- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Your basis in the stock is the cash payment plus the adjusted basis (likely, but not always, your cost) of the stock relinquished.

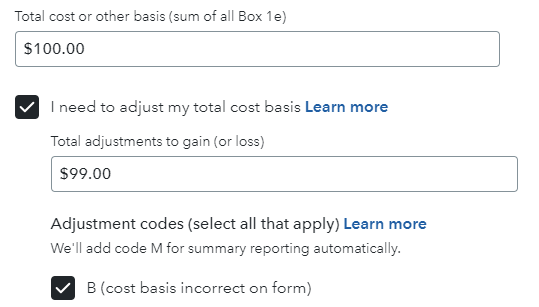

To correct the basis on the IRS form 1099-B, select I need to adjust my cost basis with adjustment code B.

IRS Publication 551 Basis of Assets, page 2, states:

The basis of stocks or bonds you buy is generally the purchase price plus any costs of purchase, such as commissions and recording or transfer fees. If you get stocks or bonds other than by purchase, your basis is usually determined by the fair market value (FMV) or the previous owner's adjusted basis of the stock.

Your 2023 IRS form 1099-B only reports your investments that were traded or sold in 2023, not simply purchased in 2023.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 13, 2024

11:21 AM