- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How do I display the Tax Computation Worksheet?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

TT will NOT display the Tax Computation Worksheet (TCW). The TCW is used to calculate the tax owed for "regular income" (income excluding qualified divs, capital gains, and Section 1250 gains). If you calculate your tax using the Schedule D Tax Worksheet, the TCW is used to calculate Lines 44 and 46. It is also used to calculate tax on other Worksheets.

The fact that TT refuses to show the TCW in its forms list is unbelievably callous. All professional tax software shows this form filled out.

Second, when I tried to call TT Support to ask about this, the automatic menu assumed I was using free TT and wanted me to pay for support. When I tried to get around paying (I use TT Deluxe and therefore am entitled to phone support) TT hung up on me. Disgraceful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

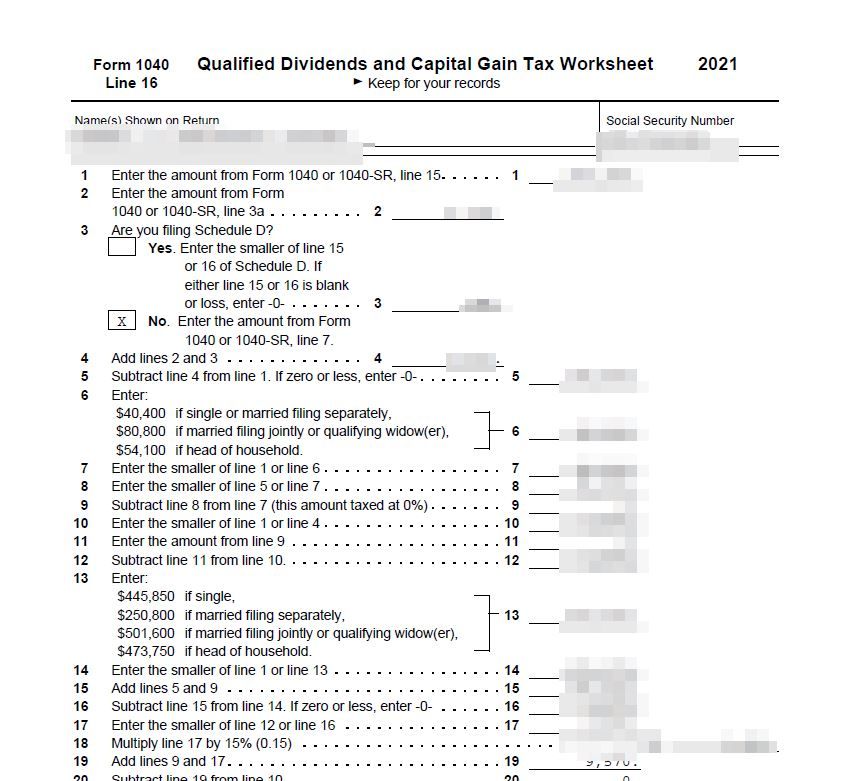

Yes you can get the tax worksheet. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return.

In the online version you need to save your return as a pdf file and include all worksheets to see it.

For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

I agree. This sends you in a circle. Turbo tax needs to make this worksheet readily available. SHAME!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

It does not show in the worksheet - it is merely an internal calc (that is never shared with the user). Thus, it requires you to go through the IRS instructions to try to tie back to what TurboTax is doing. Incredibly frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

The 2021 Tax Computation Worksheet is published in the IRS Form 1040 Instructions. The worksheet is based on your filing status.

The following information shows the calculation for each filing status. Use the income amount shown on Form 1040 line 15 as the basis for your calculation if you have no qualified dividends or capital gains included on your return.

For Single filing status:

For Married Filing Joint or Qualifying Widow(er) filing status:

For Married Filing Separate filing status:

For Head of Household filing status:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

Thank you for trying to help. The problem happens when you do have do have qualified dividends and other income that doesn't neatly fit into the tax computation worksheet. There is no way to see TurboTax's work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

This is one of the many reasons I dislike Turbo Tax. Why can I not see the form. One of the reasons I do my own taxes is that I want to see how I am being taxed. I don't want a black box.

