- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Federal return rejected with code F1040-396 regarding the student loan interest deduction. Is this an IRS or TurboTax issue? I

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return rejected with code F1040-396 regarding the student loan interest deduction. Is this an IRS or TurboTax issue? I

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return rejected with code F1040-396 regarding the student loan interest deduction. Is this an IRS or TurboTax issue? I

I did not find code 1040-396 on the list of IRS reject codes. Please post an update if you have more information.

The reject notice should state exactly why the return was rejected, and give you the steps to correct it.

See this article for more information on e-file rejects.

See this article for more information on student loan interest deductions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return rejected with code F1040-396 regarding the student loan interest deduction. Is this an IRS or TurboTax issue? I

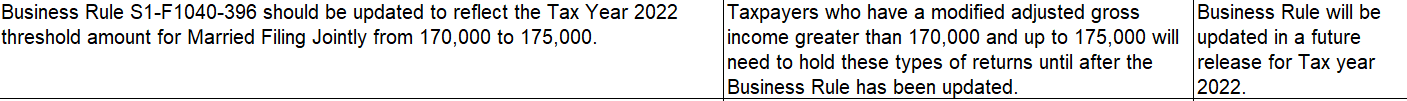

I hit this with my return as well. I did find some information on another site though I won't link it because I'm not sure of the rules. This information indicates that the IRS is aware of this error and will fix it sometime in February and potentially rerun any returns that rejected for that reason once it has been resolved, though I am unclear on whether they will rerun or we need to resubmit. The jargon used is that "effective returns will be recycled" and " you will receive an updated acknowledgement at that time".

As for WHY it is happening, I BELIEVE I got hit with this because my AGI for 2022 falls above the cutoff from 2021 for the student loan deductions (170k, married filing jointly according to the 2021 1040 instructions), but below the 2022 cutoff (175k, married filing jointly according tot he 2022 1040 instructions). TurboTax correctly added a deduction based on this year's calculations (which I confirmed manually using the 2022 1040 instructions), and the error description TurboTax provides which I assume comes from the IRS rejection message, seems to support that:

If the filing status of the return is married filing jointly and Form 1040, 'AdjustedGrossIncomeAmt' plus (+) Schedule 1 (Form 1040), 'StudentLoanInterestDedAmt' is greater than 170000, then 'StudentLoanInterestDedAmt' must be zero if an amount is entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return rejected with code F1040-396 regarding the student loan interest deduction. Is this an IRS or TurboTax issue? I

Yes, known issue from IRS not TurboTax.

@official_decoy

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Federal return rejected with code F1040-396 regarding the student loan interest deduction. Is this an IRS or TurboTax issue? I

Does anyone know if this has been corrected yet? We filed today, February 19 2023, and got rejected. Same error for married filing jointly but separate and student loan interest.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mary2ube

New Member

BUDOWMARK19

New Member

tz3019

New Member

Glory6

Level 1

miriamlara10

New Member