- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I manually enter items sold on Ticketmaster if they do not give a 1099K because of transition? It will eventually be reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I manually enter items sold on Ticketmaster if they do not give a 1099K because of transition? It will eventually be reported.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I manually enter items sold on Ticketmaster if they do not give a 1099K because of transition? It will eventually be reported.

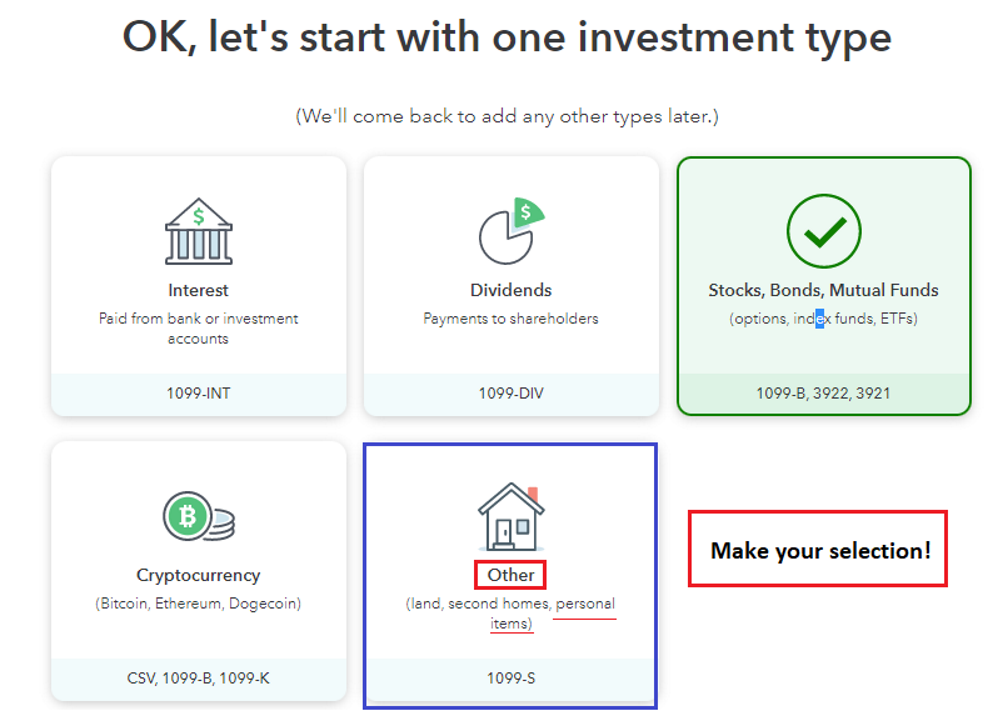

This would be entered as an investment sale of you are not in the business of buying and selling.

- Search (upper right) > type schedule d > use the Jump to... link select 'Review' or Add Investment sale > Select Other follow the prompts to complete the entry (cost, sales price, date of purchase and sale).

The law is not intended to track personal transactions such as sharing the cost of a car ride or meal, birthday or holiday gifts, or paying a family member or another for a household bill.

- Understanding third party payments from cash platforms (click the link and other links on the page for the most up to date information)

It will be very important to keep a list of payments received to document proof of non-income payments. The IRS requires reporting for anyone who receives payments that exceed $600 for 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Silverado2

Level 1

shawnMsrm

Level 3

eeeaston

New Member

tgbmom

New Member