- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 8938 major flaw

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 major flaw

Going through the form online, you get to a Qustion about wether or not you live in a foreign country. Once you entered yes and hit continue the next page shows you reporting thresholds that are a lot higher for overseas resdents. The problem is that there is a substantial presence test of beeing 330 days in a foreign country. This Test should immediately come up when you enter continue after the residency question. This Test is important, otherwise like in my case, living in a foreign country and beeing under this threshold I did not file this form and am now potentially looking at a huge penalty. Please Turbotax employee check it out for yourself. I will make a video of this flaw and post it on Facebook and Twitter. This should not happen and needs to be corrected immediately.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8938 major flaw

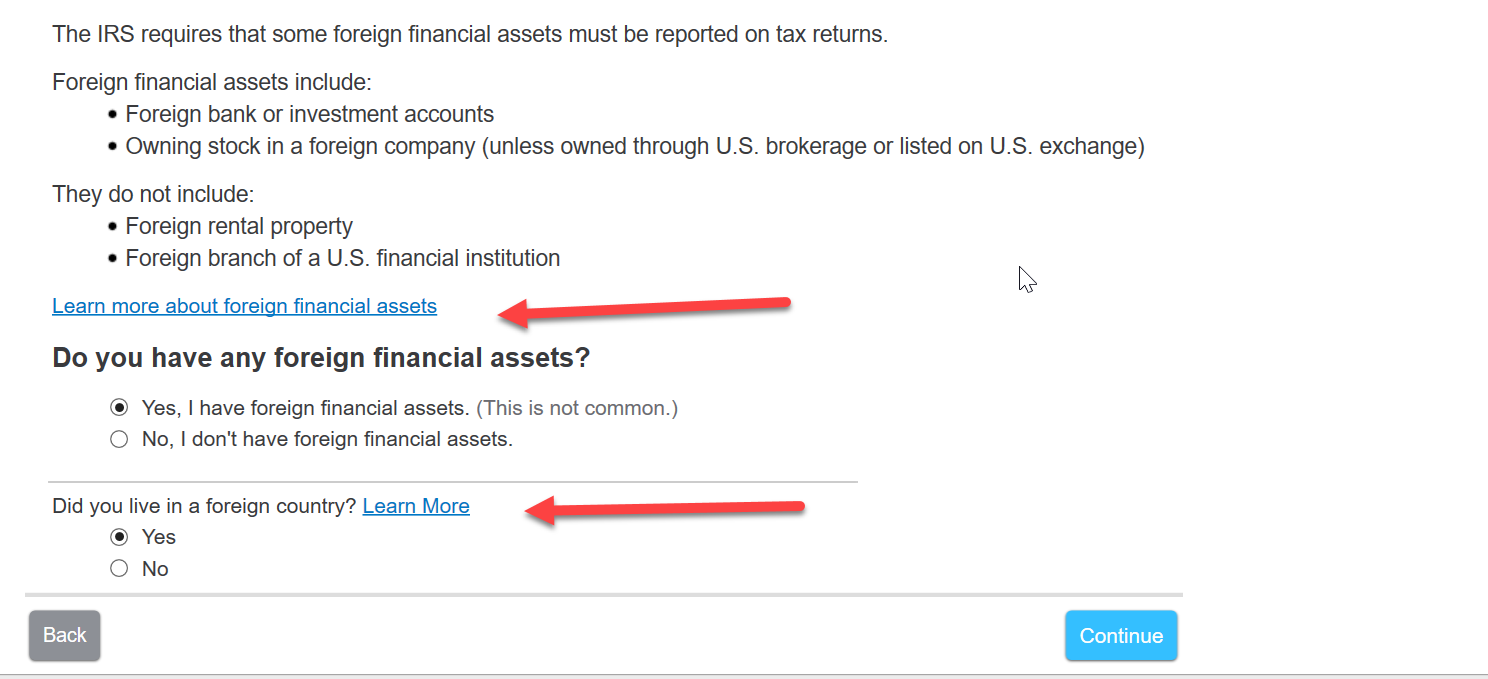

A learn more option is present under the interview section for form 8938, stating, "A U.S. citizen or resident who was in a foreign country or countries at least 330 full days during any period of 12 consecutive months that ends in the tax year for your return." The function also lists who needs to report foreign financial asset values.

When you enter the interview process for Foreign Financial Assets, you will click on learn more about foreign financial assets to see all the requirements for filing form 8938. If you click yes, you have foreign assets; the next question is, "Did you live in a foreign country?". In that case, there is a second learn more button beside this question that states again, "A U.S. citizen or resident who was in a foreign country or countries at least 330 full days during any period of 12 consecutive months that ends in the tax year for your return."

If you click yes, you will be moved to the interview question regarding the amount of your foreign financial assets. If you click "no, your financial assets were not within the requested values," you do not have to report form 8938, which aligns with what is listed on the IRS website.

If you click yes, you will be walked through the interview process to complete form 8938.

Here is a screenshot of where the learn more functions are located:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sedalia

Returning Member

Samsolve

Level 2

barbagg

Level 2

booshebach1

Level 3

cuttothechase

Returning Member