- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I handle a 1099B that is a Cash and stock merger?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I handle a 1099B that is a Cash and stock merger?

My stock were acquired on Nov 2023 with a Cash and stock deal. I only found the cash part is reflected on the 1099b, and the 1e section of 1099b of this cash transaction is 0. Shouldn't this cost section be the equal to the cost of the stock I purchased earlier?

Also, I don't see the part of the new stock in the 1099b, will this be include in this year since I did not sell those in 2023?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I handle a 1099B that is a Cash and stock merger?

Your basis in the stock is the cash payment plus the adjusted basis (likely, but not always, your cost) of the stock relinquished.

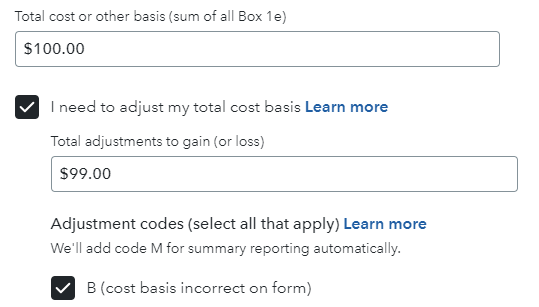

To correct the basis on the IRS form 1099-B, select I need to adjust my cost basis with adjustment code B.

IRS Publication 551 Basis of Assets, page 2, states:

The basis of stocks or bonds you buy is generally the purchase price plus any costs of purchase, such as commissions and recording or transfer fees. If you get stocks or bonds other than by purchase, your basis is usually determined by the fair market value (FMV) or the previous owner's adjusted basis of the stock.

Your 2023 IRS form 1099-B only reports your investments that were traded or sold in 2023, not simply purchased in 2023.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

tkoin1

Level 3

asomers

Returning Member

pauldev

Returning Member

sujiths80

Level 1

digian

Level 1