- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I report compensation for helping someone out?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report compensation for helping someone out?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report compensation for helping someone out?

If you received a 1099 for the work you performed then it was not a "favor". You were paid for the work and it is reportable income. As you were provided a 1099 MISC this payment to you will be reported to the IRS by the person who issued that 1099 to you. First check to make sure the amount on the 1099 is correct (matches what was paid to you). If it is not request that the issuers corrects and files an amended 1099. If it is correct then you will enter and report this income as other income, usually on Schedule C. You will transfer the information from the 1099 into Turbo Tax.

Also your "friend" likely issued and filed a 1099 to you so that he/she could deduct that amount as a business expense on his/her tax filings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report compensation for helping someone out?

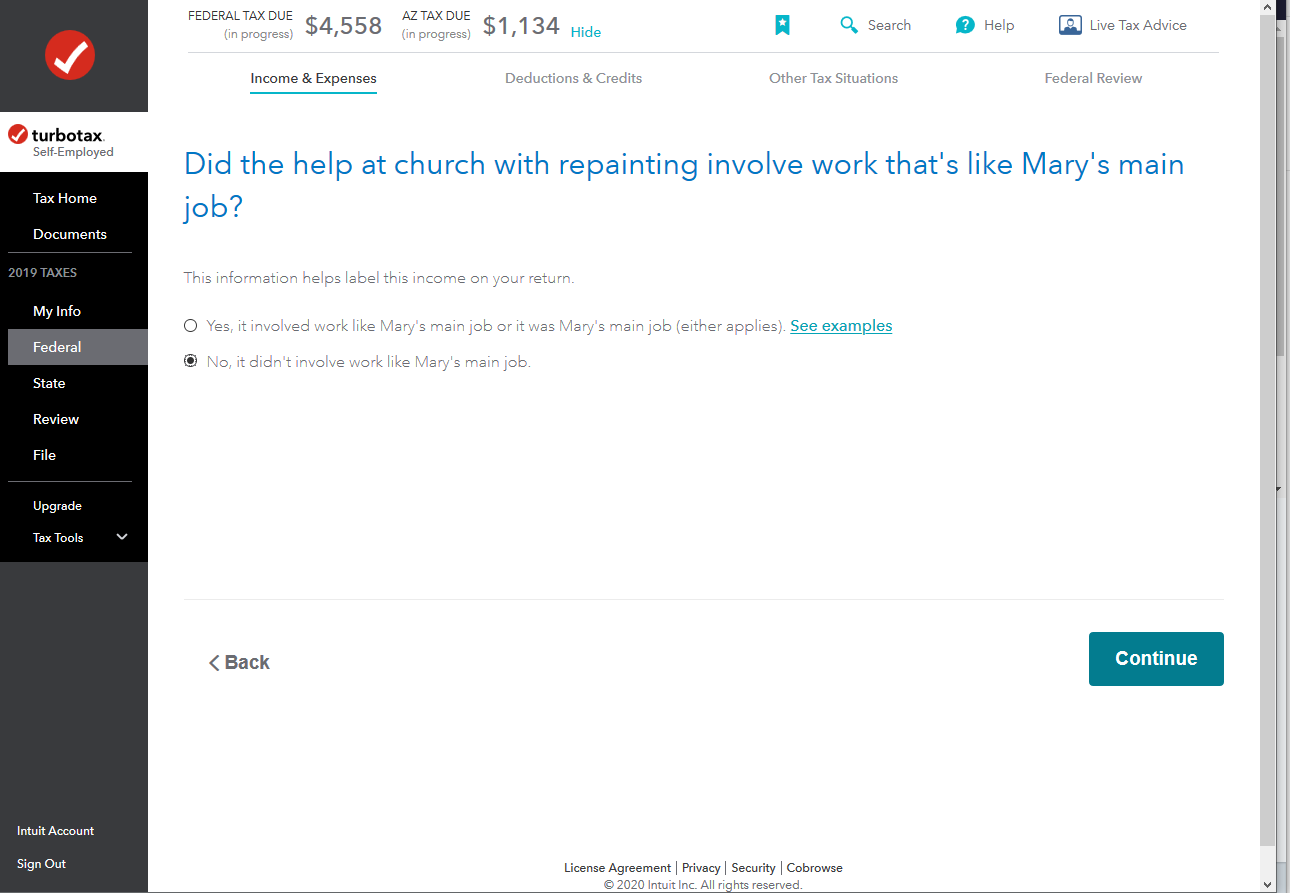

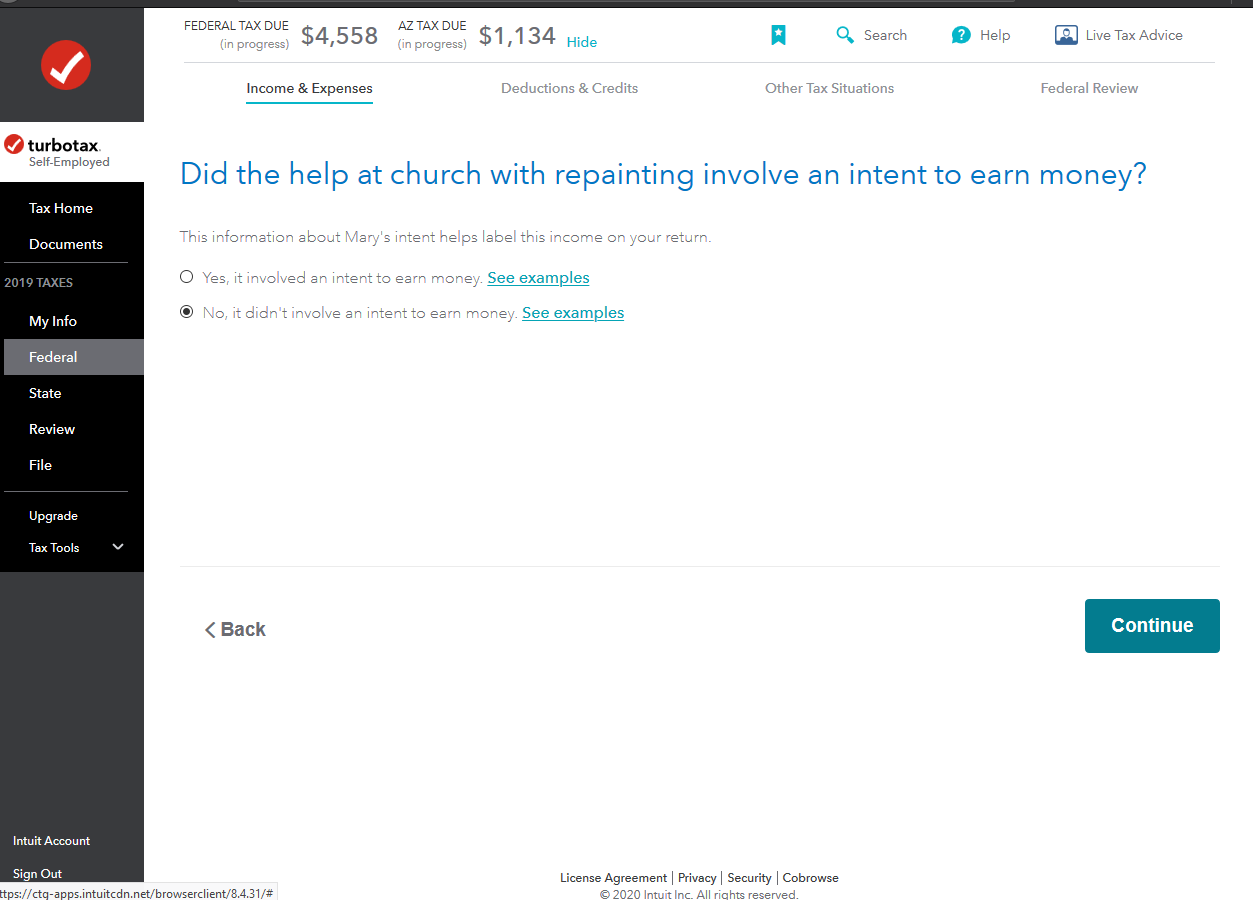

To skip reporting this one-time income as 'Self-Employment Income', when entering your 1099-Misc, choose 'this work is not like my main job' and that you 'had no intent to earn money' (screenshots).

This will put the income as Other Income in your return, instead of Self-Employment Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

danielakralph180

New Member

g-r-land

New Member

emilq30

New Member

TangledMess

Level 2

williamslauryn9

New Member