- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Final K-1( Form 1065) disposition

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

So what was the final solution?

I have the same case on my 2022 tax return. Someone from the forum told me to put "disposition was not via sale" and when I do that the program asks when property was purchased and with it was sold, but it doesn't ask about purchase/sale price.

I read in some other forum that doing so, could cause your gains to be taxed twice.

But I also called support and they told me to use instead complete disposition but I told them I did not have sale prices/purchase price, so we left that at 0 and the end result was pretty much the same.

So I don't know if one is more correct than the other.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

I'm not clear why you are not using your initial investment as the purchase price and the final distribution as the sales price. It can (in my experience) feel a little weird treating one's (a limited partner's) investment and the results of the sale as one's "purchase price" and "sales price," but I believe that's the correct way to think about it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

You cannot use the initial price as the purchase price, if you check where it asks for "Enter Sale Information, it is asking for partnership basis, not purchase price. The partnership basis gets adjusted as there are losses/gains and distributions for the investment.

For example if you invested $5K in 2020

PB = partnership basis

In 2020 if there are no other losses/gain or distribution the PB =$5K at the end of 2020

In 2021 the investment had a loss of $1000, the PB at the end 2021 is $4000

In 2022 the investment issues a Final K-1 and a final distribution of $4000

If you use the initial cost of $5000 and enter the initial investment as the PB, and your sale price as $4000, you will end up double counting the $1K loss, once in 2021 as a passive loss (for passive activities), and a capital gain loss in 2022.

TurboTax should be able to calculate the PB as you enter the K-1 for each year, and should be able to give the option where a partnership ends but without a sale.

You can try some experiments with a dummy K-1which started in 2020, and is liquidated in 2022. Depending on what options you select in the interview questions, results will be different. Also, in 2022 make sure you mark the K-1 as FINAL, in TT, this allows any passive losses, that were not allowed in previous years to be taken when the FINAL K-1 is entered. Also, if TT recognizes that the K-1 is final, next year when you import your 2022 tax return into TT, it will know that in 2022 the partnership ended in 2022, and will not carry over any information to the 2023 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

Hi. I really, really need some help here. I have spent no less than 40 hours trying to enter in a K-1 disposition (not kidding) and I keep getting an obviously wrong answer. Here goes:

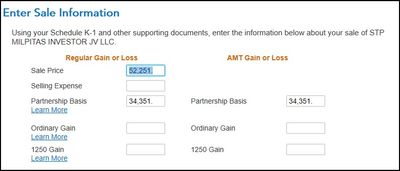

On 7/10/2020 I invested in a limited partnership for a real estate purchase. On 9/30/2022 that real estate was sold, liquidated (complete dissolution), money disbursed to partners and company ended. This seems like it should be simple. The only capital invested was the initial $35,000. There were no distributions other than the $52,251 I received upon liquidation. All activity in 2020 and 2021 are passive. Here are the details:

- Limited Partnership

-Starting investment - $35,000

- K-1 for 2022 is the final K-1

- I select "liquidated"

- I select "complete dissolution"

- Outside basis - $34,351

- Beginning capital account current year (Part 2 L) - $34,243

- Current year net income (Part 2 L) - $18,008

- Withdrawals and distributions (Part 2 L) - $52,251

- Ending Capital account (Part 2 L) - $0

- 2022 Unrecaptured section 1250 gain (Part 3 9c) - $1,691

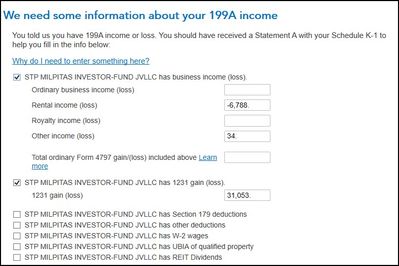

- 2022 Part 3, Box 2 - -$6,787

- 2022 Net section 1231 gain (Part 3, 10) - $24,761

- 2022 Distributions (Part 3, 19) - $52,251

- Did any Unrecaptured Section 1250 gain come from estates... or disposition of an interest in partnership - I select "no"

- All of my investment in the activity is at risk

- I have passive activity losses carried over from last year

- no uncommon adjustments

- I have completely deleted the K-1 and re-entered all data

- 2022 Other Information (Part 3, 20) A: $34; N: $5,217 V: $9,993

- I am able to enter in all the K-1 information

- I select "This partnership ended in 2022"

