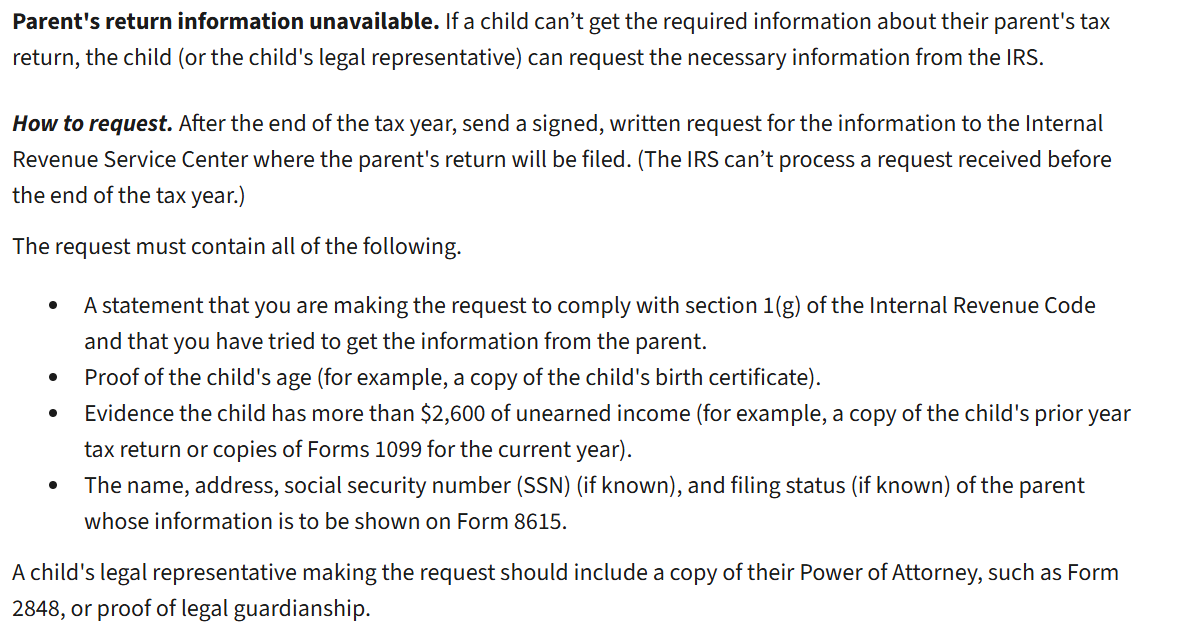

If the earned income is less than or equal to $2,600 then you don't need to file the Form 8615 so you wouldn't need to enter the parent's information. Otherwise, the IRS requires you to attempt to obtain the necessary information from the parents by requesting it from the IRS as per this excerpt from the instructions to Form 8615:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"