- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed a substitute 1099R for a Roth withdrawal in 2021. Received the actual 1099R in 2022. How do I handle this?

Hello all,

I have a somewhat complex tax question concerning Roths. I do my parents’ taxes in Turbotax. They both have Roth IRAs, which they contribute to most years. But in 2021 their income ended up over the eligibility limits, and they had to make a withdrawal of their Roth contributions for that year, along with the taxable earnings attributable to said contributions. This withdrawal was completed in 2022. As per standard procedure, their broker (Vanguard) didn’t send out the 1099R for the withdrawal until the following tax year (i.e. 2023, this year).

However, from what I understood, the earnings that the contributed amounts accrued while the remained in the Roth accounts during 2021 constituted taxable income for that year, and therefore tax needed to be paid on this income in 2022 to avoid a late payment penalty. This was a problem because I had no 1099R from the broker to use in the return for that year.

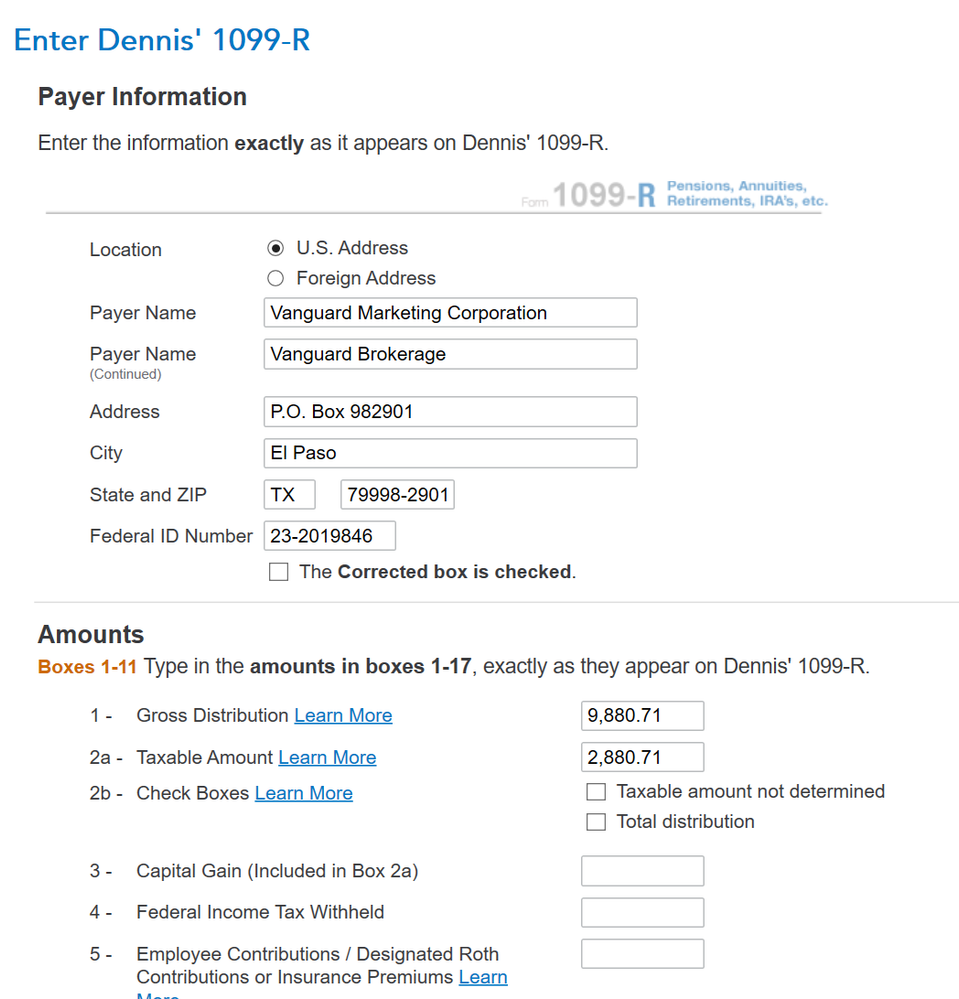

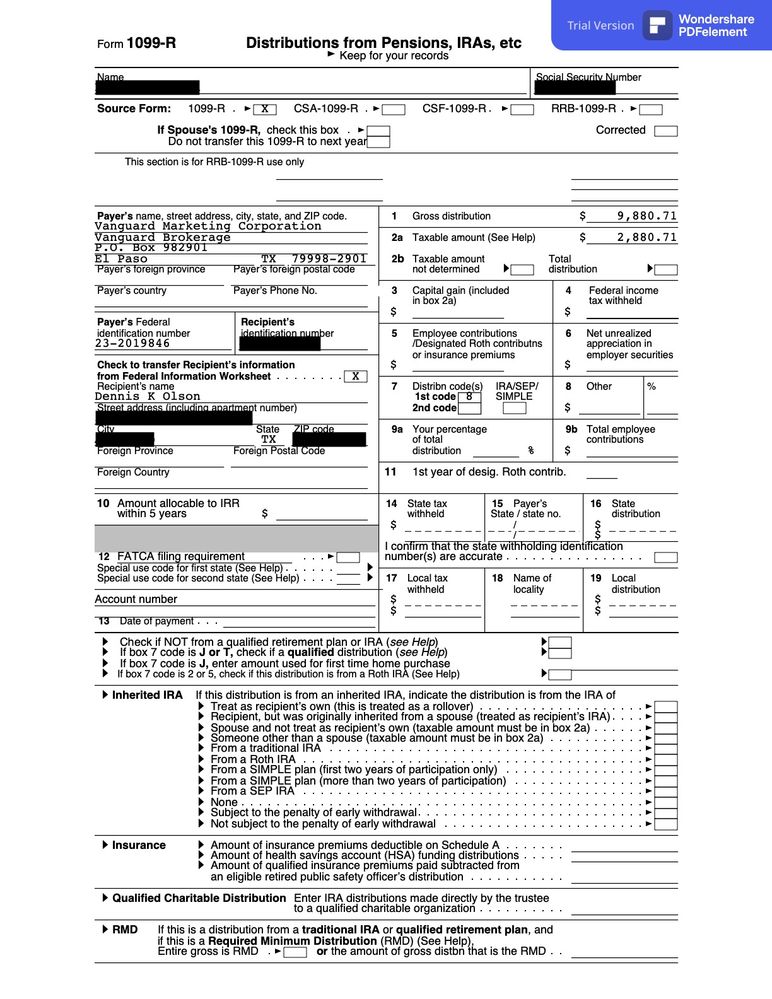