Every year I say I'm going to look at alternative software. Maybe next year.

I despite Turbo Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

You can see all the forms. And if you use the Desktop program you can see and enter into the actual forms. Desktop might be better for you. It has several advantages over the online version.

See the IRS worksheet on 1040 page 36 for how the tax is figured. Turbo Tax uses the same worksheet.

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

If you have capital gains or qualified dividends the tax is not taken from the tax table but is calculated separately from schedule D. The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet. It does not get filed with your return.

In the online version you need to save your return as a pdf file and include all worksheets to see it.

For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Click Forms in the upper right (upper left for Mac) and look through the list and open the Qualified Dividends and Capital Gain Tax Worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

The issue is that Qualified Dividends and Capital Gain Tax Worksheet line 22 states:

Figure the tax on the amount on line 5. If the amount on line 5 is less than

$100,000, use the Tax Table to figure the tax. If the amount on line 5 is

$100,000 or more, use the Tax Computation Worksheet

The Tax Computation worksheet comes from the IRS worksheet on 1040 page 36 for how the tax is figured.

This is not provided. This worksheet should be filled in with my numbers and provided. There is no reason this should happen in the background and not shown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

Yes there is the Capital Gain Worksheet. In the Online version you have to download the pdf with all the worksheets to see it. In the Desktop program you can switch to Forms Mode and open it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

You are correct. Turbo tax makes is very hard to figure out how your taxes are actually calculated if you taxes are at all complicated. Capital gains are far more complicated that they initially appear as there are "penalties" for higher income individuals. And there is also the net investment income tax on higher earners. I struggled to duplicate TT results but did after using other internet resources.

Turbo Tax is a black box. If that's what you want. it will calculate your taxes accurately. But when you find you owe $60,000 and want to know why, Turbo Tax makes that very difficult to find out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

The issue is this from does not tell you how the tax amount is calculated. The program says it does but it does not. I

There are no tax tables like in the past so it is a bit confusing to those of us who have been doing taxes ourselves for several years. Instead there is a formula from IRS publication. The program very poorly explains where this comes from. If the program would just show the calculation for this "tax formula" include the display as part of this worksheet it would be a significant improvement. The point is the program performs the calculation but does not explain where it come from.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

I did eventually find the Qualified Dividends and Capital Gain Tax Worksheet in the PDF that is downloaded from TurboTax Online.

I am using TurboTax Online on a Mac with the Safari web browser. When downloading the PDF, TurboTax automatically opens the PDF in a Safari window. In my experience, searching for the worksheet by name using Safari's search function (Command-F) was very unreliable. When I searched for "qualified dividends", Safari would find 4 matches. When I cycled through those 4 matches, I did not find the Qualified Dividends and Capital Gain Tax Worksheet. However, if I kept clicking on the ">" button to see the next result, it would actually show me a different set of results (?). Eventually, I found the worksheet that I was looking for.

Opening the PDF in Preview works a little better. If you open the PDF in Preview, search for "qualified dividends" and then scan the list of pages displayed in the panel on the left hand side, you will find a page named "Form 1040 Qualified Dividends and Capital..." - that's the page you are looking for.

This worked for me - I hope it will work for others struggling with the same problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

For some situations, the Qualified Dividends and Capital Gain Worksheet refers you to the Tax Computation Worksheet to "figure the tax" for a particular amount. I cannot find this Tax Computation Worksheet in the downloaded PDF. Its a simple worksheet. However, since I am paying a significant amount of money for TurboTax, it seems like this worksheet should be included in the downloaded PDF.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I display the Tax Computation Worksheet?

Yep. This non availability of the "Tax Computation Worksheet" REALLY ticks me off, because I can't back into the tax amount that TurboTax calculates here. Why in the world am I using software if I have to go to the IRS website, download and fill out a form to TRY to understand how the software calculates my income taxes? TurboTax has gotten progressively worse over the years. They need to up their game.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

de_mo

New Member

wendyle1993

Level 3

mstruzak

Level 2

Aquiel16

Level 1

GreggC

New Member