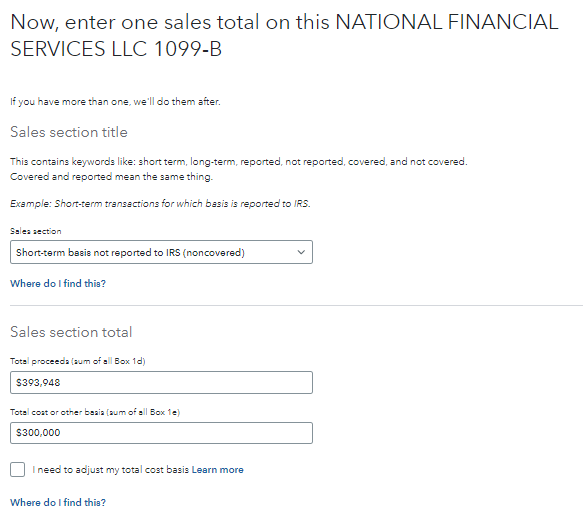

Based on trading records, I have my basis for these “Unknowns” and know that all sales were short-term. Do I enter this information as a sum total proceeds/cost basis for all transactions under “->Add Another Sales Total->Short-term basis not reported to IRS (noncovered)?

For example, I have total proceeds of $393,948.54 in this section and “UNKNOWN” in Total Cost Basis column. If, for illustrative purposes, my total cost basis is $300,000 in these transactions (all short-term), do the below screenshots show this information correctly entered into TurboTax? If not, what is the correct way to enter?

Do I need to upload any supporting evidence (trade records, etc.) showing how I arrived at the cost basis of $300,000? If so, how do I do that in TurboTax? Otherwise, it is a black-box how I came up with the $300k.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099-B Transactions for which Cost Basis /Term is Unknown

Yes, I would report the short-term proceeds with Unknown basis under one sales section total. Select sales section title (B) Short-term transactions reported on Form(s) 1099-B showing basis wasn’t reported to the IRS. The detail would include the sales date, the gross proceeds, the cost basis which you assigned to those proceeds and some declaration of how the basis was computed. Copies of trade records may be included or saved should a tax authority question at a later time how the amount was arrived at.

TurboTax Online will allow you to upload IRS form 1099-B information in PDF format but the number of pages that you report may be too large a PDF file for TurboTax to upload or the IRS to receive.

Both TurboTax Online and Desktop will accept IRS form 1099-B information in sales section format and allow you to US mail the attachments.

In TurboTax Desktop, follow these steps:

- Select Federal Taxes across the top of the screen.

- Select Wages & Income across the top of the screen.

- Select I'll choose what I work on.

- Scroll down to Investment Income.

- Select Start / Update to the right of Stocks, Mutual Funds, Bonds, Other.

- At the screen Did you sell any investments in 2022, select Yes.

- At the screen OK, let's start with one investment type, select Stocks, Bonds, Mutual Funds and select Continue.

- At the screen Let us enter your investment sale info, select Skip Import.

- At the screen Which bank or brokerage sent you this form, enter the information. Continue.

- Do these sales include any employee stock, enter No.

- Do you have more than three sales, enter Yes.

- Do these sales include any other types of investments, enter No.

- Did you buy every investment listed, enter Yes. Continue.

- On the screen Now, choose how to enter your sales, select Sales section totals. Select Continue.

- On the screen Look for your sales on your 1099-B, select Continue.

- At the screen Now, enter one sales total, enter the information. Continue.

- Select Add another sales total as necessary. Continue.

- You will mail a paper copy of the IRS form 1099-B to the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099-B Transactions for which Cost Basis /Term is Unknown

Thank you very much. You said: "The detail would include the sales date, the gross proceeds, the cost basis which you assigned to those proceeds and some declaration of how the basis was computed. "

To my knowledge, you cannot input the sales date or any declaration of how the cost basis was computed in TurboTax. Is that correct?

If that is correct, do I need to mail this to the IRS? Would I still be able to e-file and then mail the cost basis information to the IRS as supplementary information? Or do I need to paper file my entire return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099-B Transactions for which Cost Basis /Term is Unknown

I'm sorry that I was unclear.

I would report the short-term proceeds with Unknown basis under one sales section total. Sales section totals may be reported with TurboTax Desktop or TurboTax Online and the tax return may be electronically filed. When you enter this information, date acquired and date sold are not reported in TurboTax.

The Online version will upload your PDF of the detail of the sales section total. However, I do not know what size limitation that TurboTax software has or the size limitation that the IRS imposes.

In either version, if you electronically file and mail information to the IRS, the software will generate an IRS form 8453 that is mailed to the IRS with form 8949 checked.

"The detail would include the sales date, the gross proceeds, the cost basis which you assigned to those proceeds and some declaration of how the basis was computed."

I apologize. My statement was intended to refer to the detail that you forward to the IRS and not the detail entered into the TurboTax software. The detail that is forwarded to the IRS would be in IRS form 8949 format and, likely, include multiple transactions lines that equal the total proceeds of $393,948.54. For each line, you may include a declaration of how the cost basis was computed, for instance, trade records or cost allocation if the individual trade records are not included.

Finally, you may elect to paper file the tax return and no IRS form 8453 will be generated. You may attach as much detail and information to the paper filed tax return as you feel is necessary to explain your income transactions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

yamoinca

Level 2

Lala533

New Member

cerega

Level 3

Kim C1

Returning Member

Fezziwig

Level 2