- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter 1099-B Transactions for which Cost Basis /Term is Unknown

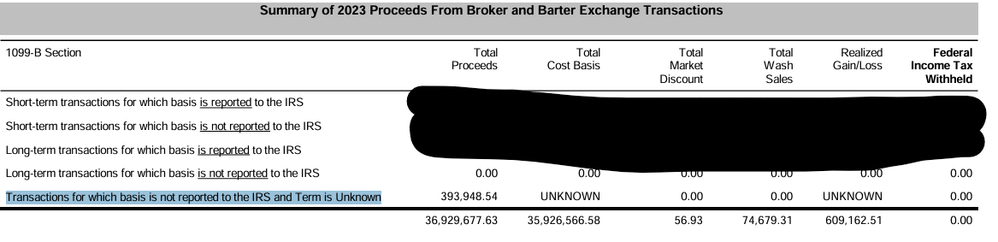

On my 1099-B from my brokerage, I have “Transactions for which basis is not reported to the IRS and Term is Unknown.” For the other sections which have known cost basis/term, I enter sales section totals since the 1099-B is ~1,000 pages long.

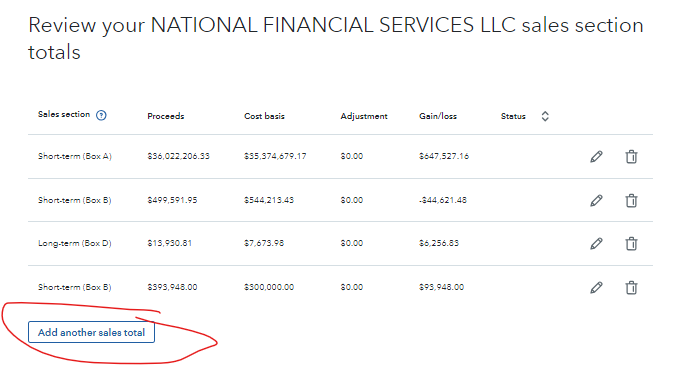

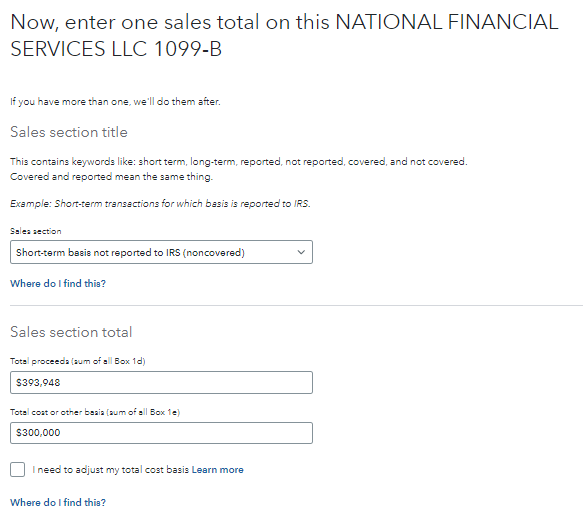

Based on trading records, I have my basis for these “Unknowns” and know that all sales were short-term. Do I enter this information as a sum total proceeds/cost basis for all transactions under “->Add Another Sales Total->Short-term basis not reported to IRS (noncovered)?

For example, I have total proceeds of $393,948.54 in this section and “UNKNOWN” in Total Cost Basis column. If, for illustrative purposes, my total cost basis is $300,000 in these transactions (all short-term), do the below screenshots show this information correctly entered into TurboTax? If not, what is the correct way to enter?

Do I need to upload any supporting evidence (trade records, etc.) showing how I arrived at the cost basis of $300,000? If so, how do I do that in TurboTax? Otherwise, it is a black-box how I came up with the $300k.