To get around this, I decided to generate a “substitute 1099R” form (which is a feature Turbotax has) showing the withdrawals and the taxable earnings amounts, as reported on Vanguard’s transaction confirmations for the withdrawals. My parents filed these with their 2021 taxes and included the taxable earnings that had to be withdrawn as ordinary income. So this was taken care of with their 2021 taxes.

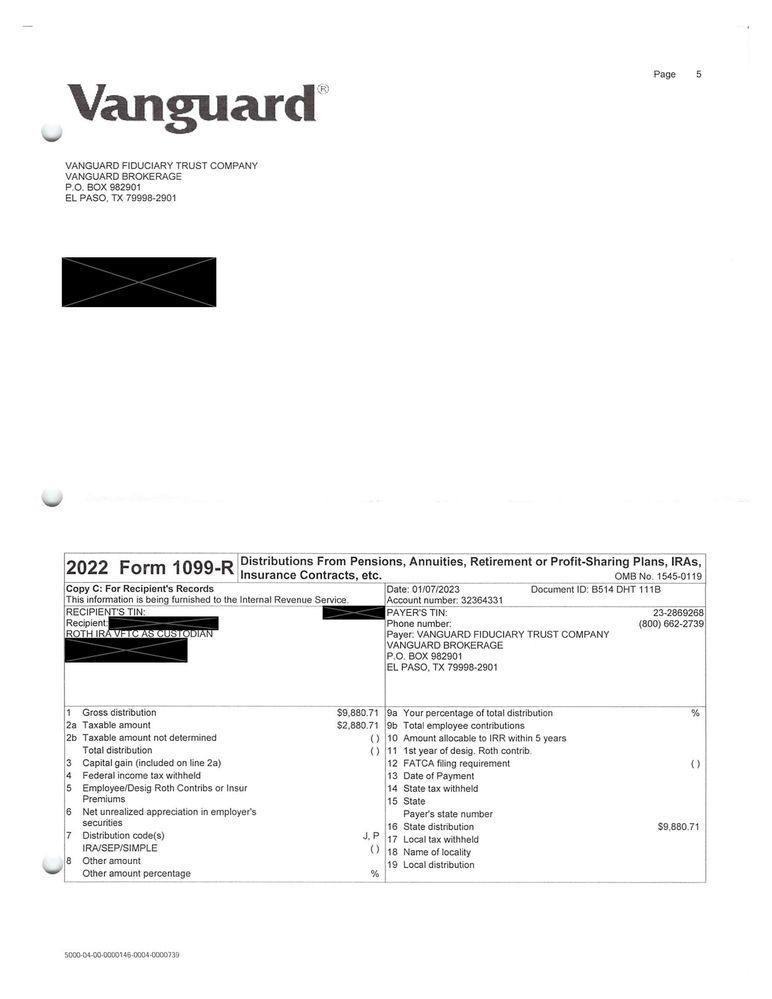

The problem we have now is that Vanguard ultimately sent out the official 1099R earlier this year, meaning the IRS will have received a redundant copy of what they already filed in their 2021 taxes. To make matters worse, the official 1099-R from Vanguard has 2022 printed as the date, even though the Roth contribution was for 2021. I’m not sure what to do about all this. Will the IRS understand that these taxes are for 2021, and have already been paid? If not, how should we explain it to them?

For reference, I’ve attached the substitute 1099-R I created in turbotax and filed with the 2021 taxes, and the official 1099R from Vanguard listing the same amounts.

We filed for an extension due to this, but now the deadline is approaching. Thanks for any advice.