- No special handling

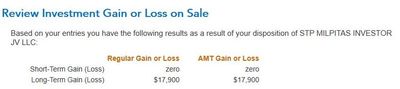

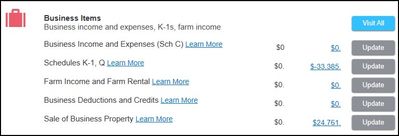

- The big problem is that I keep getting under Income - Business Items (as shown) a -$33,385 Schedule K-1 and a Sale of Business Property $24,761. This does not seem right. I earned $18,008 in current year net income. My displayed tax refund is like CRAZY high - more than $10,000 when before adding the K-1 it was around $7,500. So on this investment which was extremely profitable produces a tax refund of $3,000+

Again I am so, so desperate here - I am running out of time, taxes due 10/16/2023 and I haven't even done the final review or the state taxes. Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

look like unclear what to select in turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

@sntrypilot Part 3 line 20 A indicates investment income of $34 that should appear on any of the lines 5 through 11 in Part 2. it's needed in order to balance the schedule L income reported with the detail in part 3.

Part 3 line 20 code N is for information purposes in your situation

Ppart 3 line 20 code V only applies to tax exempt entities

*********************

you are misreporting the sale info

for your starting basis I'll use schedule L which is 34243

to that you need to add current year income of 18008

giving you a total basis of 52351 for which you received a distribution of 52351 so no gain or loss on disposition

you are misreporting the 199A income. The $34 and the 1231 gain of $24671 are excluded from 199A by law. 199A excludes portfolio/investment income ($34) and capital gains. section 1231 (24671) is capital gains.

however, there should be a statement 20Z included in you K-1 which identifies the amount of 199A income.

***********************************

something seems missing. you say you started in 2020 with a $35K investment yet in 2022 the beginning capital account is $34243.how the reduction could be so small raises a question as to what transpired in 2020 and 2021.

**********************

if you had prior suspended losses (see form 8582 from 2022 part VII) of 26598 they would be allowed due to disposition along with the current year loss of 6787 thus totaling what you see on page 2 on schedule E.

however, without either other income or additional capital contributions your capital account in schedule L at the end of 2021 beginning of 2022 would likely have been 35000-26598 or about 8400 so something is missing and its effect on your taxes is unknown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

I was in an LLC since 2015, I got K-1s every year. Early 2023 they decided to sell the properties. Some partners wanted to cash out (including me) and others wanted to do an exchange to avoid capital gains. The exchange took place a few months later and those that accepted the exchange got no proceeds from the sale and just got a single 2023 K-1 for that LLC like they'd always gotten, the sale and exchange was transparent to them. As one who chose to cash out, I got a check for the proceeds from the sale. I recently got a K-1 for that LLC marked as a Final K-1, but all it has is Box 19 (Distributions), Code C, filled in with the amount that was my Ending Capital Account from my 2022 K-1, nothing in any of the other numbered boxes. In Box L ( Partner's Capital Account Analysis ) it has that amount as my Beginning capital account (of course), then the Box 19 amount in the Withdrawals and distributions line, making the Ending capital account $0. Makes sense. Then I received another K-1, interestingly NOT marked as Final K-1, for a new LLC created just for those who cashed out (LLC name is same as previous LLC name with "SELLER" added, different EIN). This K-1 contained Box 1 for some business income, Box 2 for some rental real estate loss, Box 9c for 1250 gain, Box 10 for 1231 gain, Box 19 Code A for cash distribution, and Box 20 codes Z for Section 199 and code AJ for Excess Business Loss Limitation. Then in Box L there's my distribution amount Box 19 from my old LLC Final K-1 as the Capital contributed during the year, Current year net income line comes from sum of Boxes 1,2,10 and then the Withdrawals and distributions contains Distribution from Box 19, with a small amount in the Ending capital account, but NOT zero. It makes sense, the Final K-1 from my old LLC was just to transfer my final basis over, and the K-1 for the SELLERS LLC contains the info for the sale and proceeds. For entering the Final K-1, I have my original LLC K-1s (I did two in TT because there was a Pass-through Entity involved) in TT to edit. From reading other posts about Final K-1s, it's obvious I select "This partnership ended in 2023" in the "Describe the partnership", even though it didn't end, but my participation ended. It's the next "Describe Partnership Disposal" screen that I don't know about. So many posts about that screen varied. All I know is that Final K-1 has no sales info on it, it's just to transfer my basis to the new SELLERS K-1. If I answer anything but No Entry, it will ask me for sales info, which seems to have nothing to do with the Final K-1. I saw some who said to select No Entry (which might not mark the K-1 as Final, and may lose any carryover loses, although I don't have any loses to carry over). As for the K-1 for the new SELLERS LLC, I'd have to enter that one into TT as a brand new K-1. But again, it's not marked as a Final K-1 (we are going to get a Final K-1 for the SELLERS LLC in 2024 because they still have business expenses to take care of). So should I just enter the K-1 for the SELLERS LLC into TT like it's a brand new K-1 for a brand new LLC and answer None of these apply for "Describe this Partnership", and just let the amounts in the boxes take care of everything?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

