- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Form 3468 registration number error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

I'm using Turbotax Home and Business, desktop edition. I'm a sole proprietor with NO employees, and as a result the software is telling me I don't require an IRS assigned registration number. However, when I view my errors, I have one on Form 3468 (2A) telling me a registration number is required.

1. Am I misunderstanding this? Do I need a registration number?

2. If not, can I e-file my return with unresolved errors?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

Having the same issue. Posting as much as possible to see if we can get an answer. I think, the form has a glitch but, I cannot file on TurboTax until this is fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

Glad it's not just me. Fingers crossed for a quick resolution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

I was told to go into tax tools and delete the form. That seems to have worked!

Best

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

I get the same message and cannot file until this is resolved. What to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

Answer I got was to delete the form in TAX tools. Worked for me!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

If you do not have an investment credit but the form is being pulled into your tax return, please do the following to help resolve the issue.

- Log back into your desktop program and select the Business tab, and then select Business Income and Expenses.

- Scroll down to the section titled Less Common Business Situations.

- Select update/start to the right of the section titled Business Credits.

- On the next page, select update/start to the right of the section titled Investment credit.

- On the page titled Investments credits, answer yes to the question asking if you want to take an investment credit for 2023.

- Select Delete to the right of any investment credits listed.

- Proceed through the screens and select Federal Review.

- The error message should be gone and you should be able to file your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

It sounds like my situation is a bit different. I DO have a business credit I'm trying to claim, and so I do need the form. I'm a sole proprietor with no employees, so as I'm guided through the business credit section in Turbotax the software tells me I DON'T need a business registration number. However, when I look at my errors in review, I see one on the Investment Credit form (again, that I need) telling me I need to enter a registration number in 2A.

So, going back to my original question...do I actually need a registration number (contrary to what the software says), or can I instead e-file my return through Turbotax despite the error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

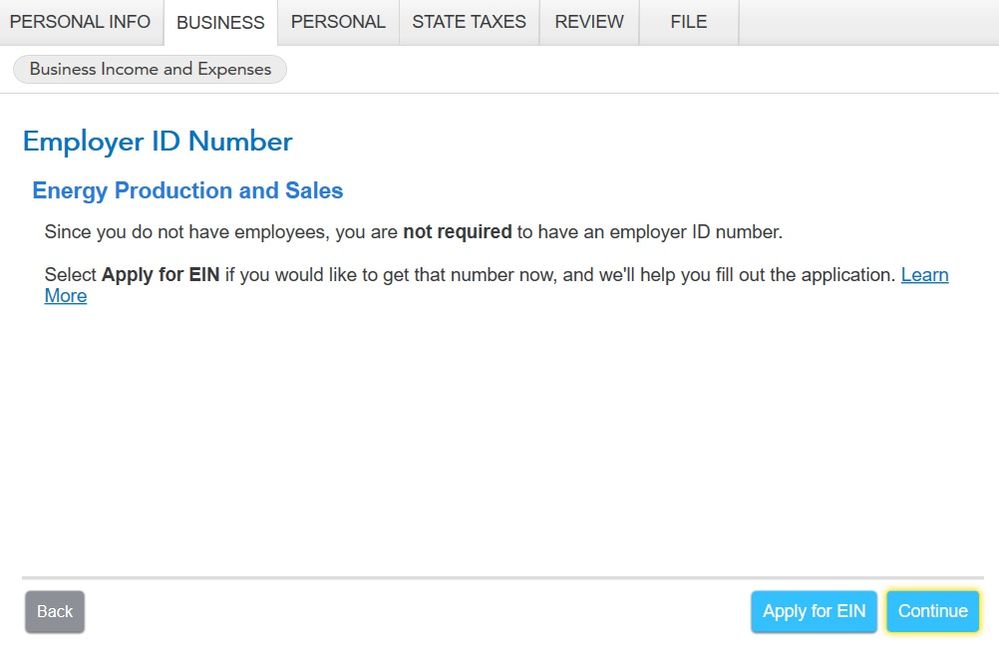

This is the screen I'm referencing, if it helps:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

This is on the IRS Known Issues Report. There is a workaround provided for this issue. If you enter ""TMXXX99XXXXX" on Line 2a, this will allow you to e-file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

Hi, I see that there is several others that are getting a error for form 3468. I tried what you show below and I still get 14 errors wanting me to fill in info. I also have tried to delete the form and it comes back. What should I do? I have never had this issue in the past. I have talked to the CPA that sent me the Schedule K-1 and she said that

Form 3468 is for investment tax credit that would have nothing to do with my LLC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3468 registration number error

Have you tried deleting your Schedule K-1 before you tried to delete Form 3468? That would be your next step.

Then when you re-enter the K-1, follow these steps:

- Return to the K-1 Summary page and add a new K-1.

- Check the box for Box 17/20 (depending on which type of K-1 you have).

- Enter only one line for Box 17/20 Code AJ and do not enter an amount.

- Continue to the page that asks for Other Information Detail. Enter a description and amount separately for both lines from Code AJ.

- Run Review/SmartCheck.

- If you again receive a request for the registration number, enter TMXXX99XXXXX. (This means Form 3468 still remains.) If you're not asked about this, skip the next step.

- Delete Form 3468 (either in Forms Mode using TurboTax for Desktop or using Tools >> Delete a form in TurboTax Online).

- Run Review/SmartCheck to confirm the error has been resolved.

These steps are easier if you are using TurboTax for Desktop, as you can make edits directly in the forms and easily see what forms have errors (red exclamation marks). But it can be done in TurboTax Online.

Additional Information:

- How do I view and delete forms in TurboTax Online?

- How do I delete a tax form in the TurboTax CD/Download software?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

NeUnhappy

New Member

biscuitme

New Member

donnadonaldson

New Member

mrgrnt

Returning Member

jose733b

Level 2