- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to e-file New York state return with a Nonresident Spouse

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to e-file New York state return with a Nonresident Spouse

I moved from PA to NY last year, so I needed two state returns, both are considered Part-Year Resident. My spouse is a nonresident alien and he doesn't have an SSN or ITIN, so I prepared my returns in Turbotax, printed them out, decide to file by mail, and attach them with Form W-7. But because of the NY e-file mandate, any NY return prepared using software needs to be e-filed. But my spouse doesn't have an SSN, how should I file it? Do I need to download blank forms from the website and filled out by hand?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to e-file New York state return with a Nonresident Spouse

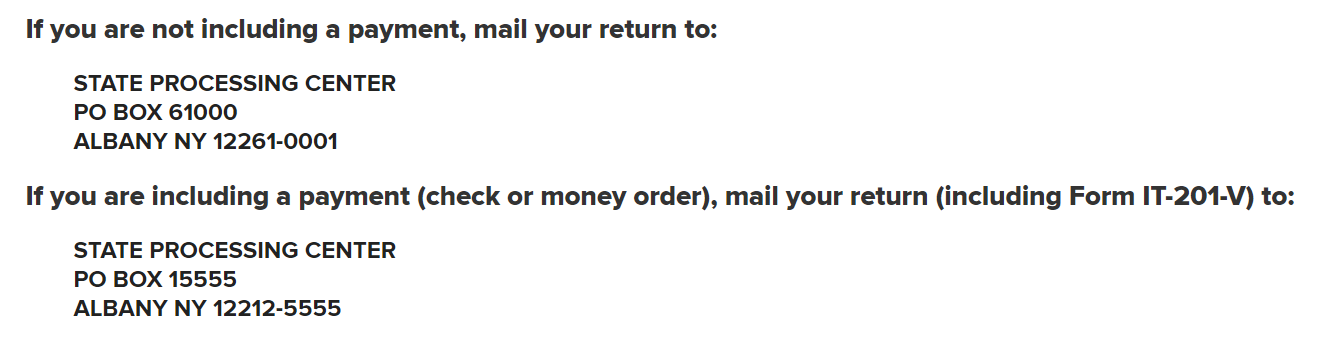

You can file the New York return by mail since you are not able to e-file it because of the social security number. You can print the return out once you pay for the program as you can keep a copy for yourself, and you can then sign the return you printed and mail it in. Here are the mailing addresses, from the New York Departmetnt of Taxation and Finance:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to e-file New York state return with a Nonresident Spouse

Thanks for your reply, I have another question. The printed NY return says that no handwritten entries are allowed, but my spouse's name and SSN are blank, do I have to handwrite their name and NRA in the SSN box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to e-file New York state return with a Nonresident Spouse

Revisit the Personal Information section of your return.

Your spouse's name should be printed on the return. You may want to delete and add again to see if this works.

If the name is still not appearing, follow the suggestion below, then log back into Turbotax and renter the information.

If using TurboTax Online: Try to clear your browser's cache and delete cookies. A full or corrupted cache can keep TurboTax from functioning properly.

If that doesn't work, try a different browser such as Safari or Firefox if you're currently using Chrome and vice versa

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to e-file New York state return with a Nonresident Spouse

I am in the same situation as the OP. My spouse's name (no SSN, applying now for ITIN) is on the federal print out but not the state forms.

This solution method offered does not appear to help.

Once the forms are completed and printed, the user has already paid for TurboTax's service. On the customer end, it appears that the forms cannot be altered or the tax prep re-visited without incurring new fees. So, there is no way to add the spouse's name that failed to be included the first time the forms printed, and there's no way to know the spouse's name is missing until the product is already paid for and the forms already printed.

Is there a way for TurboTax to allow for post-payment corrections or re-attempts without incurring fees for issues like these?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

delphier

Level 2

user17672869738

Returning Member

tp13520

Level 1

FrustratedTurboTxUser

New Member

AnnieBersch

New Member