- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do we file? Candian Spouse of USC both living together in US and approved to work but not LPR/Green Card approved yet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we file? Candian Spouse of USC both living together in US and approved to work but not LPR/Green Card approved yet

How do we file? As an USC, I married a canadian citizen in 2021 and we lived together in USA, both worked in 2021. She was given work authorization in 2021 and issued an SSN, though still awaiting LPR/green card approval. Turbo tax allows for filing as jointly, though final questions on form asking about payment under American Rescue Plan (something she was not given being a Canadian citizen) want to validate that both of us received the COVID $1,400 each. As she was not issued an IRS Letter 6475 or any payments under this program, entering $0 makes Turbo Tax immediately add in an additional $1,400 to the refund. As that does not appear correct, how do I avoid claiming this benefit?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we file? Candian Spouse of USC both living together in US and approved to work but not LPR/Green Card approved yet

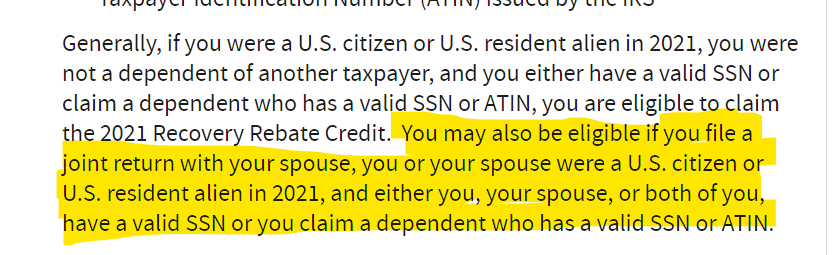

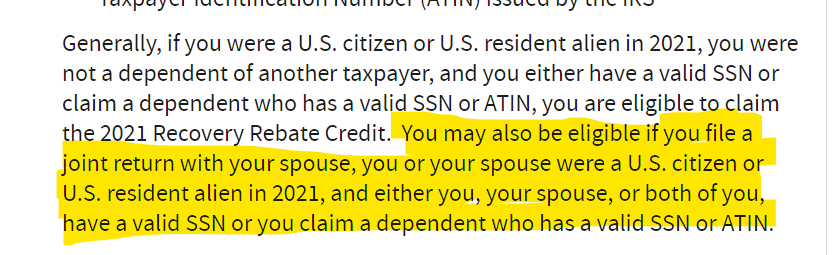

It does seem that TurboTax is correct in awarding the additional $1400 to your return.

From the IRS newsroom:

You are eligible if you or your spouse are a US citizen and you or your spouse have a valid SSN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we file? Candian Spouse of USC both living together in US and approved to work but not LPR/Green Card approved yet

It does seem that TurboTax is correct in awarding the additional $1400 to your return.

From the IRS newsroom:

You are eligible if you or your spouse are a US citizen and you or your spouse have a valid SSN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do we file? Candian Spouse of USC both living together in US and approved to work but not LPR/Green Card approved yet

Thank you PattiF, your IRS reference was a huge help in clarifying filing, resident alien clarification, and confirmation of Recovery Rebate Credit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hapagirllv

New Member

abhillman

New Member

ajm2281

Level 1

markmuse120

New Member

mckiverm

New Member