- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

Hello all,

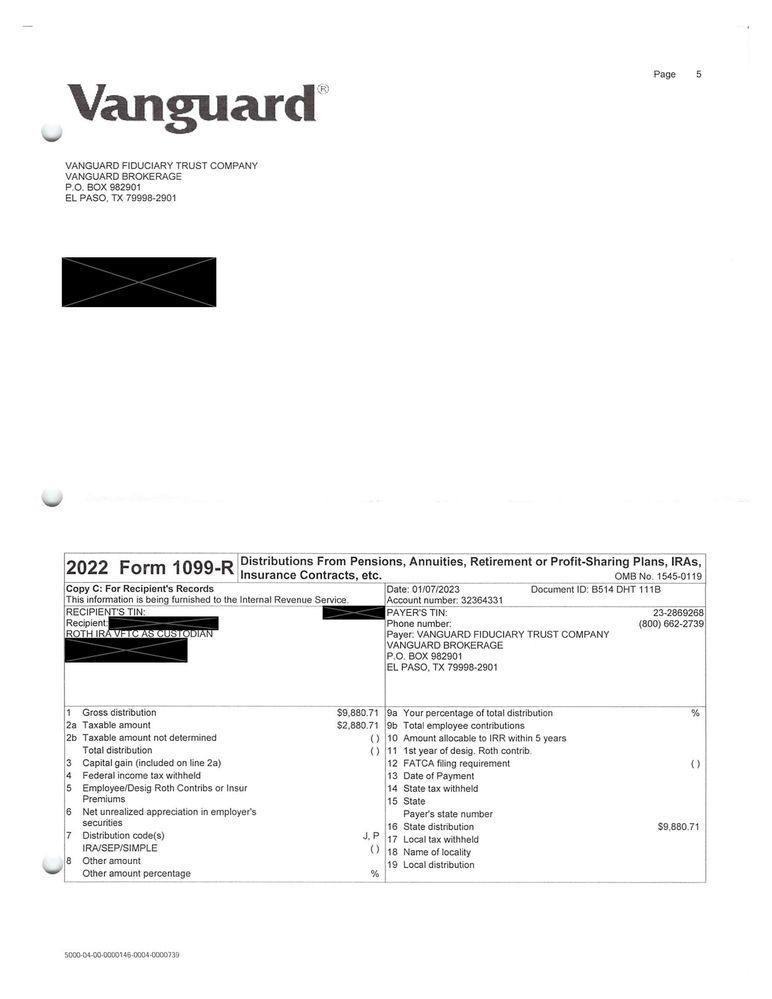

I have a somewhat complex tax question concerning Roths. I do my parents’ taxes in Turbotax. They both have Roth IRAs, which they contribute to most years. But in 2021 their income ended up over the eligibility limits, and they had to make a withdrawal of their Roth contributions for that year, along with the taxable earnings attributable to said contributions. This withdrawal was completed in 2022. As per standard procedure, their broker (Vanguard) didn’t send out the 1099R for the withdrawal until the following tax year (i.e. 2023, this year).

However, from what I understood, the earnings that the contributed amounts accrued while the remained in the Roth accounts during 2021 constituted taxable income for that year, and therefore tax needed to be paid on this income in 2022 to avoid a late payment penalty. This was a problem because I had no 1099R from the broker to use in the return for that year.

