- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Full-account Roth Conversion after Traditional IRA took a loss - Should Form 8606 line 14 total basis show non-zero number?

First time doing a non-deductible Traditional IRA contribution (using after-tax money) and converting to a Roth IRA (I think it's called Backdoor Roth conversion?). I used Wealthfront's Traditional IRA and Roth IRA for this. Here is what I did:

1. Create a new Traditional IRA account, transferred $6000.

2. After the transfer completed and the money is invested, start a Roth conversion to completely close the account and roll all amounts to the Roth IRA (pre-existing).

Due to market conditions, by the time the account is closed, the balance of the Traditional IRA became $5981, which was then added to the Roth IRA.

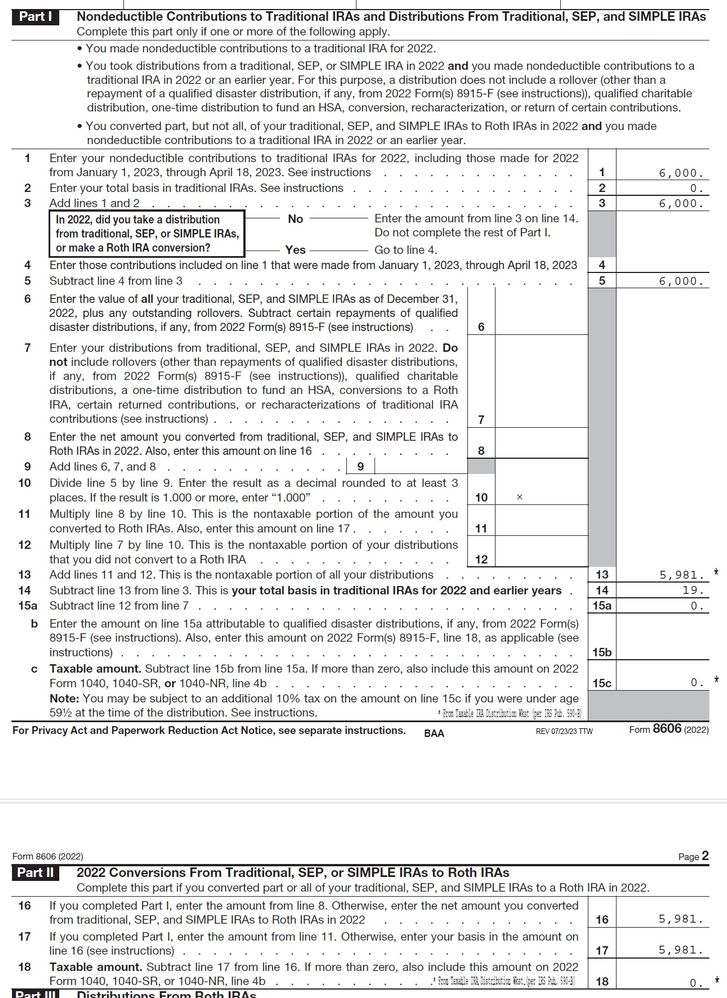

Now I'm using TurboTax Desktop and trying to figure out Form 8606. Following this support article (I did Step 2 before Step 1 since this was a fresh return), I was able to get most of the form done. Now it looks like this:

Questions:

1. Does it look right the basis is $19? I thought since I rolled over the entire account, the basis should be 0.

2. Form 1099-R line 2b only checked "Taxable amount not determined" but not "Total distribution", is this an error that I should escalate to Wealthfront?

3. When entering Form 1099-R, there was a question "Value of your Traditional, SEP, and SIMPLE IRAs on December 31, 2022" under "Tell us the value of your Traditional IRA", I'm guessing I should enter 0 because the entire account is gone, but in reality where should I look on Form 5498? Is it line 5, FMV of account?

4. Form 8606 Line 8 is empty - Should it be $5981 and subsequent lines also filled?