- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

First time doing a non-deductible Traditional IRA contribution (using after-tax money) and converting to a Roth IRA (I think it's called Backdoor Roth conversion?). I used Wealthfront's Traditional IRA and Roth IRA for this. Here is what I did:

1. Create a new Traditional IRA account, transferred $6000.

2. After the transfer completed and the money is invested, start a Roth conversion to completely close the account and roll all amounts to the Roth IRA (pre-existing).

Due to market conditions, by the time the account is closed, the balance of the Traditional IRA became $5981, which was then added to the Roth IRA.

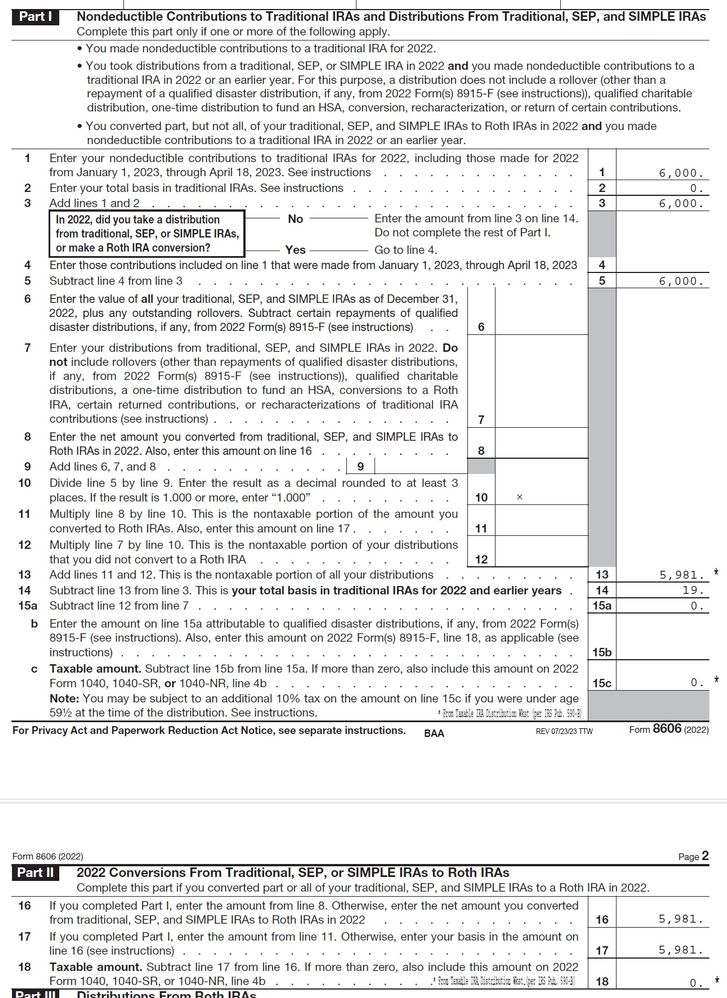

Now I'm using TurboTax Desktop and trying to figure out Form 8606. Following this support article (I did Step 2 before Step 1 since this was a fresh return), I was able to get most of the form done. Now it looks like this:

Questions:

1. Does it look right the basis is $19? I thought since I rolled over the entire account, the basis should be 0.

2. Form 1099-R line 2b only checked "Taxable amount not determined" but not "Total distribution", is this an error that I should escalate to Wealthfront?

3. When entering Form 1099-R, there was a question "Value of your Traditional, SEP, and SIMPLE IRAs on December 31, 2022" under "Tell us the value of your Traditional IRA", I'm guessing I should enter 0 because the entire account is gone, but in reality where should I look on Form 5498? Is it line 5, FMV of account?

4. Form 8606 Line 8 is empty - Should it be $5981 and subsequent lines also filled?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

Look at your Line 14. It is correct.

You have a basis remaining even though you emptied out the traditional IRA.

You will carry that basis indefinitely until you get a chance to use it in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

Look at your Line 14. It is correct.

You have a basis remaining even though you emptied out the traditional IRA.

You will carry that basis indefinitely until you get a chance to use it in the future.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

Thank you! So does that mean if the Traditional IRA suffers a loss, then I get a positive balance, but if the Traditional IRA makes a profit (e.g. instead of $5981, it ended up with $6081 when the market closes), I actually have to pay tax on that extra $81? Is this how the basis works - even if the contribution was after-tax, but depending on whether the investment turned into a profit, there may be taxable amount at Roth Conversion time?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

"(I think it's called Backdoor Roth conversion?)"

It's a Backdoor Roth Contribution.

It's for people who are not allowed to make a Roth contribution and have no balance in a Traditional IRA, in which case it can be tax free if you complete promptly. i.e. no positive earnings.

.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TheGuttes

Level 1

rhalexda

Level 2

knownoise

Returning Member

sunshineInTheRain

Level 3

Fuzzy Red Baron

Returning Member