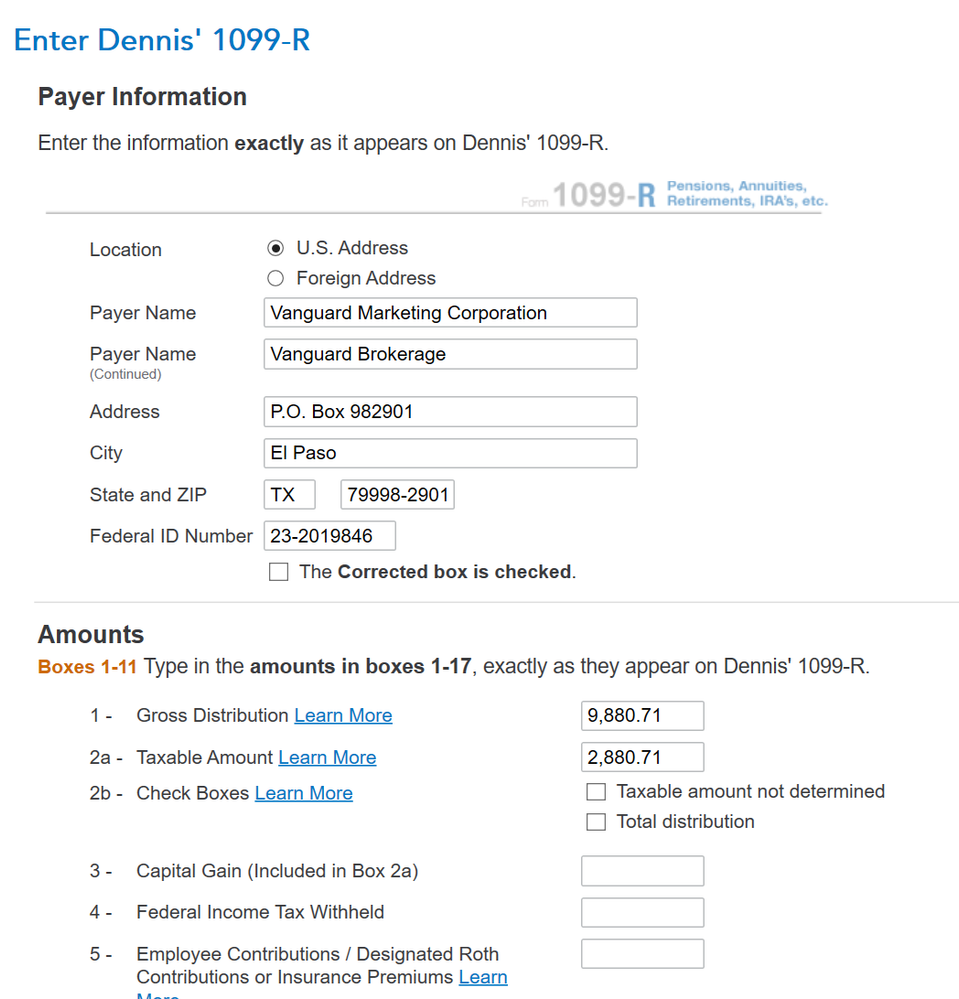

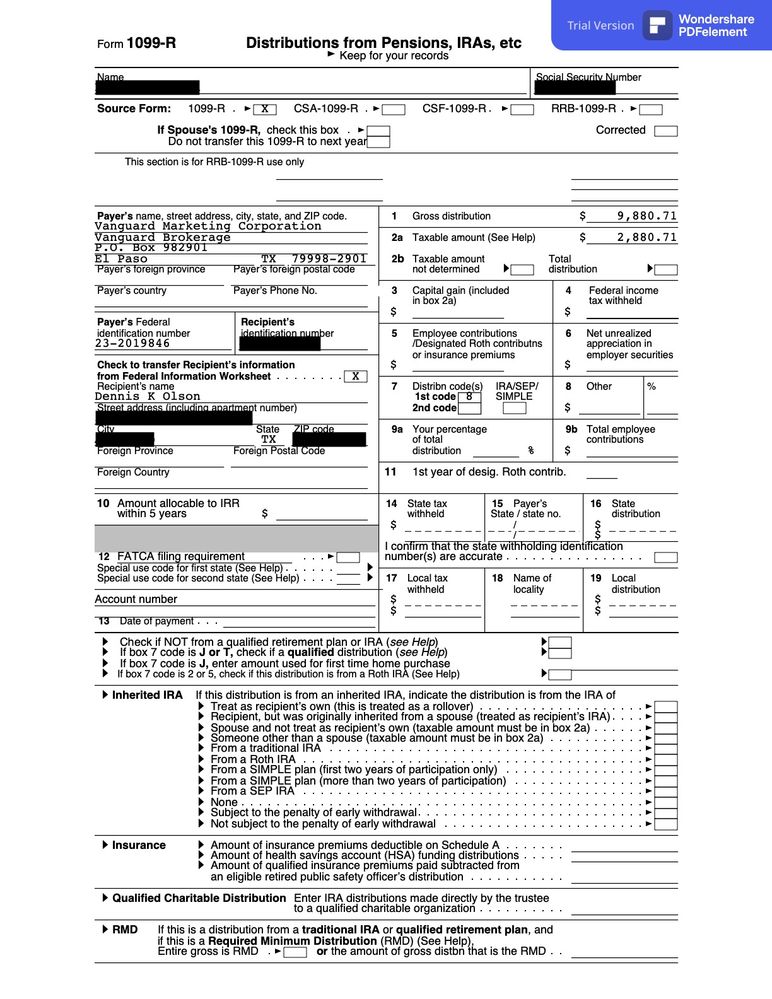

To get around this, I decided to generate a “substitute 1099R” form (which is a feature Turbotax has) showing the withdrawals and the taxable earnings amounts, as reported on Vanguard’s transaction confirmations for the withdrawals. My parents filed these with their 2021 taxes and included the taxable earnings that had to be withdrawn as ordinary income. So this was taken care of with their 2021 taxes.

The problem we have now is that Vanguard ultimately sent out the official 1099R earlier this year, meaning the IRS will have received a redundant copy of what they already filed in their 2021 taxes. To make matters worse, the official 1099-R from Vanguard has 2022 printed as the date, even though the Roth contribution was for 2021. I’m not sure what to do about all this. Will the IRS understand that these taxes are for 2021, and have already been paid? If not, how should we explain it to them?

