- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

The 1099R received for the tax year of 2022 (form CSA 1099R) shows only box 1 Gross Distibution and box 2a Taxable amount, and of course the state tax info along with total contributions. No amount correlates to what was withdrawn on 1/13/22. The letter from the TSP plan reads, "This disbursement will be reported to the Internal Revenue Service (IRS) by January 31 of the year following the date of the payment" On the back page it reads, "This payment is considered an "eligible rollover distribution" for purposes of federal income tax withholding." 20% tax was applied to this "rollover distribution" How or where do I place this data in TurboTax? or should it be for next year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

If you didn't actually roll over the funds into another retirement account then you will select you did "something else (cashed out)" instead of “I moved it to another retirement account”. Please see IRS Rollovers of Retirement Plan and IRA Distributions for more information on what a rollover is.

The note on the back seems the explain that the funds distributed would be eligible for a rollover to another retirement account and they had to withhold a 20% tax according to the rules. Please see Tax Rules about TSP Payments (Indirect Rollovers TSP page 5). If you didn't move the funds into another retirement account within 60 days then this isn't a rollover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

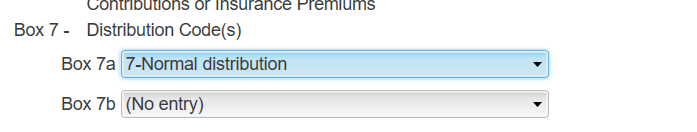

The code that is entered in box 7 should tell the system that this is a rollover. If it doesn't, TurboTax will ask if any of the contribution was removed before the return was filed and you'll tell it yes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

Thank you, Mark. Box 7a on the 1099R form does not match the #7 definition in turbo tax could this be the issue? My distribution code is 7-nondisability. Turbo Tax has normal distribution. Also, after I selected "did something else" it asked for the amount. Would that be the pretax amount or the after tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

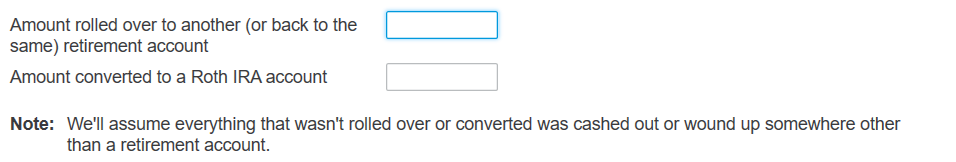

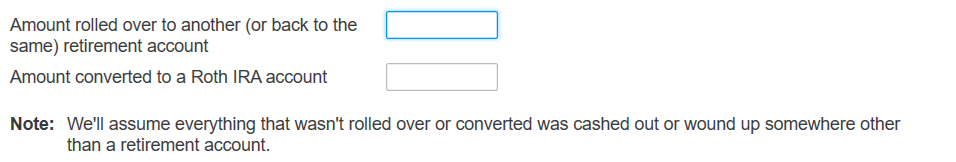

You will enter the amount that was actually rolled over to another retirement account.

Any amount that was moved from a pre-tax account to a Roth IRA account will be entered as conversion (this is taxable unless you had a basis).

[Edited 2/5/2023 | 11:21 am PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

Thank you for your time. The amount -by the TSP letter was treated as a rollover, but was in fact withdrawn to a bank for roof repair. The amount requested was not the amount received. The amount received was less due to the 20% Tax. Do I put the pretax amount (requested withdrawal) or the true amount sent (the deposit amount placed in the bank) in the box for $ rolled over?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is a pre-taxed withdrawal from a TSP not recorded on a 1099R applied in Turbo Tax

If you didn't actually roll over the funds into another retirement account then you will select you did "something else (cashed out)" instead of “I moved it to another retirement account”. Please see IRS Rollovers of Retirement Plan and IRA Distributions for more information on what a rollover is.

The note on the back seems the explain that the funds distributed would be eligible for a rollover to another retirement account and they had to withhold a 20% tax according to the rules. Please see Tax Rules about TSP Payments (Indirect Rollovers TSP page 5). If you didn't move the funds into another retirement account within 60 days then this isn't a rollover.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

temtem

New Member

spf1040

New Member

jactax2023

New Member

mawlers

Returning Member

Movie1

Level 3