You can enter that first K-1 as a sale if you want. Since your basis in the partnership was zero and your sale price was zero it's fine and true to enter that information if you want to.

And then the seller's K-1 is a new LLC - at least it's new for you. Enter it as a new partnership and the entries cover all you need to worry about.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

Thanks @RobertB4444 , the seller's K-1 is easy, as you said, I just entered it as a new LLC with all the info transferred to the appropriate boxes in TT and everything looks great. But how to enter the Final K-1 for the original LLC is still unclear. If I select "This partnership ended in 2023", which looks like the appropriate answer, even though it didn't end, it ended for me because I opted to take the cash from the sale of the original properties involved in the partnership, whereas the partnership continued for those who accepted the exchange into other properties. But then the next question is "Describe Partnership Disposal (choose how you disposed of this partnership)". Well, I didn't dispose of the partnership, the partnership ended for me because the properties were sold. Why is it now being called a disposal? And none of the four answers to choose from (No Entry, Complete Disposition, Disposition was not via a sale, Sold and am receiving payments) seem to make sense and are not even explained if you click Learn More. Learn More seems to explain a disposition as you disposing of it to another person. Nothing explains what No Entry means or when you would use it. And if it was completely disposed via a sale, do you answer Complete Disposition or Sold and am receiving payments, which interestingly returns different follow-up prompts? Answering "Sold and am receiving payments returns a prompt to enter Disposition Dates (Description, Purchase Date, Sale Date) and if you submit those, it next prompts for Sale Price, Purchase Price, Principal Payments. What is Principal Payments? I do understand, it probably doesn't matter what options I select, as long as I enter zeros for everything. But then again, if all I want is nothing to be entered, why don't I just delete that K-1 from TT, the result will be the same. Sorry if I sound frustrated, but it's because I am. TurboTax NEVER handled the entry of the K-1 well. There was no reason just because you had entries in more than one of the first three boxes you had to enter multiple K-1s into TT for the one K-1 you received. And then in following years, even if you only had something in one of the first three boxes, if you had any losses to carry over you had to continue to enter multiple K-1s. TurboTax works best when all you do is enter a form into it. It is at its worst when the boxes you enter or questions you answer don't match what's the form and you have to guess (or get other multiple opinions) what the answers mean. For the Final K-1, the Learn More should clearly explain what is meant by each of the four answers to Describe Partnership Disposal. But then, they make things worse by having no Learn More with the questions given if you answer Complete Disposition. It says Tell Us About Your Sale (What type of disposition was this?). Again, there are four possible answers (Sold Partnership Interest, Abandoned Partnership Interest, Liquidated Partnership Interest, Owner Died and Interest was Transferred), none seem to be due to the sale of the properties, instead it sounds again like it is about you disposing of your interest in the partnership . No matter which you choose, the follow-up questions ask for Purchase Date and Sales Date (for your interest in the partnership), and then prompts concerning the Gains and Loses, including the Sale Price and Partnership Basis. So @RobertB4444 , is that where you are saying I should enter the basis in the partnership as zero and the sale price as zero? Or should I be following the prompts to answering "Sold and am receiving payments" instead of "Complete Disposition" to the Describe Partnership Disposal question? Thanks, in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Final K-1( Form 1065) disposition

Personally, in your case, I would go with the 'No Entry' option at the first prompt and skip it. That just says to leave the disposition blank.

If you don't want to do that then the disposition is a sale and you'll click on complete disposition and enter the purchase date as the date that you bought the partnership, the purchase price as zero, the sale date as the date that you had the other partnership created for you and the sale price as zero.

In this case disposition just means got rid of. And a sale is a way to get rid of something.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michpr

Level 2

JB...

Level 3

statusquo

Level 3

sakethuk2

Level 2

selina-farrell

New Member