For reference, I’ve attached the substitute 1099-R I created in turbotax and filed with the 2021 taxes, and the official 1099R from Vanguard listing the same amounts.

We filed for an extension due to this, but now the deadline is approaching. Thanks for any advice.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

Although the substitute Form 1099-R entered into 2021 TurboTax was incorrect, it produced the correct taxable result on the 2021 tax return so I would do nothing. Entering this 2022 Form 1099-R into 2022 TurboTax will have no effect on the 2022 tax return, so you can either enter it or omit it from 2022 TurboTax. If you enter it into 2022 TurboTax , TurboTax will simply remind you that it was reportable on the 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

By entering a substitute Form 1099-R you unnecessarily caused TurboTax to include the form in your 2021 filing despite the fact that the 2022 From 1099-R from Vanguard was neither late nor incorrect. That substitute form was a 2021 Form 1099-R with code 8 without the IRA/SEP/SIMPLE box marked suggesting a return of contribution made from a traditional account in an employer plan, not the proper 2022 Form 1099-R with codes J and P indicating the return of contribution from a Roth IRA in 2022. However, the required explanation statement would probably be sufficient to establish the nature of the distribution despite the incorrect coding.

The code in box 7 of the Form 1099-R and the year of the form indicate the year that the $2,880.71 must be included in income. Code 8 on a 2021 Form 1099-R and code P on a 2022 Form 1099-R both mean that the income is includible on your 2021 tax return.

When you perform a return of contribution, your tax return for the year of the contribution is required to include an explanation statement describing the transaction. This explanation takes the place of the Form 1099-R that you will not receive until later, so there is no need to enter the form as a substitute form. TurboTax prompts you to prepare the required explanation statement when you enter an excess contribution and then indicate that you will (or did) have some or all of the excess contribution returned.

I'm rethinking that there is no error on your 2021 tax return. If you were under age 59½ at the time of the return of contribution and that distribution was made before December 29, 2022, the $2,880.71 of taxable gains is subject to a 10% early distribution penalty on your 2021 tax return. The SECURE 2.0 Act eliminated the early distribution penalty for those under age 59½, but only for distributions made on or after December 29, 2022, the date that the SECURE 2.0 Act became law.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

Although the substitute Form 1099-R entered into 2021 TurboTax was incorrect, it produced the correct taxable result on the 2021 tax return so I would do nothing. Entering this 2022 Form 1099-R into 2022 TurboTax will have no effect on the 2022 tax return, so you can either enter it or omit it from 2022 TurboTax. If you enter it into 2022 TurboTax , TurboTax will simply remind you that it was reportable on the 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

@dmertz Thanks for responding so quickly!

What was incorrect on the substitute 1099-R? Anything we should worry about?

My concern is that nowhere on the official form does it mention the tax year as 2021. In fact, this actually happened for both 2021's and 2022's contributions, and both official 1099-Rs are dated 2022 at the top, as shown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

By entering a substitute Form 1099-R you unnecessarily caused TurboTax to include the form in your 2021 filing despite the fact that the 2022 From 1099-R from Vanguard was neither late nor incorrect. That substitute form was a 2021 Form 1099-R with code 8 without the IRA/SEP/SIMPLE box marked suggesting a return of contribution made from a traditional account in an employer plan, not the proper 2022 Form 1099-R with codes J and P indicating the return of contribution from a Roth IRA in 2022. However, the required explanation statement would probably be sufficient to establish the nature of the distribution despite the incorrect coding.

The code in box 7 of the Form 1099-R and the year of the form indicate the year that the $2,880.71 must be included in income. Code 8 on a 2021 Form 1099-R and code P on a 2022 Form 1099-R both mean that the income is includible on your 2021 tax return.

When you perform a return of contribution, your tax return for the year of the contribution is required to include an explanation statement describing the transaction. This explanation takes the place of the Form 1099-R that you will not receive until later, so there is no need to enter the form as a substitute form. TurboTax prompts you to prepare the required explanation statement when you enter an excess contribution and then indicate that you will (or did) have some or all of the excess contribution returned.

I'm rethinking that there is no error on your 2021 tax return. If you were under age 59½ at the time of the return of contribution and that distribution was made before December 29, 2022, the $2,880.71 of taxable gains is subject to a 10% early distribution penalty on your 2021 tax return. The SECURE 2.0 Act eliminated the early distribution penalty for those under age 59½, but only for distributions made on or after December 29, 2022, the date that the SECURE 2.0 Act became law.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

caitastevens

New Member

rodiy2k21

Returning Member

galaxy-bean-03

New Member

HW11

Returning Member

Vermillionnnnn

Returning Member

in Education