- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filing within the virgin islands

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing within the virgin islands

Turbo Tax makes it clear that tax returns for the Virgin Islands either have to be mailed to the US or an address within the territory. However, while indicating that the 1040ss needs to be completed, Turbotax automatically fills in schedule 2 and the schedule se. How does one complete an over ride to remove this? Or if the tax return is filed in the US with the self-employment taxes noted in other taxes, can this be skipped?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing within the virgin islands

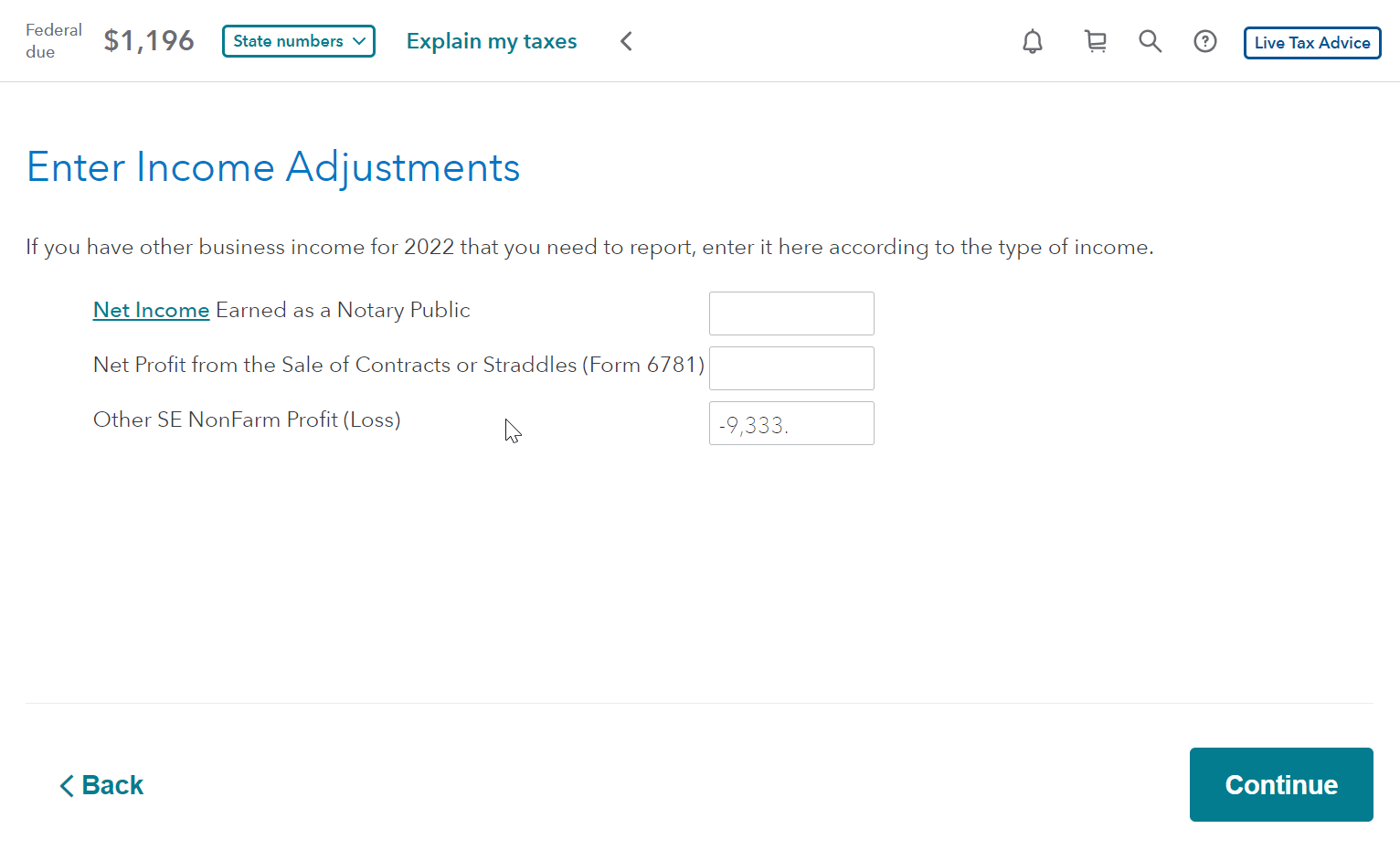

Here’s how to remove self-employment tax from the Form 1040 that you are filing with the U.S. Virgin Islands:

- Type sch se in Search (magnifying glass) in the top right corner

- Select Jump to sch se

- On the screen “Self-Employment Tax” select Make Adjustments

- On “Enter Income Adjustments” enter your net profit as a negative number in Other SE NonFarm Profit (Loss)

You’ll know you did this correctly when the screen “Self-Employment Tax” says That’s all we need for our calculation of self-employment tax, and you don’t owe self-employment tax for 2022.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sam_gorham

New Member

dstx144_

Returning Member

carishmam

New Member

bhuether

Level 3

prrigaud

New Member