- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Home Business Expenses in 2023

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Expenses in 2023

In 2022, I used my house for business and claimed home business expenses. However, in 2023, I no longer used my house for business purposes. Instead, my sister used the house for her own business. Can my sister claim home business expenses for the year 2023? It's the same property.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Expenses in 2023

If you no longer used your Home Office for your Business, you should EDIT your Business and indicate that you 'stopped this business in 2023' to take the Business stuff out of your tax return.

If your sister used your home for her business, she can report that on her tax return.

There can be more than one business at the same address.

Here's some detailed info on The Home Office Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Expenses in 2023

"you should EDIT your Business and indicate that you 'stopped this business in 2023' to take the Business stuff out of your tax return."

I want to make sure about this. My business is still operational in 2023. It's just that I no longer use a home office for my business.

Should I "edit stopped"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Home Business Expenses in 2023

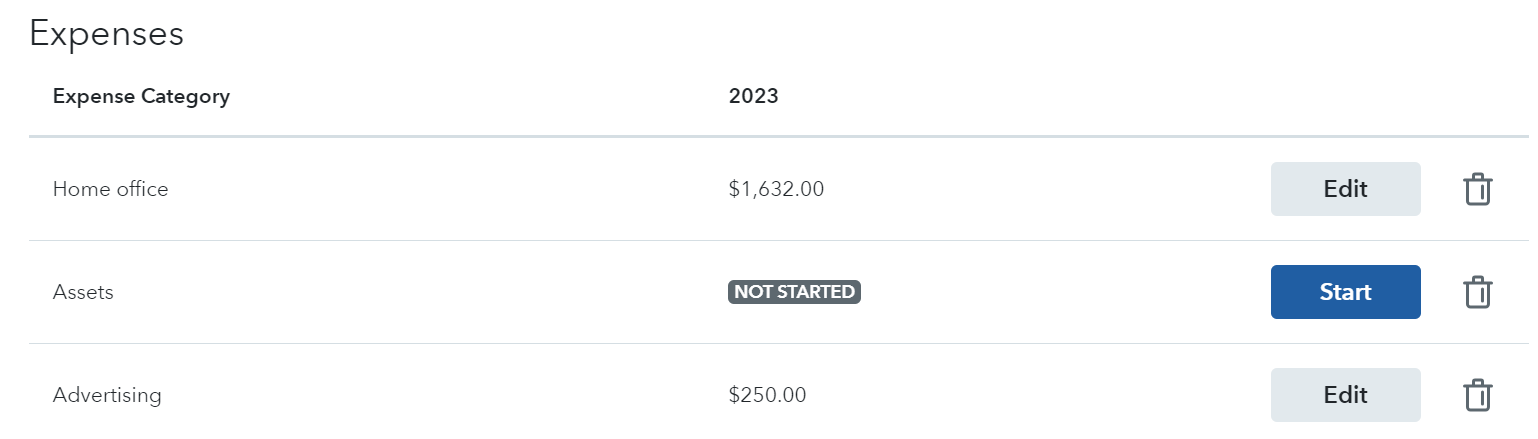

No, do not stop the business just delete the information for the business home expense. To do that on TurboTax:

- Open or continue your return.

- Go to Wages & Income

- Select Edit/Add next to Self-employment income and expenses

- Select Edit under your business

- Under the Expense category select the trash can next to the Home office

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aubutndan

Level 2

vgutierrez65

New Member

vgutierrez65

New Member

vgutierrez65

New Member

CCCD

New Member